Markets Weekly Update (July 5) : US unemployment rate higher than expected

Markets Weekly Update (July 5) : US unemployment rate higher than expected

Macro Matters

宏观事项

US unemployment rate higher than expected

美国失业率高于预期

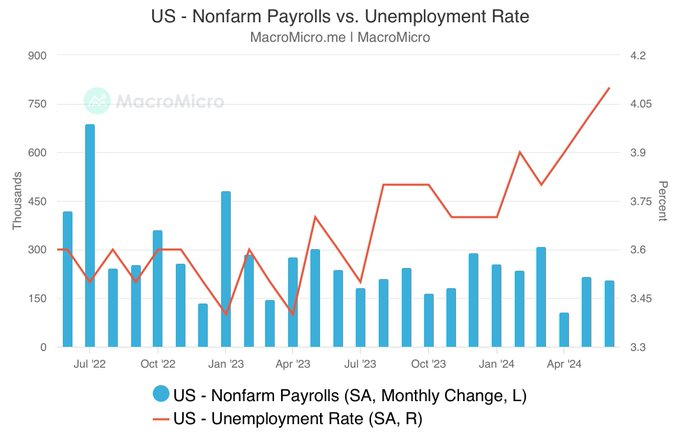

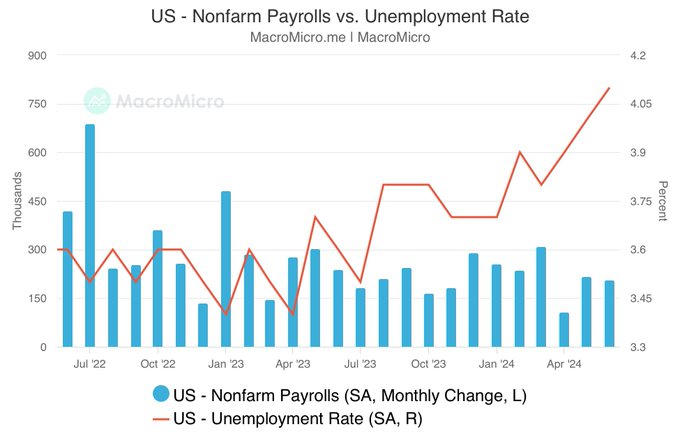

Nonfarm Payrolls 206K (est. 191K, prev. 218K)

非农就业人数为20.6万(预估为19.1万,前值为218K)

Private Nonfarm Payrolls 136K (est. 160K, prev. 193K)

私人非农就业人数为13.6万(预估为16万,前值为193K)

Unemployment rate 4.1% (est. 4.0%, prev. 4.0%)

失业率为4.1%(预估为4.0%,前值为4.0%)

Average hourly earnings YoY 3.9% (est. 3.9%, prev. 4.1%)

平均每小时收入同比增长3.9%(预估为3.9%,前值为4.1%)

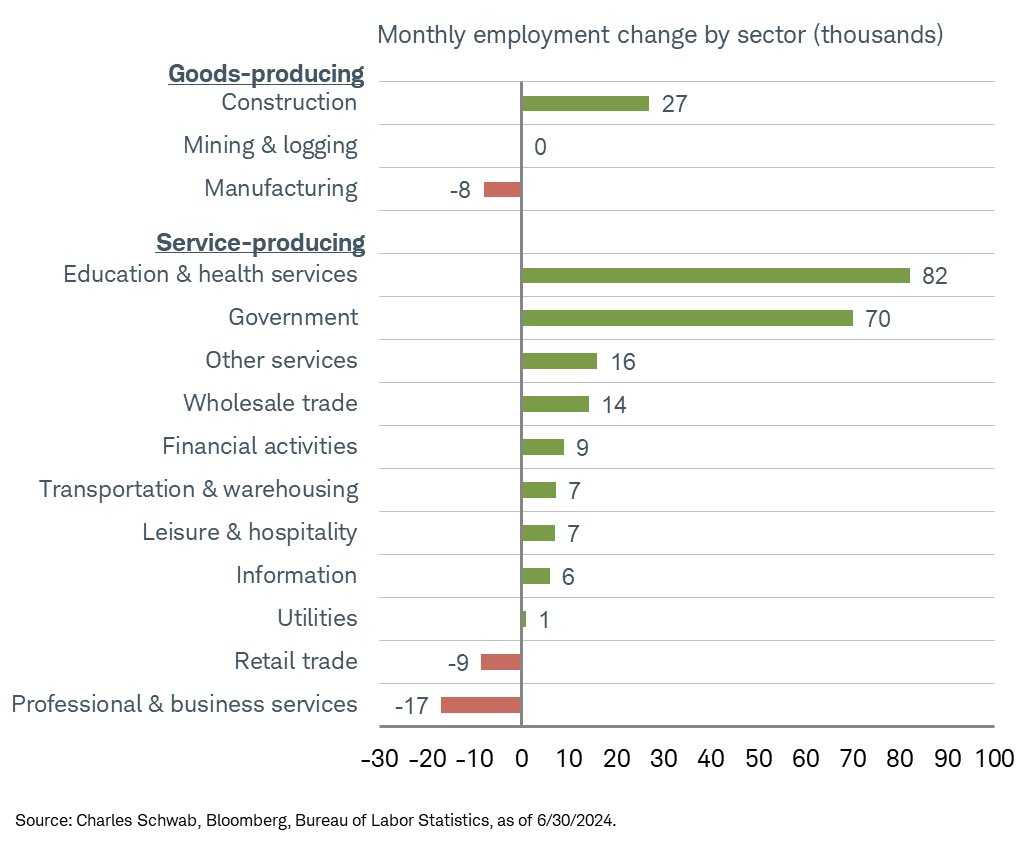

Payrolls by sector: largest gains from education/health and government.

行业就业人数情况:教育/卫生和政府贡献最大的增长。

Gold edges higher as US jobs report looms, fed rate cut expectations grow

随着美国就业报告的公布,黄金价格上涨,联邦利率降息预期增加。

Gold firmed up around $2,360 per ounce on Friday and was set to advance for the second straight week as investors look forward to a key US monthly jobs report that could cement expectations for Federal Reserve interest rates this year. Earlier this week, data pointed to a surprise contraction in services activity and disappointing private employment numbers in the US, supporting a dovish outlook on Fed policy. Markets are currently priced for about a 73% chance that the Fed would start cutting rates in September.

周五,黄金价格稳定在每盎司2360美元左右,有望连续第二周上涨,因投资者期待关键的美国月度就业报告,这可以巩固今年联邦储备利率的预期。本周早些时候,数据显示美国服务活动意外收缩和私人就业数字令人失望,支持对联邦政策的鸽派展望。目前市场上对于美联储在9月份开始降息的概率约为73%。

Source: Trading Economics

资料来源:Trading Economics

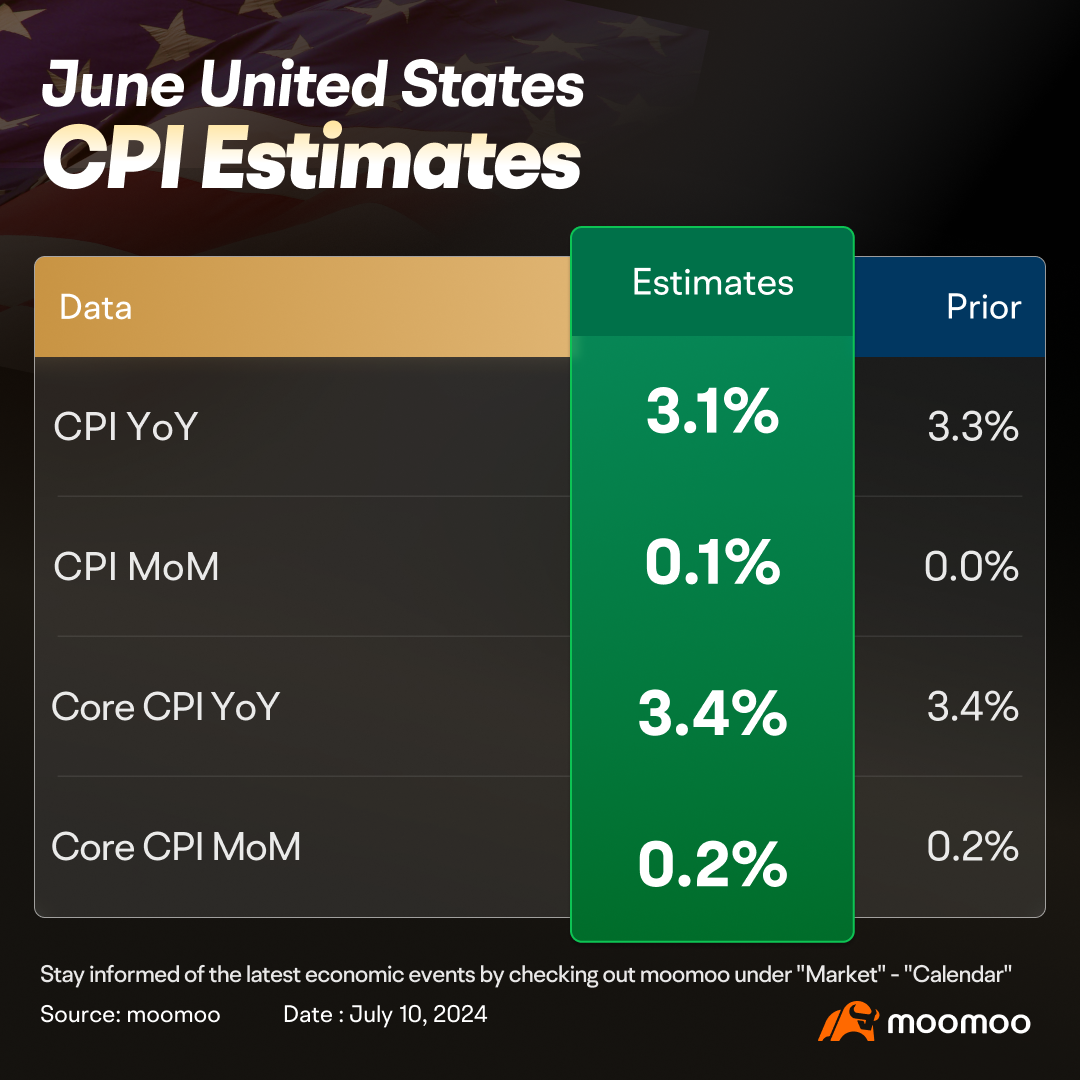

June CPI is expected to show further moderation ahead of the July 11 release

7月11日公布的CPI预计会显示进一步缓和

The headline CPI for June, set to be released on July 11, is anticipated to show a modest increase of 0.1%, primarily due to a significant seasonally adjusted decrease in gasoline prices. More importantly, the monthly core CPI is predicted to maintain a steady growth of 0.2%, with sectors such as used cars and recreation contributing to a slowing inflation rate. Year-over-year, the headline CPI is projected to drop to 3.1%, down from May's 3.3%, while the core CPI is expected to remain unchanged at 3.4%.

6月份核心CPI预计保持0.2%的稳定增长趋势,其中二手汽车和娱乐等行业将会对物价上涨率减缓做出贡献。预计CPI同比增长率将从5月份的3.3%下降至3.1%,而核心CPI同比增长率预计将保持在3.4%。

Source: Moomoo

来源:moomoo

Smart Money Flow

智能资金流

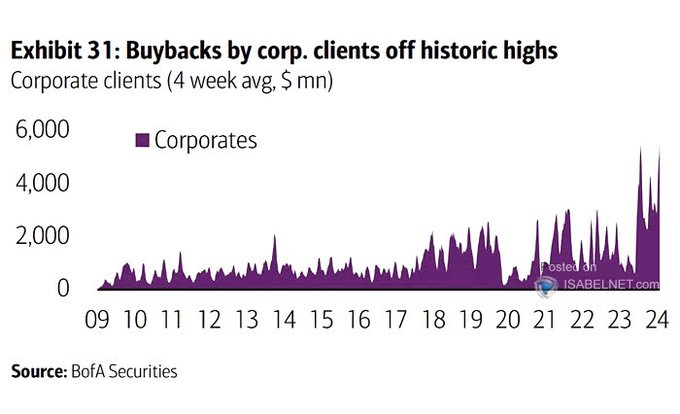

The strong buyback activity by BofA's corporate clients, which is well above historical averages, is expected to be viewed positively by investors as it signals confidence in the companies' prospects and potential for future growth.

BofA的企业客户进行的强烈回购活动高于历史平均水平,这可能会被投资者看作是对公司前景和未来增长潜力的信心信号。

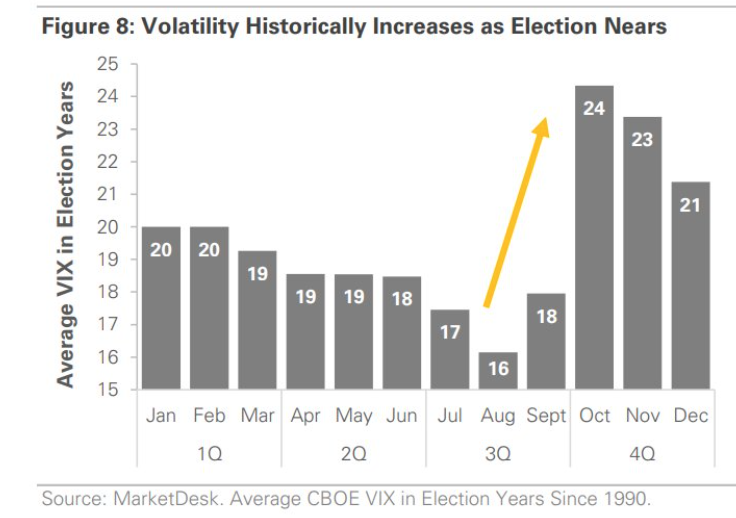

Volatility Historically Increases as Election Nears.

选举临近时,历史上波动率会上升。

Bitcoin set for worst week in over a year on Mt. Gox liquidation fears.

比特币因担忧莫克斯交易所清算而面临一年多以来最糟糕的一周。

Bitcoin was set for its biggest weekly fall in more than a year on Friday, as traders fretted over the likely dumping of tokens from defunct Japanese exchange Mt. Gox and further selling by leveraged players after the cryptocurrency's strong run.

周五,比特币价格下跌了8%,至每枚53523美元,为去年2月下旬以来最低点,预计将会有更多令人担忧的投机客出售比特币,这是该加密货币一段很长时间以来的最大周跌幅。

The price of the world's largest cryptocurrency slid as much as 8% on the day to $53,523, its lowest since late February.

全球最大的加密货币价格跌至53523美元,下跌幅度高达8%,是自去年11月初以来最大的跌幅。

It was on track for a more than 12% weekly decline, its biggest since early November 2022.

比特币价格下跌超过12%,这是自2022年11月初以来的最大跌幅。

Top Corporate News

头条公司新闻

Analysts reset Tesla stock price targets as robotaxi event looms.

随着机器人出租车的发布, 分析师重设特斯拉股票价格目标。

Tesla shares have soared more than 68% since their late-April lows, powered in part by CEO Elon Musk's renewed focus on the group's self-driving and AI ambitions and a key investor vote that approved his delayed $56 billion pay deal.

自4月下旬以来,特斯拉股票已上涨超过68%,这在一定程度上得益于首席执行官伊隆·马斯克对公司自动驾驶和人工智能计划的重新关注以及一项重大投资者投票批准了他迟延的560亿美元薪资协议。马斯克还计划在8月8日的活动上展示公司的机器人出租车原型,这标志着该公司已从传统的汽车制造业务转变为以自主驾驶技术、能源储存和下一代机器人技术为主导的广泛业务模式。

Musk also plans to unveil the group's robotaxi prototype at an August 8 event, as the group pivots from its traditional carmaking roots to a broader business model lead by autonomous driving, energy storage and next-generation robotics.

来源:moomoo

In the meantime, a better-than-expected tally of second quarter vehicle deliveries, published yesterday, assuaged investor concerns that a slump in EV demand and the ongoing global price war would both eat into Tesla's sales and further reduce its already-narrowing profit margins.

与此同时,昨天发布的第二季度交付车辆数量高于预期的情况缓解了投资者的担忧,即电动汽车需求下降和全球价格战将同时侵蚀特斯拉的销售并进一步缩小其已经越来越窄的利润率。

Jeff Bezos to sell Amazon shares worth about $5 billion after stock hits record high.

股票创纪录新高后,Jeff Bezos打算出售亚马逊股票约50亿美元。

Amazon founder and executive chair Jeff Bezos is planning to sell almost $5 billion worth of shares in the e-commerce giant, a regulatory filing showed, after its stock hit a record high.

亚马逊创始人兼执行主席Jeff Bezos计划出售价值近50亿美元的电子商务巨头股票,监管文件显示。这项交易计划在周二市场收盘后公布,这家公司的股票在当天交易中创下了历史新高,达到了200.43美元。今年以来,其股价已经上涨超过30%,超过了道琼斯工业指数的4%。

The proposed sale of 25 million shares was disclosed in a notice filed after market hours on Tuesday. The stock had hit an all-time high of $200.43 during the session. It has jumped more than 30% so far this year, outpacing the 4% gain in the Dow Jones Industrial Average index.

拟售出的2500万股份的交易是在周二盘后公布的。亚马逊的股价在当天交易中创下了历史新高,达到了200.43美元。今年以来,其股价已经上涨超过30%,超过了道琼斯指数的4%的上涨幅度。

After the sale plan, Bezos would own about 912 million Amazon shares, or 8.8% of the outstanding stock.

在该销售计划后,Bezos将拥有约91200万股亚马逊股票,占流通股的8.8%。

He sold shares worth roughly $8.5 billion in February, after the stock rallied 80% in 2023.

在股票在2023年上涨了80%后,他在2月份出售了价值约85亿美元的股票。

Meta’s Threads considers ads as rivalry with X approaches first anniversary

Meta的Threads认为广告是与X竞争的对手,距离首个周年纪念日越来越近

Meta Platforms Inc.’s Threads, launched a year ago as Mark Zuckerberg’s response to Elon Musk’s struggles with X (formerly Twitter), is now gearing up to sell ads in its feed. The rivalry between Zuckerberg and Musk has evolved into a significant business competition. Threads, resembling X with features like likes, followers, and a user interaction-based feed, has grown to over 175 million monthly users from 150 million three months ago, spurred by user dissatisfaction with changes at X in July 2023.

Meta平台公司的Threads于一年前推出,是Mark Zuckerberg对Elon Musk旗下的X(前称Twitter)的回应,现正准备在其Feed中销售广告。Zuckerberg和Musk之间的竞争已经演变成重要的商业竞争。Threads类似于X,具有喜欢,追随者和用户互动式Feed等功能,由于用户对X在2023年7月进行的更改不满,用户数量已经从三个月前的1500万增加到了17500万。

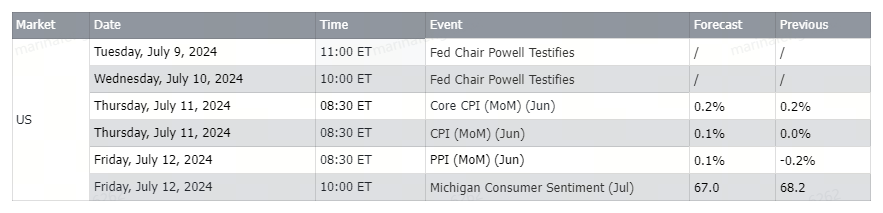

Upcoming Economic Data

免责声明:本演示仅供信息和教育目的;不是任何特定投资或投资策略的建议或认可。在此提供的投资信息具有一般性质,仅供说明目的,并可能不适合所有投资者。它是在没有考虑个人投资者的财务知识水平、财务状况、投资目标、投资时间范围或风险承受能力的情况下提供的。在做出任何投资决策之前,您应考虑此信息是否适合您的相关个人情况。过去的投资业绩并不表明或保证未来的成功。收益将有所不同,所有投资都存在风险,包括本金损失。

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

moomoo 是由 Moomoo Technologies Inc 提供的一款金融信息和交易应用程序,在美国,Moomoo Financial Inc 为投资者提供投资产品和服务,为 FINRA/SIPC 的成员。

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

Moomoo 是由 Moomoo Technologies Inc 提供的一款金融信息和交易应用程序,在美国,Moomoo Financial Inc 为投资者提供投资产品和服务,为 FINRA/SIPC 的成员。