Today, the top three net buy-ins on the Dragon and Tiger List are Shenzhen Genvict Technologies, Surfilter Network Technology, and Jiangsu Shagang.

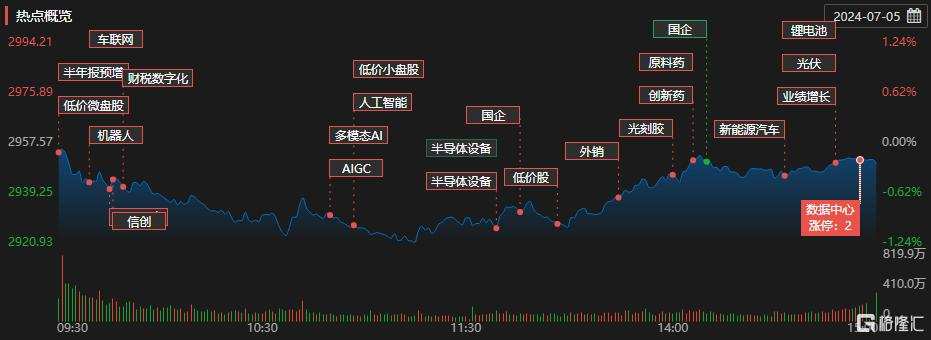

On July 5, the A-share market saw more gains than losses, with more than 3,900 stocks rising and more than 2,700 falling, with a total turnover of 574.9 billion yuan for the day. The market hotspots focused on medical, precious metals, medical instruments, telecommuting, automobile and photovoltaic sectors.

There were a total of 36 stocks that hit the limit up today, with 5 consecutive boards, and 9 stocks that failed to hit the limit up, with a limit up rate of 80% (excluding ST shares, delisted shares and newly listed shares that have not yet started trading). As for the focus stocks, Dong Yi Ri Sheng and Orient Group both hit the limit up and upgraded to their 4th consecutive board; pharmaceutical stocks surged in the afternoon, Changjiang Pharmaceutical Group gained 3 consecutive boards in 4 days.

Now let's take a look at today's Longhu Bang.

The top three stocks with net buy amount in the Dragon and Tiger List today were Shenzhen Genvict Technologies, Surfilter Network Technology, and Jiangsu Shagang, with net buy amounts of RMB 80.3062 million, RMB 74.3997 million, and RMB 63.1468 million, respectively.

The top three stocks with net sell amount in the Dragon and Tiger List today were Hengdian Precision, Shenzhen Emperor Technology, and SMS Electric, with net sell amounts of RMB 56.1115 million, RMB 46.3671 million, and RMB 43.0746 million respectively.

Among the stocks involving institutional-specific seats in the Dragon and Tiger List, the top three with net buy amount on the day were Shenzhen Genvict Technologies, Zhejiang Huahai Pharmaceutical, and Jiangsu Shagang, with net buy amounts of RMB 1.19 billion, RMB 0.109 billion, and RMB 41.5546 million, respectively.

Among the stocks involving institutional-specific seats in the Dragon and Tiger List, the top three with net sell amount on the day were Jian Bang Shares, Shenzhen Emperor Technology, and Raytron, with net sell amounts of RMB 47.928 million, RMB 25.3003 million, and RMB 9.7939 million, respectively.

Some of the top stock themes on the lists are:

Shanghai Dragonnet Technology (database + digital tax + internet finance)

Today's limit up, turnover rate of 18.06% for the day, turnover of RMB 0.401 billion, amplitude of 24.92%. The Dragon and Tiger List data shows that institutions net sold RMB 0.4176 million, while the sales departments collectively bought net RMB 36.872 million.

1. The company stated that the Tianji PBData series of database cloud platforms has completed compatibility testing with the OpenGauss database; the company has participated in the information construction of some brokerages, providing products and services such as databases and platforms.

2. The cooperation between the company and Huawei is the company's self-developed PhegData-X distributed storage product. The company's database integrated machine and Huawei Gauss database have been certified for compatibility. The company and Huawei also cooperate in the field of smart cities and other solutions.

3. In the July 3, 2024 interactive session, the company's integrated machine product served some provincial finance and taxation departments.

4. The company's main services and products include IT support and maintenance services, etc. Its customers cover more than 90% of financial enterprises and assist Chinese financial enterprises in achieving digital transformation relying on financial technology.

Zhejiang Huahai Pharmaceutical (performance forecast + innovative drugs + active pharmaceutical ingredient)

Today, the limit was up, with a turnover rate of 2.76% for the day, turnover of RMB 0.705 billion, and amplitude of 6.78%. The Dragon and Tiger List data shows that institutions net bought RMB 0.109 billion, Shanghai-Hong Kong Stock Connect net bought RMB 34.626 million, and sales seats collectively net sold RMB 0.119 billion.

1. The announcement after the market on July 4, 2024, shows that the company's net profit attributable to the parent is expected to be between RMB 0.728 billion and 0.785 billion in the first half of 2024, an increase of about 28% to 38% year-on-year.

2. Biopharmaceuticals and innovative drugs are important strategic layouts in the company's development process and are new production forces of the company.

3. The company is one of the world's leading suppliers of cardiovascular (mainly Pril and Shan series of products), psychiatric and neurological raw materials (such as paroxetine, levetiracetam and pregabalin), with a coverage rate of nearly 90% for major customers in the market.

4. The company's main business is pharmaceutical preparations and raw materials, forming a series of products dominated by cardiovascular, psychiatric, neurological and anti-infective categories.

Key trading stocks of institutions:

Shagang sharesToday's limit up, turnover rate of 3.91% for the day, turnover of RMB 0.351 billion, and amplitude of 10.53%. The Dragon and Tiger List data shows that institutions net bought RMB 41.5546 million, Shenzhen-Hong Kong Stock Connect net bought RMB 30.2708 million, and sales seats collectively net sold RMB 8.6786 million.

Shenzhen Genvict TechnologiesToday's decline is 5.41%, with a turnover of 1.118 billion yuan and a turnover rate of 24.95%. Dragon and tiger list data shows that two institutions are ranked in the buy one and buy two positions, with a total net purchase of 0.119 billion yuan; 'Shandong Gang' is in the sell two position, with a net sell of 16.0916 million yuan.

Sansheng retreatToday's decline is 8.70%, with a turnover rate of 9.14% for the whole day, a turnover of 7.232 million yuan, and a fluctuation rate of 10.00%. Dragon and tiger list data shows that the business department seats have a total net selling of 1.1287 million yuan.

Daoming Optics&ChemicalToday's decline is 8.18%, with a turnover rate of 6.41% for the whole day, a turnover of 0.268 billion yuan, and a fluctuation rate of 8.95%. Dragon and tiger list data shows that the institutions have a net purchase of 6.812 million yuan, and the business department seats have a total net purchase of 1.4758 million yuan.

Beijing Philisense TechnologyToday's daily limit, with a turnover rate of 13.55%, a turnover of 0.345 billion yuan, and a fluctuation rate of 24.26%. Dragon and tiger list data shows that institutions have a net purchase of 5.9601 million yuan, and the Shenzhen-Hong Kong Stock Connect has a net purchase of 4.4407 million yuan, and the business department seats have a total net purchase of 27.9039 million yuan.

Surfilter Network TechnologyToday's daily limit, with a turnover rate of 13.05%, a turnover of 0.312 billion yuan, and a fluctuation rate of 20.94%. Dragon and tiger list data shows that the business department seats have a total net purchase of 74.3997 million yuan.

In the dragon and tiger list, there are 3 stocks related to the Shanghai-Hong Kong Stock Connect dedicated seats, and the net purchase amount of the XD Yulong shares' Shanghai-Hong Kong Stock Connect dedicated seats is the largest, with a net purchase of 43.9741 million yuan.

In the dragon and tiger list, there are 5 stocks related to the Shenzhen-Hong Kong Stock Connect dedicated seats, and the net purchase amount of the Shagang shares' Shenzhen-Hong Kong Stock Connect dedicated seats is the largest, with a net purchase of 30.2708 million yuan.

Yoozoo operation dynamics:

Shandong Bang: Net purchase of XD Yulong shares is 13.3666 million yuan, net sale of Shenzhen Genvict Technologies is 16.0916 million yuan

Chengdu system:Net selling of Heng Precision is 12.1438 million yuan

Achang:Net selling of Xinling Electric is 12.1087 million yuan

Position Mining:Net purchase of Surfilter Network Technology is 19.2035 million yuan

New speculators:Net purchase of Hongbaoli Group Corporation is 10.4023 million yuan

Leisure and entertainment group:Net purchase of Hualing Xianlan is 12.0678 million yuan

Hongling Road:Sold a net amount of 36.1298 million yuan in Zhejiang Huahai Pharmaceutical.