Jinwu Financial News | On June 28, Beijing Tongrentang Healthcare Investment Co., Ltd. submitted a prospectus application to the Hong Kong Stock Exchange to be listed on the main board of the Hong Kong Stock Exchange. CICC is its sole sponsor. As the third company under the Tong Ren Tang Group to hit the Hong Kong stock listing, it is also considered a light vehicle for Tong Ren Tang Group, and the company that hit the listing this time is a subsidiary of the company that operates the healthcare/pension business.

According to reports, Tong Ren Tang Medical Care is a medical institution managed according to the three levels of hospital chains, primary chain medical institutions, and internet hospitals. As of the last implementation date, the company has 11 offline medical institutions, 1 internet hospital, and 9 offline managed medical institutions. According to the 2022 ranking of the total number of outpatient visits and the aggregated revenue of outpatient medical services, the company is the largest traditional Chinese medicine hospital group in the medical service industry of non-utilitarian traditional Chinese medicine hospitals.

Compared to other private medical institutions, the company with “Tong Ren Tang”, an old Chinese brand certified by the country, undoubtedly has a first-mover advantage in terms of goodwill. However, under China's current healthcare system, the future of private healthcare will inevitably be questioned. How has the company performed in the past? And has the outlook for the private healthcare industry changed? This article will analyze this.

Traditional Chinese medicine services are “people-oriented”, resources are tight and competition is fierce

Judging from the scope of business, the business operated by Tongrentang Medical Clinic is a “private traditional Chinese medicine institution”, which itself is an industry supported by the national medical system. According to Wind data, as of 2021, the financial allocation for traditional Chinese medicine hospitals accounted for about 3.2% of the national government's health expenditure. The amount increased from 21.171 billion yuan in 2014 to 66.205 billion yuan in 2021, with a compound annual growth rate of 17.69%. In terms of numbers, according to the China Health Statistics Yearbook, the number of traditional Chinese medicine hospitals reached 4,630 in 2021, accounting for 12.66% of the total number of hospitals in the country.

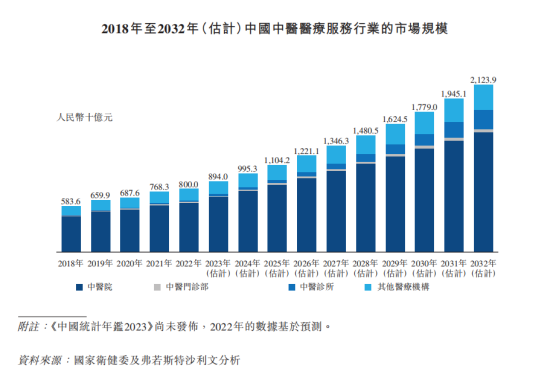

According to Frost & Sullivan's data, based on revenue generated by TCM medical service providers, the market size of China's TCM medical service industry grew from 583.6 billion yuan in 2018 to 800 billion yuan in 2022, with a compound annual growth rate of 8.2%, accounting for 13.4% of China's total medical service industry in 2022. Furthermore, in the next 10 years, the scale of the traditional Chinese medicine medical service industry will grow sharply to 2123.9 billion yuan, during which time the compound annual growth rate will reach 10.3%.

As traditional medicine passed down from ancient times to the present, traditional Chinese medicine has a profound influence in the Chinese character cultural circle, and is considered an important medical outline for studying human physiology, pathology, and diagnosis/prevention of diseases. However, due to its high value and origin, the balance between supply and demand in the traditional Chinese medicine market has always been in a tight state. On the one hand, large market demand is driving the continuous growth of traditional Chinese medicine talents, but there are still some shortages in supply today. On the other hand, there are many enterprises engaged in traditional Chinese medicine diagnosis/outpatient/community medical institutions/traditional Chinese medicine departments in the market, and the industry has always been in a highly competitive and fragmented environment.

However, in a fiercely competitive environment, experienced medical professionals are the “resource” with the most profound influence on the industry. Traditional Chinese medicine services based on the “ask and hear” system give physicians' experience significantly higher than traditional modern medicine, and the number of traditional Chinese medicine physicians owned by medical institutions is regarded as one of the important indicators of traditional Chinese medicine medical service capabilities. As of the last practical date of the report, the company had a total of 2,088 physicians in its medical service network, including 20 physicians with national honorary titles.

Based on the resources of more than 2,000 traditional Chinese medicine practitioners, the company has established 21 medical service institutions, including Internet hospitals. Looking at the distribution area, most of the company's offline traditional Chinese medicine service agencies are concentrated in North China and East China. Among them, Beijing has the highest number of offline traditional Chinese medicine service institutions, reaching 8. This is also related to the fact that Tongrentang Group itself is headquartered in Beijing. While providing medical services, the company also provides exclusive health products and pharmaceutical products through the above institutions to supplement the company's medical services.

In response to the differentiated medical needs of patients, the company divides the medical service system into three levels: outpatient clinics in traditional Chinese hospitals that require detailed examinations, community medical institutions that provide treatment for common, mild, and chronic diseases, and Internet hospitals that provide online medical services and an online drug supply chain. Overall, the classification is somewhat similar to outpatient/social welfare and online consultations in public hospitals. However, the company's focus is mainly on the field of traditional Chinese medicine, forming a certain differentiation and complement to the public healthcare system.

High-frequency mergers and acquisitions have maintained revenue growth and profit correction, but they are still low

In terms of revenue, from 2021 to 2023, Tongrentang Healthcare achieved annual revenue of 0.47 billion yuan, 0.697 billion yuan, and 0.895 billion yuan, respectively. According to the company classification, the company's revenue sources are composed of four parts: medical services, management services, sales of health products and other products, and other income. As of 2023, more than 80% of the company's revenue was provided by medical services, and sales of health products were the company's second-largest revenue source, accounting for 15.4% of revenue.

The company's revenue experienced steady growth from 2021 to 2023, with a 3-year compound annual growth rate of nearly 38%. The reason for this may be related to the company's acquisition and merger of Sankeitang's traditional Chinese medicine service institutions. According to the prospectus, the company acquired 65% of the shares of Sankeitang Health Hospital and Sankeitang Chinese Pharmacy at a price of 0.284 billion yuan in 2022. In 2023, the two hospitals mentioned above provided the company with 0.361 billion yuan in revenue, accounting for more than 40% of total revenue.

Looking back at Tong Ren Tang's expansion history, we will find that “mergers and acquisitions” have been the main means for the company to grow rapidly in scale since 2021. In addition to the above two traditional Chinese medicine institutions, the company also successively acquired 6 institutions from 2021 to 2023, including Huangsi Clinic, Yaxin Clinic, Seven Star Hospital, Beijing Tongrentang No. 1 Chinese and Western Integrated Hospital, and Taiyuan Medical Management. As of June 2024, the company also completed the acquisition of Beijing Chengzhitang within the year, and is expected to complete the acquisition of Shanghai Zhonghe Tang by the end of 2024.

From a gross profit perspective, the company's operating gross margin shows a trend of increasing year by year. From 2021 to 2023, the company's gross operating margins were 16.85%, 17.6%, and 21.6%, respectively. The company's main sales costs come from medical service pharmaceuticals and consumables, accounting for 57.6% of the company's operating costs in 2023. The company's cost growth is on the same trend as the company's revenue growth.

However, when it comes to profit, the company's profit margin performance is not that satisfactory. As of 2023, the company only achieved a profit correction for the year for the first time. Previously, it was a loss from 2021 to 2022. Even in a profitable 2023, the company achieved a net profit margin of only 4.98%. From the cost side, high administrative expenses are the main reason affecting the company's profit margin. From 2021 to 2023, the company's administrative expenses accounted for 20.1%, 17.1%, and 13.8% of revenue, respectively, most of which were employee benefit expenses.

Moreover, at the balance sheet, the disadvantages of successive acquisitions and expansions are also reflected in the balance sheet. First, goodwill in non-current assets grew rapidly from 2022 to 2023, accounting for 14.66% of total assets. Second, current liabilities and non-current liabilities both experienced rapid growth from 2021 to 2023, from 0.185 billion yuan to 0.509 billion yuan, and the net current asset value also fell from 0.131 billion yuan to 58.97 million yuan.

Overall, however, there is no obvious debt pressure on the company. As of the end of 2023, the company's cash and cash equivalents were 0.241 billion yuan. As of April 30, 2024, the company's bank loans to be repaid within one year were about 42.5 million yuan, and the total number of bank loans to be repaid was 0.142 billion yuan.

Can “smart” listed people get what they want?

Judging from the timing, Tong Ren Tang Healthcare is unquestionably a “smart” listed company. The time for submitting the statement happened to be stuck at a time when its business was improving and revenue was improving. Judging from the profit statement alone, Tong Ren Tang's growth rate is relatively good, and the prospects are also promising. In the context of China's aging population, the traditional Chinese medicine medical service industry, which focuses on traditional Chinese medicine, diagnosis and treatment of chronic diseases, and health services, is also often viewed as an industry with excellent prospects and broad market space.

However, as mentioned earlier, if you look closely at the root causes of its rapid growth, the growth rate through mergers and acquisitions will inevitably make it difficult to reassure and question the sustainability of its growth. However, if you compare Tongrentang Medical Care with a traditional Chinese medicine service company that has already been listed, its business scale and revenue performance are actually not superior. The company's biggest advantage also comes from its signature “Tong Ren Tang” IP, which is widely recognized by the market. After all, the investment in Tong Ren Tang Healthcare is still a newcomer to Tong Ren Tang's signature brand in the sales market.

According to the prospectus, the capital raised from the company's listing will be used to expand the service network of medical institutions and enhance medical service capabilities, repay certain outstanding bank loans, supplement working capital and other general corporate purposes. If it is successfully listed, the hidden dangers left by past development may be filled with capital. However, in today's sluggish new development environment, it is still unknown whether the company will be able to successfully pass the hearing and whether it will be able to raise sufficient funds based on its current financial performance.