Financial giants have made a conspicuous bearish move on MicroStrategy. Our analysis of options history for MicroStrategy (NASDAQ:MSTR) revealed 47 unusual trades.

Delving into the details, we found 38% of traders were bullish, while 46% showed bearish tendencies. Out of all the trades we spotted, 12 were puts, with a value of $803,321, and 35 were calls, valued at $1,554,170.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $800.0 to $2000.0 for MicroStrategy over the last 3 months.

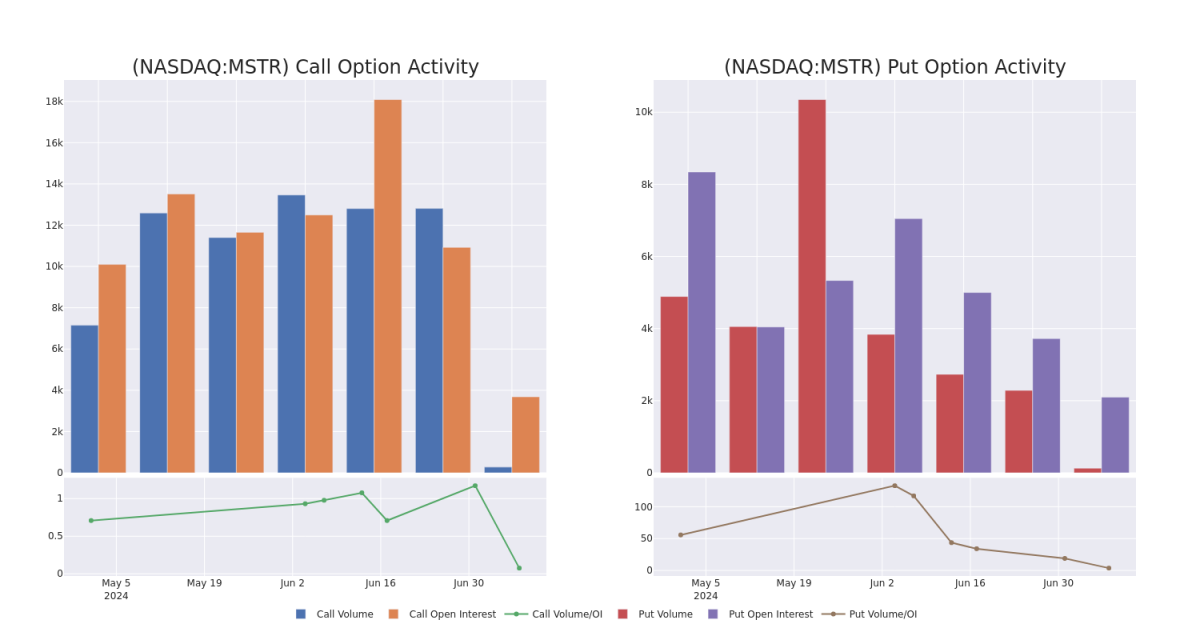

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for MicroStrategy options trades today is 144.21 with a total volume of 399.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for MicroStrategy's big money trades within a strike price range of $800.0 to $2000.0 over the last 30 days.

MicroStrategy Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MSTR | PUT | TRADE | BEARISH | 11/15/24 | $220.2 | $214.0 | $220.2 | $1200.00 | $220.2K | 125 | 0 |

| MSTR | PUT | TRADE | BULLISH | 07/12/24 | $218.5 | $215.0 | $215.0 | $1500.00 | $107.5K | 63 | 3 |

| MSTR | PUT | TRADE | BEARISH | 12/19/25 | $435.0 | $428.1 | $435.0 | $1200.00 | $87.0K | 15 | 0 |

| MSTR | PUT | SWEEP | BEARISH | 08/16/24 | $91.25 | $89.95 | $91.25 | $1180.00 | $82.4K | 12 | 41 |

| MSTR | CALL | TRADE | BULLISH | 01/17/25 | $246.4 | $238.55 | $246.4 | $1700.00 | $73.9K | 171 | 2 |

About MicroStrategy

MicroStrategy Inc is a provider of enterprise analytics and mobility software. It offers MicroStrategy Analytics platform that delivers reports and dashboards and enables users to conduct ad hoc analysis and share insights through mobile devices or the Web; MicroStrategy Server, which provides analytical processing and job management. The company's reportable operating segment is engaged in the design, development, marketing, and sales of its software platform through licensing arrangements and cloud-based subscriptions and related services.

Following our analysis of the options activities associated with MicroStrategy, we pivot to a closer look at the company's own performance.

MicroStrategy's Current Market Status

- With a volume of 161,380, the price of MSTR is up 2.38% at $1312.19.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 22 days.

Professional Analyst Ratings for MicroStrategy

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $2264.2.

- An analyst from TD Cowen has decided to maintain their Buy rating on MicroStrategy, which currently sits at a price target of $1880.

- An analyst from Bernstein has revised its rating downward to Outperform, adjusting the price target to $2890.

- An analyst from Canaccord Genuity persists with their Buy rating on MicroStrategy, maintaining a target price of $1826.

- In a cautious move, an analyst from Bernstein downgraded its rating to Outperform, setting a price target of $2890.

- Reflecting concerns, an analyst from Maxim Group lowers its rating to Buy with a new price target of $1835.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for MicroStrategy with Benzinga Pro for real-time alerts.