In the coming weeks, as investors gradually learn whether other companies' profit growth is catching up with the leading tech giants, the rise in the US stock market will be tested beyond large technology companies such as Nvidia. On the product structure, 100-300 billion yuan product operating income was 401/1288/60 million yuan respectively.

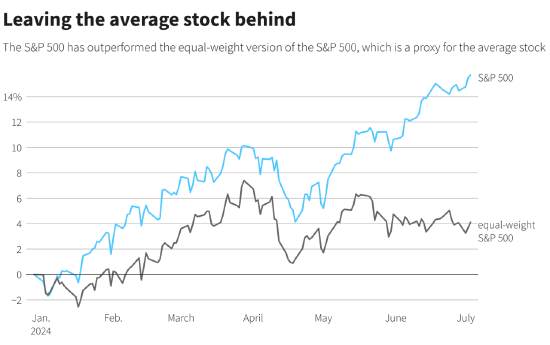

This year, the S&P 500 index has risen 16%, mainly driven by a small number of large stocks that will benefit from emerging AI technology. According to data from Bank of America global research strategist, only 24% of the stocks in the S&P 500 index outperformed the index in the first half of the year.

At the same time, the S&P 500 Equal Weight Index (SPXEW, representative of general stocks) has only risen about 4% this year. As of Tuesday, about 40% of the S&P 500 index constituents had fallen this year.

The release of second-quarter earnings begins next week, with JPMorgan and Citigroup announcing new quarter earnings on July 12. At that time, investors will focus on whether the profits of these companies catch up with the "Big Seven" of the US stock market, namely Nvidia, Microsoft, Apple, Alphabet, Amazon, Meta, and Tesla, many of which rebounded from the 2022 predicament.

Many investors believe that even a small rebound is not secure, as weakness in just a few large stocks can cause the overall index to fall; but some hope that the rally will expand in the second half of the year.

Many investors expect the US economy to achieve a soft landing. Therefore, they believe that more companies will see improved earnings, thereby driving these stocks to trade at more appropriate valuations.

"If we're looking for a catalyst to get more people involved in this year's rebound, then it's likely going to be the second-quarter earnings season," said Art Hogan, chief market strategist at B Riley Wealth.

Hogan said the expected price-to-earnings ratio for the S&P 500 index was 21 times. But if the top 10 market cap stocks were excluded, the average P/E ratio for the rest of the index would drop to 16.5 times.

As a further sign of a slight increase, only two of the 11 industries covered by the S&P 500 index have outperformed the overall index this year, those being information technology (IT) and communications services, which include much of the "Big Seven".

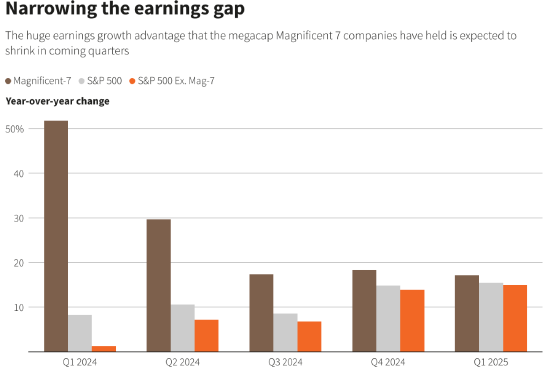

"Big Seven" Q1 profit grew 51.8% YoY, while earnings for the rest of the S&P 500 index's companies grew only 1.3%, said Tajinder Dhillon, senior research analyst at LSEG.

According to LSEG's data, this gap is expected to narrow, with Q2 profit for the "Big Seven" expected to grow 29.7% YoY, while earnings for the rest of the index will grow 7.2%.

"We believe that a greater balance of profitability could lead to broader market participation in the coming quarters," said Chris Haverland, global equity strategist at Wells Fargo Investment Institute (WFII).

WFII recommends that investors lower their expectations of gains in the technology and communications services industries to take advantage of weakness in the energy, medical care, industrial, and materials sectors.

Later this year, the profit advantage of the "Big Seven" is expected to further weaken. It is expected that the profit YoY of the seven companies in Q3 will increase by 17.4%, and in Q4 it will increase by 18.3%. In contrast, earnings for other index constituent companies in Q3 are expected to increase by 6.8%, and in Q4 they will increase by 13.9%.

"We expect almost every industry in the S&P 500 index to participate in this year's earnings growth," said Katie Nixon, chief investment officer at Northern Trust Wealth Management.

Of course, not everyone believes that other companies are about to catch up, as AI is still a dominant factor driving stock prices higher. Robert Pavlik, senior investment portfolio manager at Dakota Wealth Management, expressed skepticism about whether profit growth can meet expectations due to weak consumer spending, high inflation, and other worrying economic indicators.

In any case, in the coming days, investors may have a clearer understanding of the health of the economy and when the Fed will begin to cut rates, which could trigger a broader market rally. Federal Reserve Chairman Jerome Powell will testify before Congress next Tuesday, and the monthly consumer price index to be released thereafter will provide important references for inflation.