Macro trend

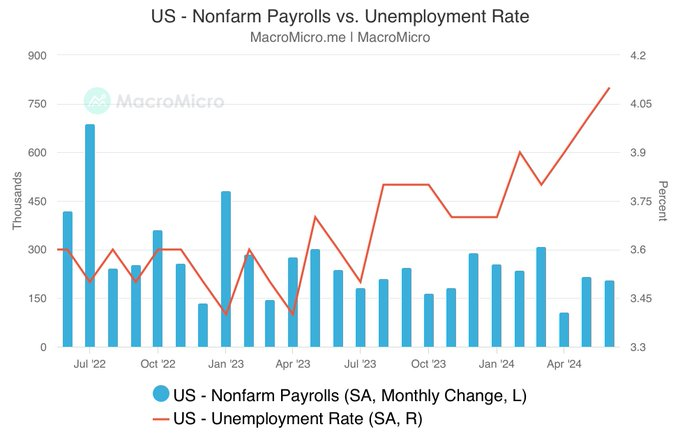

US unemployment rate higher than expected.

Non-farm employment of 0.206 million people (estimated 0.191 million, previous value 218k).

Private non-farm employment of 0.136 million people (estimated 0.16 million, previous value 193k).

Unemployment rate of 4.1% (expected value of 4.0%, previous value of 4.0%4.0%).

Average hourly wage increased by 3.9% YoY (estimated 3.9%, previous value 4.1%).

Employment by sector: Education/Health and Government have the largest increase.

As the US employment report approaches, market expectations for Fed interest rate cuts increase and gold prices rise.

Gold stabilized around $2360 per ounce on Friday and rose for the second consecutive week as investors expect the key monthly US employment report, which may consolidate expectations for Fed interest rates this year. Data released earlier this week showed that US service sector activity unexpectedly shrank and private sector employment data was disappointing, supporting dovish views on Fed policy. The market currently expects a 73% chance of Fed cuts starting in September.

Source: Trade Economics.

It is expected that CPI will slow down further before it is released on July 11th.

Overall CPI in June, which is expected to be released on July 11th, is expected to increase moderately by 0.1%, mainly due to a significant seasonal adjustment in gasoline prices. More importantly, it is expected that core CPI will maintain a stable growth rate of 0.2%, and industries such as used cars and entertainment will help slow down the inflation rate. Overall CPI is expected to drop from 3.3% in May to 3.1% YoY, while core CPI is expected to remain unchanged at 3.4%.

Fund Flows.

Strong share repurchases by Bank of America's corporate clients (far higher than historical average levels) are expected to be positively evaluated by investors, as it indicates that investors are confident in the prospects and future growth potential of these companies.

Historically, volatility will increase as the election approaches.

Bitcoin is about to have its worst week in over a year due to concerns over the liquidation of Mt. Gox.

Bitcoin is expected to have the largest weekly decline in over a year on Friday, as traders are concerned that the bankrupt Japanese exchange Mt. Gox may sell tokens, and leverage investors may sell Bitcoin after the strong rise of this cryptocurrency. The price fell by 8% that day to $53,523, the lowest level since the end of February.

Company news.

As the self-driving taxi incident approaches, analysts are resetting their stock price targets for Tesla.

Tesla's stock price has soared more than 68% since its low in late April, in part because CEO Elon Musk is refocusing the group's ambitions on autonomous driving and artificial intelligence, as well as a pivotal investor vote approving his delayed $56 billion compensation plan. Musk also plans to debut the group's robotaxi prototype at an event on August 8th, as the group pivots from traditional carmaking to a broader business model dominated by autonomy, energy storage, and next-generation robotics. Meanwhile, Tesla's second-quarter car deliveries, which were released yesterday, were better than expected, easing investors' concerns that the electric vehicle demand was declining and the ongoing global price war would erode Tesla's sales and further squeeze its already-shrinking margins.

After Amazon's share price hit a record high, Jeff Bezos will sell around $5 billion worth of Amazon shares.

Regulatory filings show that Jeff Bezos, Amazon's founder and executive chairman, plans to sell nearly $5 billion worth of shares in the e-commerce giant after its share price hits an all-time high. A post-close disclosure submitted on Tuesday revealed the news of the planned sale of 25 million shares. The stock hit an intraday high of $200.43, an all-time high, and has risen over 30% so far this year, outpacing the Dow Jones industrial average's gain of 4%. After the sale plan is completed, Bezos will own approximately 0.912 billion shares of Amazon stock, or 8.8% of the issued shares. In February of this year, he sold shares worth approximately $8.5 billion, after the stock had risen 80% in 2023.

Meta's Threads advertising business will compete directly with X.

Mark Zuckerberg launched Threads a year ago to compete with Elon Musk's X (formerly known as Twitter), and the monthly number of users has grown from 0.15 billion three months ago to 0.175 billion. The company is now preparing to sell advertisements in its news feed.

Important economic data of the week

This content is for informational and educational purposes only and does not constitute a recommendation or endorsement of any particular security or investment strategy. The information contained in this content is for illustrative purposes only and may not be suitable for all investors. This content does not consider the investment objectives, financial situation, or needs of any specific person and should not be regarded as individual investment advice. It is recommended that you consider the suitability of the information for your individual circumstance before making any investment decisions in any capital market product. Past investment performance is not indicative of future results. Investment involves risk and the possibility of loss of principal.

On moomoo, investment products and services in the United States are provided by Moomoo Financial Inc, a licensed entity regulated by the US Securities and Exchange Commission (SEC). Moomoo Financial Inc. is a member of Financial Industry Regulatory Authority (FINRA) and of Securities Investor Protection Corporation (SIPC).