During times of turbulence and uncertainty in the markets, even when markets are at all-time highs, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting our Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the real estate sector.

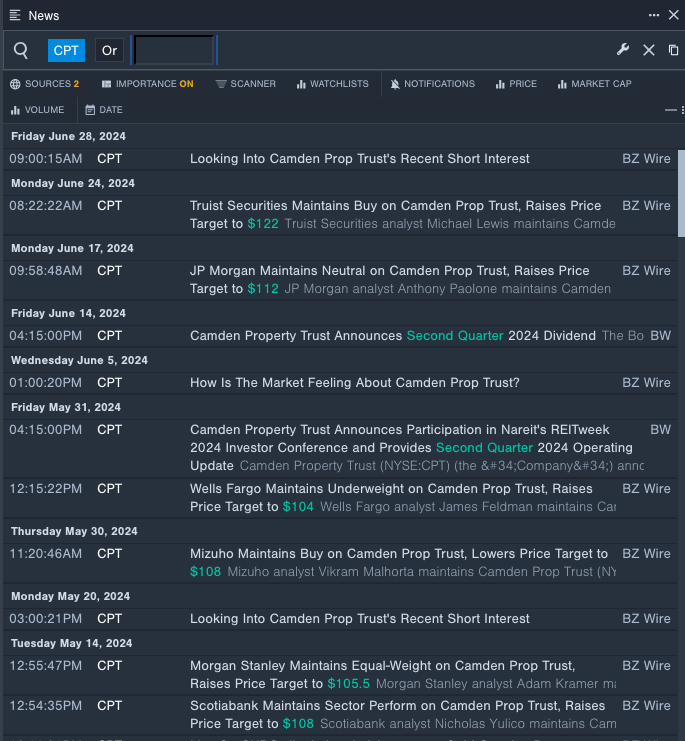

Camden Property Trust (NYSE:CPT)

- Dividend Yield: 3.83%

- Truist Securities analyst Michael Lewis maintained a Buy rating and raised the price target from $114 to $122 on June 24. This analyst has an accuracy rate of 66%.

- JP Morgan analyst Anthony Paolone maintained a Neutral rating and increased the price target from $104 to $112 on June 17. This analyst has an accuracy rate of 68%.

- Recent News: On June 14, Camden Property Trust declared a second quarter cash dividend of $1.03 per share.

- Benzinga Pro's real-time newsfeed alerted to latest CPT's news

Equity Residential (NYSE:EQR)

- Dividend Yield: 4.00%

- Truist Securities analyst Michael Lewismaintained a Buy rating and raised the price target from $67 to $73 on June 24. This analyst has an accuracy rate of 66%.

- JP Morgan analyst Anthony Paolonemaintained a Neutral rating and increased the price target from $66 to $68 on June 17. This analyst has an accuracy rate of 68%.

- Recent News: Equity Residential said it will release its second quarter 2024 operating results on Monday, July 29, after the closing bell.

- Benzinga Pro's charting tool helped identify the trend in EQR's stock.

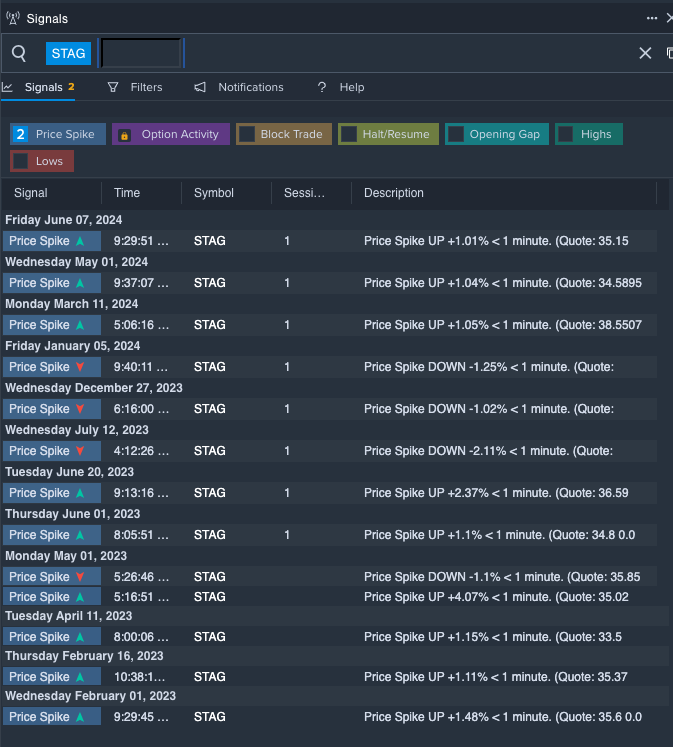

STAG Industrial, Inc. (NYSE:STAG)

- Dividend Yield: 4.10%

- Baird analyst David Rodgers downgraded the stock from Outperform to Neutral but raised the price target from $38 to $41 on Jan 5. This analyst has an accuracy rate of 62%.

- Raymond James analyst William Crow maintained an Outperform rating and cut the price target from $39 to $37 on Oct. 31, 2023. This analyst has an accuracy rate of 74%.

- Recent News: STAG Industrial said it will release its second quarter 2024 operating and financial results after the closing bell on Tuesday, July 30.

- Benzinga Pro's signals feature notified of a potential breakout in STAG's shares.