下半年希望在哪

我如果說外資下半年看好中國股市,你們不會罵我吧?

這些國際大行看好中國股市的共同原因是:聯儲局降息時點越來越近了。

最新的6月非農數據來看,聯儲局似乎真的要熬不住了,降息終點指日可待。

最新的6月非農數據來看,聯儲局似乎真的要熬不住了,降息終點指日可待。

1

非農就業數據推升降息預期

美國6月份新增非農就業20.6萬人,略高於市場預期的19萬人,但失業率從4.0%升至4.1%,高於市場預期的4.0%,自從2021年11月以來首次觸及這一水平,顯示美國勞動力市場進一步降溫。

時薪增速也在放緩。6月美國時薪環比上升0.3%,同比上漲3.9%,均符合市場預期,但同比增速爲2021年以來的最小增幅。

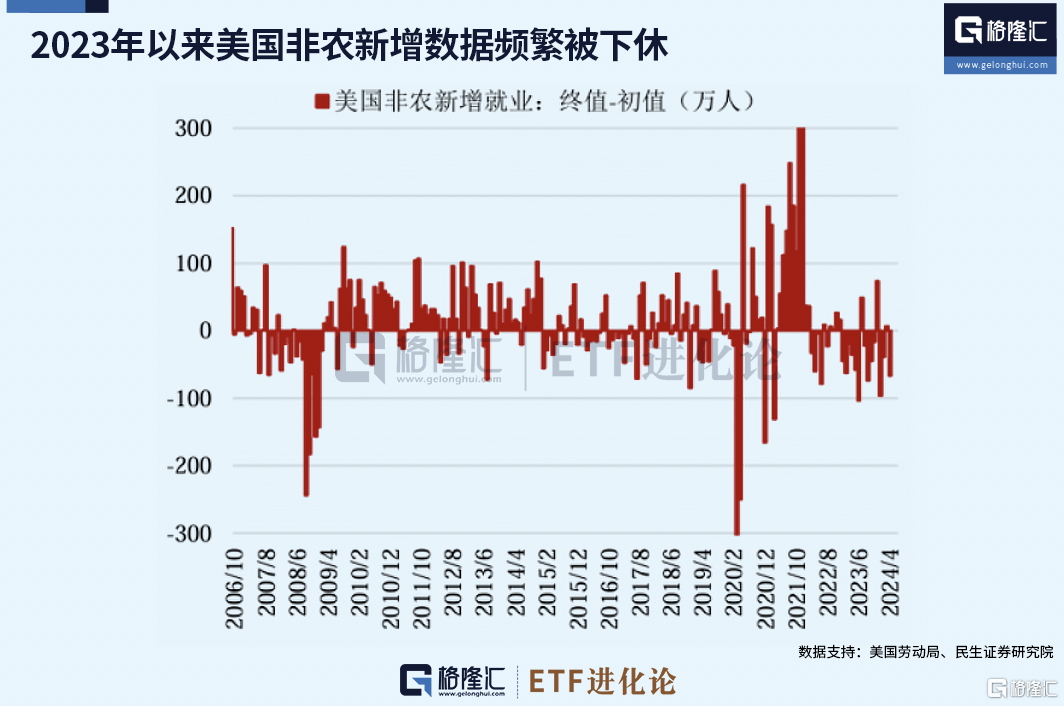

同時美國勞動部繼續例行公事,下調之前的非農數據,5月的非農數據27.2萬被大幅度下修到了21.8萬,4月的16.5萬下修到了10.8萬,合計下修了11.1萬。

數據發佈後,黃金和美股上漲、美債收益率下行,CME聯儲局觀察工具顯示9月降息的概率上升至70%以上。

不同於之前的數據打架,令市場躊躇不已。近期公佈的美國經濟數據均顯示出美國通脹趨緩,勞動力市場降溫。

美國5月JOLTS職位空缺814萬人,意外好於預期的795萬人。6月小非農ADP數據和上週初請失業金人數均顯示美國勞動力市場有所降溫。

就連聯儲局主席鮑威爾週二都鬆口表示,美國正重回“通脹回落軌道”,但仍強調降息前需要更多數據來驗證近期通脹率下降是否準確反映了經濟狀況。

週五的6月的非農數據進一步佐證美國勞動力市場降溫的觀點,市場降息預期迅速升溫。CME數據顯示,截至7月6日,市場預期聯儲局大概率9月降息,概率超過7成,並預期年內降息次數爲2次。

當全球最大流動性錨終於要被撬動,全球資產的定價會如何轉換?

2

亞洲股市下半年優於美股?

彭博社的一項調查顯示,中國和印度的股票被認爲是亞洲下半年潛在跑贏的兩個股市,因爲投資者紛紛湧向新興市場主題。

19位亞洲策略師和基金經理中,約有三分之一的人表示,他們認爲中國股市在未來六個月領漲,還有三分之一的人擇印度股市。

匯豐資產管理全球首席策略師Joseph Little在其年中展望中寫道:“我們認爲,估值折讓和全球經濟增長擴大爲新興市場(尤其是亞洲新興市場)提供了在下半年引領市場的機會。

高盛大宗經紀業務數據顯示,新興市場亞洲是6月份名義淨買入量最大的地區,而全球股市的淨賣出速度爲兩年來最快。

其中對沖基金在美國股市的淨槓桿率下降幅度最大,因爲它們紛紛退出科技股。在全球範圍內,對沖基金連續第三個月淨拋售股票,速度爲兩年來最快,其中北美地區的淨拋售規模爲去年9月以來最大。

泰國交易所數據顯示,7月3日全球基金淨買入3,600萬美元該國股票,爲5月16日來最高。

匯豐看好中國股市,預計“中國股市的非常負面情緒將慢慢轉變”,亞洲股票策略師Herald van der Linde表示。鑑於“中國經濟活動改善緩慢”,他將在下半年增加倉位。

儘管聯儲局下半年降息的概率越來越大,但美國11月的總統選舉也是不容忽視的風險點之一。

雖然超過一半的調查受訪者認爲,到2024年底,亞洲股市的表現可能會跑贏美國股市,理由是聯儲局降息和估值低廉。然而,他們中的大多數人認爲收益空間可能在在10%或更少。

3

ETF資金本週買什麼?

本週A股迎來罕見的連續三個交易日跌破6000億關口,疊加央行融券做空債市的動作頻頻,還在活躍的ETF資金會買什麼?

除開衆所周知的四隻滬深300ETF,資金佈局力度較爲明顯的是債券ETF、創業板ETF以及科創50ETF。

海富通基金短融ETF本週淨流入24.73億元,富國基金政金債券ETF淨流入9.21億元,鵬揚基金30年國債ETF淨流入3.2億元。

華夏基金科創50ETF、易方達基金創業板ETF、國聯安基金半導體ETF和易方達基金科創板50ETF本週分別淨流入7.1億元、6.71億元、5.54億元和5.34億元。

(本文內容均爲客觀數據信息羅列,不構成任何投資建議)

近期市場一大核心問題是縮量,成交量持續低迷,連續三個交易日低於6000億關口,的確是罕見了。但某種程度上也說明,跌到一定程度,願意賣的人就少了。賣盤減少,市場承壓殺跌的動能也隨之下降。

賣盤壓力降低的同時,從四隻滬深300ETF近三個交易日的資金流向來看,能看出神祕力量的態度就是防守,等待反擊。

短期角度來看,市場或寄希望於重要會議能夠帶來變化,中期角度就看股市生態的變化,以及上市公司盈利能否迎來較大改善,或者聯儲局降息放水。