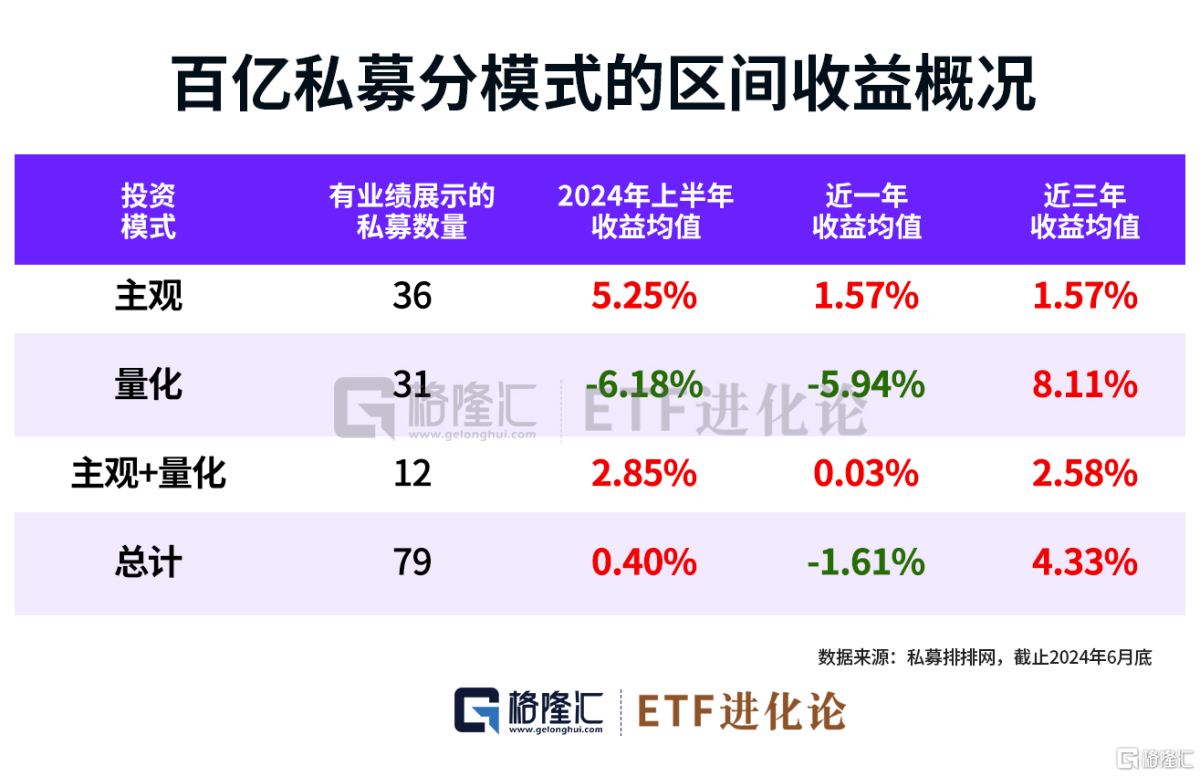

The half-year results of one hundred billion private equity funds are released. Data from the Private Equity Network's ranking shows that more than 40% of them achieved positive returns in the first half of this year. Due to adjustments in the small-cap index, the average returns of quantitative strategies were significantly lower than those of subjective bull strategies.

Specifically, the average return of the 79 billion-yuan level private equity funds with performance records in the first half of the year was 0.40%. 32 institutions realized floating profits, accounting for 40.51% of the total. Among them, 21 billion-yuan private equity funds had floating profits of over 5%, and 9 institutions had floating profits of over 10%, with the highest floating profit being nearly 50%.

On the champion and runner-up list, the performance champion of one hundred billion private equity funds is Dongfang Gangwan, under Dan Bin, with a return rate of 47.92%; the runner-up is Hainan Xiwa, under Liang Hong, with a return rate of 29.48%.

Dongfang Gangwan won the championship in the first half of the year, mainly due to investments in the US stock market. Dan Bin has publicly stated many times in the past year that he is heavily invested in AI tracks in the US stock market.

NVIDIA's gains were as high as 242% last year, and as high as 150% in the first half of this year. In June, it once again ranked first in global market cap.

Dan Bin revealed in the China Gold Yangtze Private Equity Fund Development Summit in June that NVIDIA's position now accounts for 45%-50% because it has risen a lot and he has not sold a single share, and he will continue to buy if he has money.

Dan Bin said: People who have made big money on Tencent have unconsciously gone to buy NVIDIA and Bitcoin in the AI era. The most difficult "unity of knowledge and action" in investment, most people will miss an era. In 2034 and 2044, the first company with a market cap of 10 trillion USD may appear in human history, and this 10 trillion USD market cap company is most likely still these American technology giants.

Liang Hong's fund won the runner-up of one hundred billion private equity funds in the first half of the year, with a return rate of 29.48%. The market speculates that the fund mainly invests in high dividend-paying stocks in Hong Kong stocks.

Liang Hong said that many high-yield stocks in Hong Kong stocks are still cheap, with attractive dividend yields. Liang Hong once revealed that he likes oil and gas stocks and said that we should not envy other countries' unstable high-tech companies. We have coal, oil, and electricity, which are no worse than Apple, Microsoft, and NVIDIA. Moreover, they can also distribute dividends, and earn more shares when the price rises and distribute dividends when it falls.

Liang Hong judged that the long-term trend of oil prices is upward. It is difficult to judge the short-term price, but 70 is the bottom based on the annual average price. The center is around 80 (Saudi Arabia's fiscal balance position, US strategic oil reserve position). It is possible to go up to any level.