Market Whales and Their Recent Bets on Unity Software Options

Market Whales and Their Recent Bets on Unity Software Options

Benzinga's options scanner has just identified more than 8 option transactions on Unity Software (NYSE:U), with a cumulative value of $774,990. Concurrently, our algorithms picked up 2 puts, worth a total of 106,043.

Benzinga的期權掃描儀剛剛在Unity Software(紐約證券交易所代碼:U)上發現了超過8筆期權交易,累計價值爲774,990美元。同時,我們的算法獲得了 2 個看跌期權,總價值爲 106,043 個。

Projected Price Targets

預計價格目標

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $12.5 to $17.5 for Unity Software during the past quarter.

分析這些合約的交易量和未平倉合約,看來大型企業一直在關注Unity Software在過去一個季度的價格範圍從12.5美元到17.5美元不等。

Volume & Open Interest Trends

交易量和未平倉合約趨勢

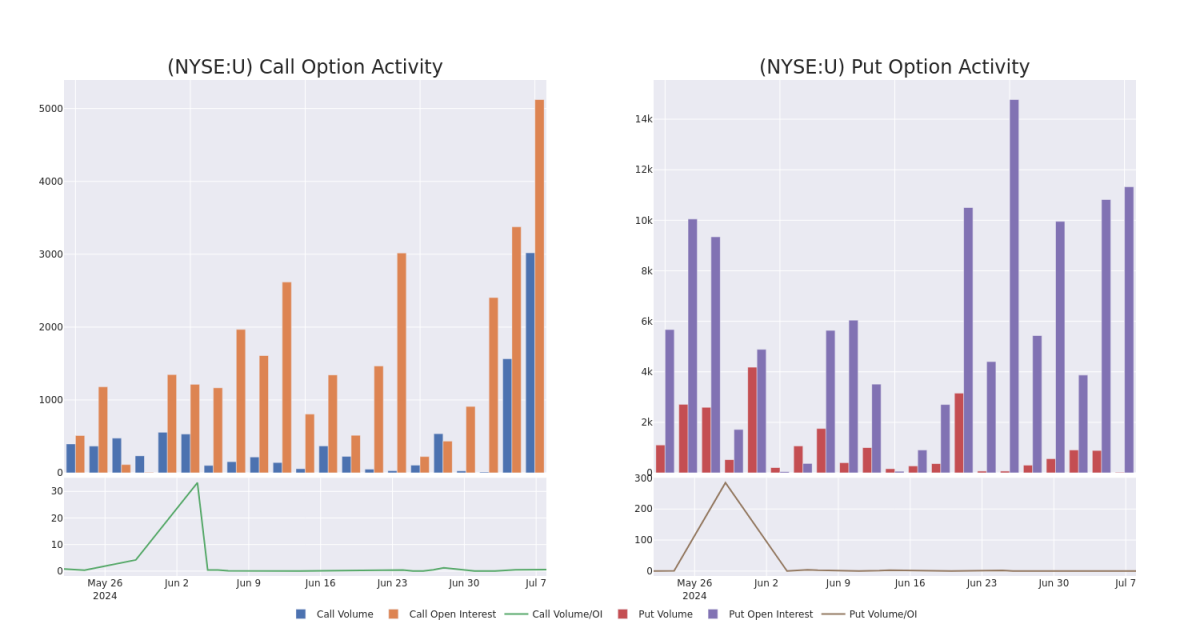

In today's trading context, the average open interest for options of Unity Software stands at 2741.0, with a total volume reaching 3,040.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Unity Software, situated within the strike price corridor from $12.5 to $17.5, throughout the last 30 days.

在當今的交易背景下,Unity軟件期權的平均未平倉合約爲2741.0,總交易量達到3,040.00美元。隨附的圖表描繪了過去30天內Unity Software高價值交易的看漲和看跌期權交易量以及未平倉合約的變化,行使價走勢從12.5美元到17.5美元不等。

Unity Software Option Volume And Open Interest Over Last 30 Days

過去 30 天的 Unity 軟件期權交易量和未平倉合約

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| U | CALL | SWEEP | BULLISH | 08/16/24 | $1.53 | $1.52 | $1.53 | $16.00 | $295.5K | 1.0K | 1.5K |

| U | CALL | TRADE | BULLISH | 08/16/24 | $1.49 | $1.48 | $1.49 | $16.00 | $149.0K | 1.0K | 108 |

| U | CALL | SWEEP | BULLISH | 01/17/25 | $4.15 | $4.1 | $4.15 | $14.00 | $124.5K | 503 | 0 |

| U | PUT | SWEEP | BULLISH | 01/17/25 | $1.27 | $1.22 | $1.23 | $12.50 | $70.0K | 4.4K | 21 |

| U | CALL | SWEEP | BULLISH | 06/20/25 | $3.85 | $3.75 | $3.85 | $17.00 | $42.3K | 1.7K | 0 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| U | 打電話 | 掃 | 看漲 | 08/16/24 | 1.53 | 1.52 美元 | 1.53 | 16.00 美元 | 295.5 萬美元 | 1.0K | 1.5K |

| U | 打電話 | 貿易 | 看漲 | 08/16/24 | 1.49 美元 | 1.48 美元 | 1.49 美元 | 16.00 美元 | 149.0K | 1.0K | 108 |

| U | 打電話 | 掃 | 看漲 | 01/17/25 | 4.15 美元 | 4.1 美元 | 4.15 美元 | 14.00 美元 | 124.5 萬美元 | 503 | 0 |

| U | 放 | 掃 | 看漲 | 01/17/25 | 1.27 | 1.22 | 1.23 美元 | 12.50 美元 | 70.0K | 4.4K | 21 |

| U | 打電話 | 掃 | 看漲 | 06/20/25 | 3.85 美元 | 3.75 美元 | 3.85 美元 | 17.00 美元 | 42.3 萬美元 | 1.7K | 0 |

About Unity Software

關於 Unity 軟件

Unity Software Inc provides a software platform for creating and operating interactive, real-time 3D content. The platform can be used to create, run, and monetize interactive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices. The business is spread across the United States, Greater China, EMEA, APAC, and Other Americas, of which key revenue is derived from the EMEA region. The products are used in the gaming industry, architecture and construction sector, animation industry, and designing sector.

Unity Software Inc 爲創建和操作交互式實時 3D 內容提供了一個軟件平台。該平台可用於爲手機、平板電腦、PC、遊戲機以及增強現實和虛擬現實設備創建、運行交互式、實時 2D 和 3D 內容並從中獲利。該業務分佈在美國、大中華區、歐洲、中東和非洲、亞太地區和其他美洲,其中主要收入來自歐洲、中東和非洲地區。這些產品用於遊戲行業、建築和建築行業、動畫行業和設計領域。

Present Market Standing of Unity Software

Unity 軟件目前的市場地位

- With a volume of 5,547,289, the price of U is up 3.88% at $16.32.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 23 days.

- U的交易量爲5,547,289美元,上漲3.88%,至16.32美元。

- RSI 指標暗示,標的股票目前在超買和超賣之間保持中立。

- 下一份業績預計將在23天后公佈。

What Analysts Are Saying About Unity Software

分析師對Unity軟件的看法

In the last month, 2 experts released ratings on this stock with an average target price of $19.5.

上個月,2位專家發佈了該股的評級,平均目標價爲19.5美元。

- Maintaining their stance, an analyst from Stifel continues to hold a Buy rating for Unity Software, targeting a price of $25.

- Maintaining their stance, an analyst from Macquarie continues to hold a Underperform rating for Unity Software, targeting a price of $14.

- Stifel的一位分析師堅持自己的立場,繼續維持Unity Software的買入評級,目標價格爲25美元。

- 麥格理的一位分析師堅持自己的立場,繼續對Unity Software維持表現不佳的評級,目標價格爲14美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。