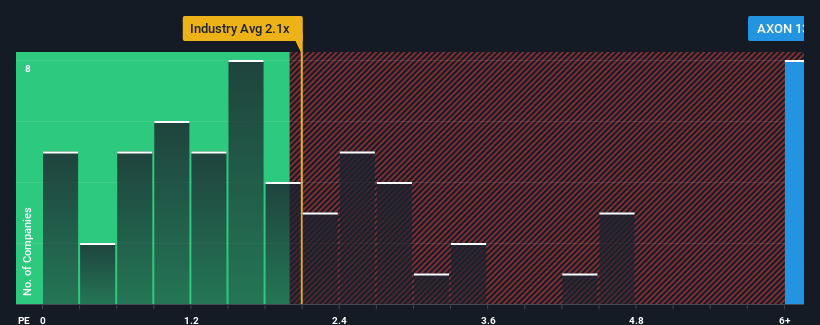

Axon Enterprise, Inc.'s (NASDAQ:AXON) price-to-sales (or "P/S") ratio of 13.4x may look like a poor investment opportunity when you consider close to half the companies in the Aerospace & Defense industry in the United States have P/S ratios below 2.1x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

How Has Axon Enterprise Performed Recently?

Recent times have been advantageous for Axon Enterprise as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Axon Enterprise.Is There Enough Revenue Growth Forecasted For Axon Enterprise?

The only time you'd be truly comfortable seeing a P/S as steep as Axon Enterprise's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 32% last year. Pleasingly, revenue has also lifted 131% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should demonstrate the company's robustness, generating growth of 24% as estimated by the eleven analysts watching the company. With the rest of the industry predicted to shrink by 3.5%, that would be a fantastic result.

With this in consideration, we understand why Axon Enterprise's P/S is a cut above its industry peers. At this time, shareholders aren't keen to offload something that is potentially eyeing a much more prosperous future.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We can see that Axon Enterprise maintains its high P/S on the strength of its forecast growth potentially beating a struggling industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Questions could still raised over whether this level of outperformance can continue in the context of a a tumultuous industry climate. Although, if the company's prospects don't change they will continue to provide strong support to the share price.

Plus, you should also learn about these 3 warning signs we've spotted with Axon Enterprise.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com