The global trend of allocating funds towards Chinese assets continues to heat up.

On July 4, 2022, ETFs were officially included in the Mainland and Hong Kong stock market trading link mechanism, with a total of 87 underlying assets in the first batch, including 53 H shares ETFs, 30 A shares ETFs, and 4 Hong Kong stock connect ETFs.

Today marks the two-year anniversary of the launch of ETF connectivity, with the number of products continuously expanding from 87 to 151, including 141 A shares and H shares ETFs, as well as 10 Hong Kong stock connect ETFs. As of the end of the first half of 2024, the total scale of "ETF Connect" has exceeded 1.7 trillion yuan.

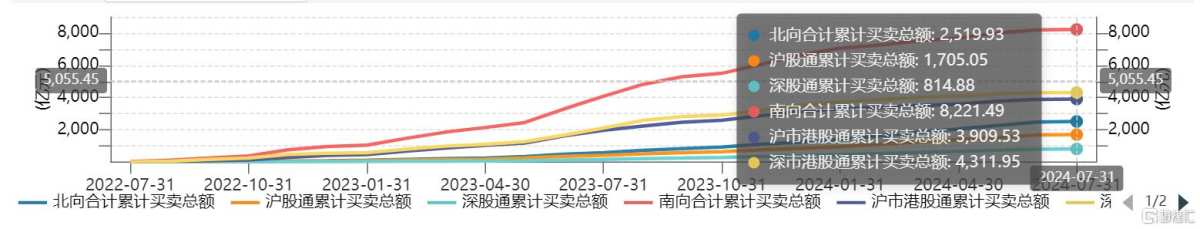

Southbound trading is significantly more active than northbound trading. According to Wind data, as of July 5th, the cumulative trading volume of northbound funds since the inclusion of ETF in the cross-market trading link mechanism two years ago was 251.9 billion yuan, while the cumulative trading volume of southbound funds exceeded 822.1 billion Hong Kong dollars.

As of July 5th, the size of southbound investors holding 10 Hong Kong stock connect ETFs reached 17.744 billion yuan. Among them, CSOP Hang Seng Tech Index ETF, Tracker Fund of Hong Kong, Hang Seng H-Share Index ETF, ChinaAMC Hang Seng Tech Index ETF, and Hang Seng Tech Index ETF are the most popular among investors, with the size of southbound investors holding CSOP Hang Seng Tech Index ETF reaching 12.55 billion yuan, accounting for 48.31% of the total issued shares of the fund; the size of southbound investors holding Tracker Fund of Hong Kong reached 4.483 billion yuan; and the size of southbound investors holding Hang Seng H-Share Index ETF was 1 billion yuan.

Overall, the scale of "ETF Connect" continues to grow. As of the end of the first half of 2024, the scale of 141 A shares and H shares ETFs reached 1.58 trillion yuan RMB, and the scale of 10 Hong Kong stock connect ETFs reached 0.21 trillion HKD. The total scale of "ETF Connect" exceeded 1.7 trillion yuan.

In April 2024, the China Securities Regulatory Commission issued five measures for capital market cooperation with Hong Kong, one of which is to expand the scope of eligible stock ETF products under the Shanghai-Hong Kong Stock Connect. On April 19th, the Shanghai and Shenzhen Stock Exchanges issued detailed rules for the adjustment of the scope of the Shanghai-Hong Kong Stock Connect ETF. The optimization of the ETF underlying assets mainly includes two aspects: one is to lower the ETF inclusion threshold; the other is to lower the index weight of the ETF.

In addition, in order to further enrich the underlying assets of connectivity, the Shanghai and Shenzhen Stock Exchanges released the latest revised implementation measures for the Shanghai-Hong Kong Stock Connect business on June 14th, modifying the scope of the mainland and Hong Kong ETFs, and lowering the inclusion standards for ETF connectivity, which will help increase Hong Kong stock liquidity.

As for the inflow, the ETF inclusion threshold for Shanghai-Hong Kong Stock Connect is adjusted from no less than 1.5 billion yuan to no less than 0.5 billion yuan; the inclusion ratio is adjusted to "the weight of Shanghai and Shenzhen listed stocks in the constituent securities of the tracked underlying index is no less than 60%, and the weight of Shanghai-Hong Kong Stock Connect stocks is no less than 60%"; For Hong Kong Stock Connect, the ETF inclusion threshold is adjusted from no less than HKD 1.7 billion to no less than HKD 0.55 billion; the inclusion ratio is uniformly adjusted to "the weight of Hong Kong Exchange listed stocks in the constituent securities of the tracked underlying index is no less than 60%, and the weight of Hong Kong stock connect stocks is no less than 60%", without distinguishing by index.

As for the outflow, the ETF outflow scale for Shanghai-Hong Kong Stock Connect is adjusted from less than 1 billion yuan to less than 0.4 billion yuan; the outflow ratio is adjusted to "the weight of Shanghai and Shenzhen listed stocks in the constituent securities of the tracked underlying index is less than 55%, or the weight of Shanghai-Hong Kong Stock Connect stocks is less than 55%"; for Hong Kong Stock Connect, the outflow scale is adjusted from less than HKD 1.2 billion to less than HKD 0.45 billion; the outflow ratio is uniformly adjusted to "the weight of Hong Kong Exchange listed stocks in the constituent securities of the tracked underlying index is less than 55%, or the weight of Hong Kong stock connect stocks is less than 55%", without distinguishing by index.

The Shanghai and Shenzhen Stock Exchanges have reached a consensus on expanding the scope of ETF connectivity and plan to further adjust the ETF list in July 2024, which is expected to take effect from July 22nd.

Pang Yaping, general manager of the Index Research Department of E Fund, said that at the expansion of the Shanghai-Hong Kong Stock Connect in July, 82 ETFs listed in mainland China are expected to be included in the connectivity, including 43 products that track indices not covered by previous connectivity ETFs; When expanding Hong Kong stock connectivity, three Hong Kong-listed ETFs, involving the Hang Seng Index and the Hong Kong Dividend Index, are expected to be included in connectivity.

In the view of industry insiders, the inclusion of ETFs in the mutual access program is an important measure for China's global strategy in the capital markets, and it helps to increase the proportion of long-term capital and enable more global investors to allocate assets in China.