The top three net buy-in amounts on today's Longhu list are Fine Made Microelectronics Group, Shenzhen Kaizhong Precision Technology, and Guangdong Guanghua Sci-Tech.

On July 8th, the main A-share indices continued to decline, with more than 4,800 stocks falling on the two markets. The total turnover for the day was 582 billion yuan, which is below 600 billion yuan for the fourth consecutive day.

On the market, digital sentry and digital currency sectors fell, while human brain engineering and longevity medicine sectors weakened. The education sector fluctuated downward, and domestic software, short drama concepts, and multimodal AI sectors are among the top decliners. In addition, the chicken concept and food safety sector rose slightly.

There were 19 stocks with daily limit-up today, with a total of 4 consecutive stocks, and 12 stocks failed to hit the limit. The limit-up rate was 61% (excluding ST stocks, delisted stocks and unlisted new stocks).

There were 19 stocks with daily limit-up today, with a total of 4 consecutive stocks, and 12 stocks failed to hit the limit. The limit-up rate was 61% (excluding ST stocks, delisted stocks and unlisted new stocks).

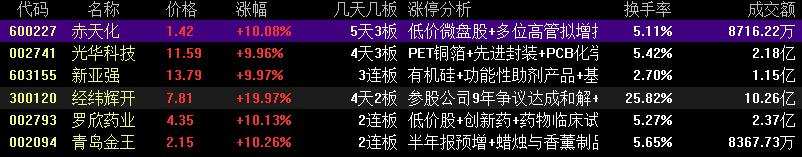

Regarding the focus stocks, Xinyaqiang, Guanghai Technology, and Jingwei Huikai have had 3 and 2 consecutive daily limit-ups, respectively, and low-priced stock Chitianhua has had 5 limit-ups in 3 days and Luoxin Pharmaceuticals has had 2 consecutive limit-ups.

Now let's take a look at today's Longhu Bang.

Today's top three net purchases on the Longhu Bang were Fuman Microelectronics, Kaizhong Precision, and Guanghai Technology, with 71.4394 million yuan, 62.1574 million yuan, and 29.8487 million yuan, respectively.

Today's top three net sells on the Longhu Bang were Naxin Wei, Xianying Technology, and Hunan Copote Science and Technology, with 0.117 billion yuan, 46.3552 million yuan, and 42.3154 million yuan, respectively.

Among the individual stocks involved in the Longhu Bang with institutional dedicated seats, Luoxin Pharmaceuticals, Xinling Electric, and Enpack Packaging had the top three net purchases of 18.038 million yuan, 5.5222 million yuan, and 4.4952 million yuan, respectively.

Among the individual stocks involved in the Longhu Bang with institutional dedicated seats, Naxin Wei, Meixin Technology, and Shenyang Yuanda Intellectual Industry Group had the top three net sells of 0.156 billion yuan, 21.0176 million yuan, and 16.1638 million yuan, respectively.

Some of the top stock themes on the lists are:

Fuman Microelectronics (Integrated circuits + Advanced packaging)

On the news front, most of TSMC's customers have agreed to raise foundry prices for reliable supplies.

1. The company is a national-level high-tech enterprise and a key integrated circuit design enterprise encouraged by the national government, focusing on high-performance, high-quality analog IC chip design research and development, packaging, testing, and sales.

2. The company's products are divided into four major categories, mainly covering many fields such as video display, wireless communication, storage, and power management. The main products are LED screen controllers and drivers, MOSFET, MCU, fast charging protocol chips, and various ASIC chips.

3. The company's 5G RF chips have started mass production, and its main customers include domestic mainstream mobile phone and ODM manufacturers; the company's power controller chips can support 160W and 120W power. The company's ACDC power controller chips can support GAN devices.

Kaizhong Precision (Lithium battery concept + new energy automobile industry chain)

1. On the evening of June 30, 2024, the company received a designated notification of a project from a well-known European automaker to provide precision electric vehicle connectors for its power battery and drive motor core modules. The total sales amount during the project life cycle is approximately RMB 1.35 billion, and mass production is scheduled to begin in the first quarter of 2026.

2. The company's products applied in the intelligent driving field mainly include EPS power steering system connectors, a new generation of brake system connectors and other products. The company provides integrated solutions for key core components to dozens of global Fortune 500 customers, including key core component products and technologies in the fields of new energy automobiles, lightweight automobiles, self-driving automobiles, and intelligent automobiles.

3. The company mainly produces precision parts and components, and some products are applied in the fields of smart homes and offices, intelligent equipment, photovoltaic power generation equipment, aviation and aerospace, etc.

Naxin Wei (Automotive chips + advanced packaging + integrated circuits)

In terms of news, due to their own capital needs, shareholders Guorun Ruiqi, Huiyue Growth, Suzhou Huaye, and their concerted action parties Changsha Huaye plan to reduce their holdings by no more than 2% of the company's total equity through bidding transactions and bulk transactions from July 29, 2024 to October 28, 2024.

Some of the top stock themes on the lists are:

Luoxin Pharmaceuticals: Two consecutive boards hit the limit and closed at 4.35 yuan/share with a turnover of 0.237 billion yuan and a total market value of 4.731 billion yuan. According to the statistics of the top 10 brokerage firms, institutions had a net purchase of 18.038 million yuan and northbound capital had a net sale of 4.3628 million yuan. Well-known institutional investors such as Zhang Mengzhu, quantitative investors made a big move.

Xinling Electric: the stock fell 6.04% with a turnover rate of 26.34%, total volume of 0.0859 million shares, and a turnover of 0.186 billion yuan. According to the statistics of the top 10 brokerage firms, institutions had a net purchase of 5.5222 million yuan. Well-known institutional investors such as Zhang Mengzhu made a big move.

Guangdong Enpack Packaging: the stock hit the limit for the first time at 7.72 yuan/share, with a turnover of 0.152 billion yuan and a total market value of 3.242 billion yuan. According to statistics of the top 10 brokerage firms, institutions had a net purchase of 4.4952 million yuan. Well-known institutional investors such as quantitative investors, Beijing Zhongguancun made a big move.

Nanxin Micro: the stock fell by 15.4% with a turnover rate of 5.96%, and a turnover of 0.491 billion yuan. According to the statistics of the top 10 brokerage firms, institutions had a net sale of 0.156 billion yuan and northbound capital had a net purchase of 16.2777 million yuan.

Mestech: the stock rose 2.27% with a turnover rate of 31.22%, a total volume of 0.0346 million shares, and a turnover of 0.225 billion yuan. According to statistics of the top 10 brokerage firms, institutions had a net sale of 21.0176 million yuan.

Shenyang Yuanda Intellectual Industry Group: the stock hit the limit down with a turnover rate of 6.19%, a total volume of 0.6442 million shares, and a turnover of 0.156 billion yuan. According to the statistics of the top 10 brokerage firms, institutions had a net sale of 16.1638 million yuan.

In the list of institutional trading top 10, there are 2 stocks using Shanghai Stock Connect seats. Bomin Electronics' SQ seat had the largest net purchase of 3.3802 million yuan.

In the list of institutional trading top 10, there are 4 stocks using Shenzhen Stock Connect seats. Fine Made Microelectronics' SZ seats had the largest net purchase of 15.1541 million yuan.

Yoozoo operation dynamics:

Dongbei Mengnan: net bought Kaizhong Precision Technology for 35.69 million yuan and net sold Copote Science Technology for 24.48 million yuan.

Hu Jialou: net bought Jingwei Huikai Optoelectronic for 50.56 million yuan and Fine Made Micro for 18.22 million yuan.

Mining undervalued stocks: net bought Fine Made Micro for 15.15 million yuan and Hengguang Stock for 10.45 million yuan.

Shang Tang Road: net bought Xinyaqiang Silicon Chemistry for 27.58 million yuan, Guangdong Guanghua Sci-Tech for 25.84 million yuan, net sold Xian Ying Technology for 30.05 million yuan, and Jingwei Huikai Optoelectronic for 10.31 million yuan.

Zhao Laoge: net bought Sunny Loan Top for 12.74 million yuan.

Siming South Road: net sold Jingwei Huikai Optoelectronic for 32.55 million yuan.

今日共19股涨停,连板股总数4只,12股封板未遂,封板率为61%(不含ST股、退市股及未开板新股)。

今日共19股涨停,连板股总数4只,12股封板未遂,封板率为61%(不含ST股、退市股及未开板新股)。