On Friday, July 5th, the positive non-farm payroll report and expectations for interest rate cuts boosted the NASDAQ, while the S&P 500 and Dow Jones Industrial Average also turned upward.

Led by technology stocks, the NASDAQ continued its three-day streak of setting new closing highs and further rose; the intraday increase once expanded by 110.8 points or 0.6%; the S&P 500 opened high and turned slightly upward after falling to nearly 0.1%; blue-chip stocks gathered in the Dow Jones Industrial Average turned upward, and the intraday decline once deepened to 139 points or over 0.35%, and then turned upward.

Most of the growth tech stocks showed gains. Large technology stocks rose sharply, with "metaverse" Meta up 3.7%, Google A up to 2.2%, Netflix up over 1.8%, Apple up over 1.7%, Microsoft up over 1.3%, and Amazon up to 1.5%; however, Tesla opened with a dive and turned downward after a seven-day rally, with the decline expanding by 1.6% within 20 minutes, then rebounded and turned upward, with an increase once expanding by over 2.4%.

Chip stocks experienced different gains and losses. The Philadelphia semiconductor index and the industry ETF SOXX turned downward at the beginning of the trading day, and the decline within the first 20 minutes of the opening once expanded by 0.46% and 0.38%, respectively. Nvidia had an initial dive of more than 2%, and the two-times long ETF for Nvidia once fell more than 4%. Arm Holdings rose rapidly, up over 8%, while Micron Technology fell more than 4%.

On the news side, some analysts believe that there are "contradictions" in today's employment report. On one hand, non-farm payrolls boosted expectations for a September rate cut and U.S. stocks rose. However, the data also showed signs of a softening U.S. economy, which raised concerns in the market.

AI concept stocks saw mixed gains and losses. Palantir rose more than 5.3%, while Dell Technologies fell more than 2.8%.

China concept stocks underperformed the U.S. stock market. The ETF KWEB's decline once expanded more than 3%, CQQQ fell more than 3.5%, and the Nasdaq Golden Dragon China Index (HXC) fell more than 2.7%.

Popular individual stocks generally fell, and new energy vehicle makers plummeted. XPeng once fell more than 10.6%, Jidu Auto fell more than 8%, NIO fell more than 9.3%, and Li Auto fell more than 3.2%; in addition, JD.com fell more than 2.7%, PDD Holdings fell more than 3%, Baidu fell more than 2.4%, and Tencent (ADR) fell 1.5%.

Individual investors remained enthusiastic about holding Gauss electronic stocks, and the increase once exceeded 74%.

The following is the updated content before 21:50 Beijing time.

The U.S. non-farm payroll employment rose by 0.206 million in June. Although it greatly exceeded the expected 0.19 million, it still fell significantly from the previous value of 0.272 million. The total number of newly employed people in April and May decreased by 0.111 million compared with the revised figure. The unemployment rate hit a two-and-a-half-year high, indicating a cooling labor market that boosted expectations for an interest rate cut.

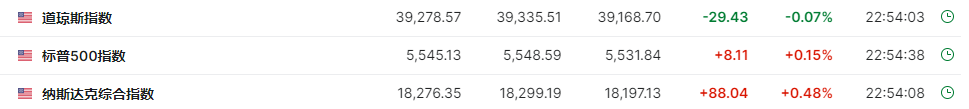

The three major U.S. stock indexes showed mixed gains and losses at the beginning of the trading day, with the NASDAQ rising 0.07%, the S&P 500 index rising 0.04%, and the Dow Jones Industrial Average falling 0.04%.

At the time of publication, the three major indexes collectively rose.

Among technology stocks, Tesla turned downward, falling more than 1%, while TSMC rose more than 0.49%, and Nvidia fell more than 1%.

Most China concept stocks showed declines, with XPeng falling more than 8%, Li Auto and NetEase falling more than 2%, NIO falling more than 7%, and Huya falling more than 3%.

US bond yields fell across the board.

The yield on the 10-year U.S. Treasury fell 4.6 basis points to 4.298%.

The U.S. dollar continued to decline.

The U.S. dollar fell 0.18% to 104.94 during the day.

Gold, silver, and copper all rose.

Spot gold continued to rise above $2,370 per ounce, up nearly 1% during the day; spot silver rose more than 1%, continuing yesterday's highs.

The London copper futures contract was quoted at $9,969 per ton, and once exceeded the $10,000 mark.

Bitcoin's decline narrowed.

Bitcoin's decline narrowed to 2%, now at 55,718 US dollars per coin, previously fell below the 540,000 level, the lowest level in two months.