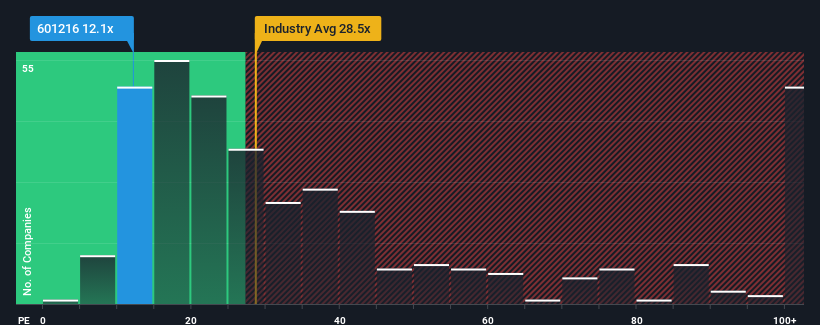

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 28x, you may consider Inner Mongolia Junzheng Energy & Chemical Group Co.,Ltd. (SHSE:601216) as a highly attractive investment with its 12.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

As an illustration, earnings have deteriorated at Inner Mongolia Junzheng Energy & Chemical GroupLtd over the last year, which is not ideal at all. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as Inner Mongolia Junzheng Energy & Chemical GroupLtd's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered a frustrating 37% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 51% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Retrospectively, the last year delivered a frustrating 37% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 51% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

In contrast to the company, the rest of the market is expected to grow by 36% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we are not surprised that Inner Mongolia Junzheng Energy & Chemical GroupLtd is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On Inner Mongolia Junzheng Energy & Chemical GroupLtd's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Inner Mongolia Junzheng Energy & Chemical GroupLtd revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 1 warning sign for Inner Mongolia Junzheng Energy & Chemical GroupLtd that you need to take into consideration.

If you're unsure about the strength of Inner Mongolia Junzheng Energy & Chemical GroupLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com