- Post

*The X (old Twitter) share button is not available on your current browser

PDF (844KB)

Completion of public offering and issuance of real estate security tokens for the first time in Japan to invest in the rental detached house “Kolet (Colet)”

July 9, 2024

Kenedix Co., Ltd.

SMBC Trust and Banking Co., Ltd.

Nomura Securities Co., Ltd.

BOOSTRY CO., LTD

Kenedix Co., Ltd. (hereinafter “Kenedix”), SMBC Trust Bank, Ltd. (hereinafter “SMBC Trust Bank”), Nomura Securities Co., Ltd. (hereinafter “Nomura Securities”), and BOOSTRY Co., Ltd. (hereinafter “BOOSTRY”) collaborated on the public offering of real estate security tokens*2 (hereinafter “this ST”) utilizing the consortium blockchain platform “ibet for Fin*1”, and announced that recruitment and issuance have been completed I will.

This ST forms real estate trust beneficiary rights for the rental detached house Kolet series (hereinafter “target property”) operated by the smart home-compatible next-generation rent house brand “Kolet (Colet)” provided by Kenedix, which has one of the largest rental detached house portfolios in Japan, as trust assets, and manages securities information and transaction information related to those beneficiary rights using ibet for fin.

Overview of this ST

| The name of this product | Kenedix Realty Token Kolet-1 (with transfer restrictions) |

|---|---|

| Real estate to be invested (price of real estate beneficiary rights) | Beneficiary rights for real estate management and disposal trusts with 484 rental detached houses (462 properties) in the Kolet series located in 1 metropolitan area and 3 prefectures as trust assets (approximately 20.7 billion yen in total) |

| Number of issues/total amount issued | 9,251 units/9.251 billion yen |

| Issue price/application unit | 1 million yen per unit/1 unit or more per unit |

| Operation period | Approximately 5 years and 1 month (redemption schedule for the 2029/7 fiscal year) *Early redemption or a period of up to 3 years can be extended at the discretion of the asset manager |

| Types of securities offered | A security token representing the beneficiary rights of a beneficiary securities issuance trust |

| issuers | Contractor KST Co., Ltd. 11*3 Trustee SMBC Trust Bank |

| asset manager | Kenedix Investment Partners, Inc. |

| Handling company | Nomura Securities |

| render | Sumitomo Mitsui Banking Corporation |

Kenedix is one of the largest real estate asset management companies in Japan that manages real estate exceeding 3 trillion yen. In August 2021, we launched a real estate security token offering (hereinafter “STO”) for the first time in Japan to raise funds by issuing real estate ST. Also, in August 2021, we announced the rental detached house brand “Kolet (Colet)” operated by Kenedix, and we have been pursuing new possibilities for rental detached houses in Japan. Recently, by merging these two new businesses and carrying out a public offering for this ST, which invests in the rental detached house KOlet series (484 units) as the 12th real estate STO, a project contributing to providing new options to investors and expanding the real estate ST market has come to be realized. As a result, the total asset size of real estate ST managed by Kenedix group companies is approximately 140 billion yen, including this ST. Kenedix will continue to promote the dissemination and establishment of new lifestyles with next-generation rent houses through business development of the rental detached house Kolet series, and aims for a future where 2.5 trillion yen real estate is STed across the entire market by 2030 in order to make real estate ST, which is a new investment opportunity utilizing digital technology, the “third pillar of business” after REITs and private placement funds.

Overview of Kenedix's rental detached housing “Kolet (Colet)” business

The rental detached houses included in this ST are located in the three prefectures of Tokyo, Kanagawa, Saitama, and Chiba. There is a large supply of rental housing for single people in the rental housing market in 1 metropolitan area and 3 prefectures, and the ratio of rental housing with a floor area of 70 square meters or more is only about 12% *4 of the total stock, and we recognize that it is not easy for child-rearing households and people seeking a spacious home to find rental housing with an ideal number of rooms and space.

The spread of rental detached housing is not progressing in Japan, and while the ratio of newly built rental detached houses to newly built rental housing in 1 metropolitan area and 3 prefectures is only about 1% ※5, I believe there is a lot of demand for rental detached housing against the backdrop of diversifying lifestyles. Under these circumstances, Kenedix anticipates that there is a potential market size of rental detached housing exceeding 1 million units in 1 metropolitan area and 3 prefectures due to market backgrounds such as soaring construction prices, decline in homeownership intentions, lack of large rental housing, etc., and is pioneering the industry by developing the rental detached housing brand “Kolet (Colet)” and expanding its business scale.

As a general rule, Kolet (Colet) has 2 to 3 floors in 1 metropolitan area and 3 prefectures, and has a spacious floor plan with 3 or more rooms in addition to the LDK, and it is a housing option that can meet people's diverse lifestyles, such as people who are concerned about noise and privacy, people who want to live with their parents in 2 households, and people who need space to enjoy their hobbies. Furthermore, through the Kolet (Colet) business, Kenedix is promoting sustainability initiatives such as “adopting electricity derived from real renewable energy” and “contributing to a decarbonized society by supplying wooden rental housing,” and improving the safety and convenience of residents through “smart houses that have already introduced home IoT.” Kenedix will continue to maximize the potential of rental detached housing and open up new rental housing markets to discover unmet needs for more comfortable housing, starting with child-rearing households, and realize contributions to diverse societies.

SMBC Trust Bank is developing products and services related to the issuance and management of ST supporting various assets in this field by utilizing knowledge related to real estate and securitization products, etc. as a trust bank for the development of the STO market. Going forward, we will continue to strive to create social value through product development and business promotion, etc., and work on co-creation with companies inside and outside the SMBC Group.

Nomura Securities aims to quickly provide products and services through cooperation with various partners and a multifaceted approach for digital asset-related businesses utilizing blockchain technology, which is expected to become one of the new services in the capital market. Starting with handling the first public offering of real estate ST in Japan in July 2021, we have been working on the development and expansion of the ST market, such as handling green digital truck bonds*6 for institutional investors and the largest real estate ST*7 ever in Japan. Going forward, we will continue to work to provide a wider range of investment opportunities than ever before, starting with the handling of this ST, which supports the first rental detached house in Japan.

BOOSTRY provides IT services centered around “ibet for Fin.” ibet for Fin manages multiple public real estate security tokens, public corporate bond security tokens, and private real estate security tokens. By expanding existing capital markets, BOOSTRY aims to create new capital markets that lead to corporate capital raising and core business support.

Going forward, we will continue to provide investors with new investment opportunities through collaboration across industries, and in addition to responding to social issues of “from savings to investment,” we will also aim to diversify fund raising methods by expanding investment management products such as this ST, which supports real estate, etc.

1 For details, please refer to the site published by the ibet for Fin consortium.

2 For details, please refer to the website published by Nomura Securities.

For details on this ST during the operation period, please refer to the site operated by the Kenedix Group (scheduled to open on 2024/7/10).

3 It is a special purpose company established to issue ST.

4 See “Housing and Land Statistics Survey (2018).”

5 See “Housing Commencement Statistics.” The ratio of single-family homes (rental houses) to the number of newly built housing starts in 2022 in Tokyo, Kanagawa, Saitama, and Chiba prefectures is about 1.3%.

6 For details, please refer to the news release “Hitachi's Collaboration to Issue Digital Environmental Bonds” dated 2023/11/16.

7 For details, please refer to the news release “Completion of the public offering and issuance of the largest real estate security token ever in Japan” dated 2023/8/30.

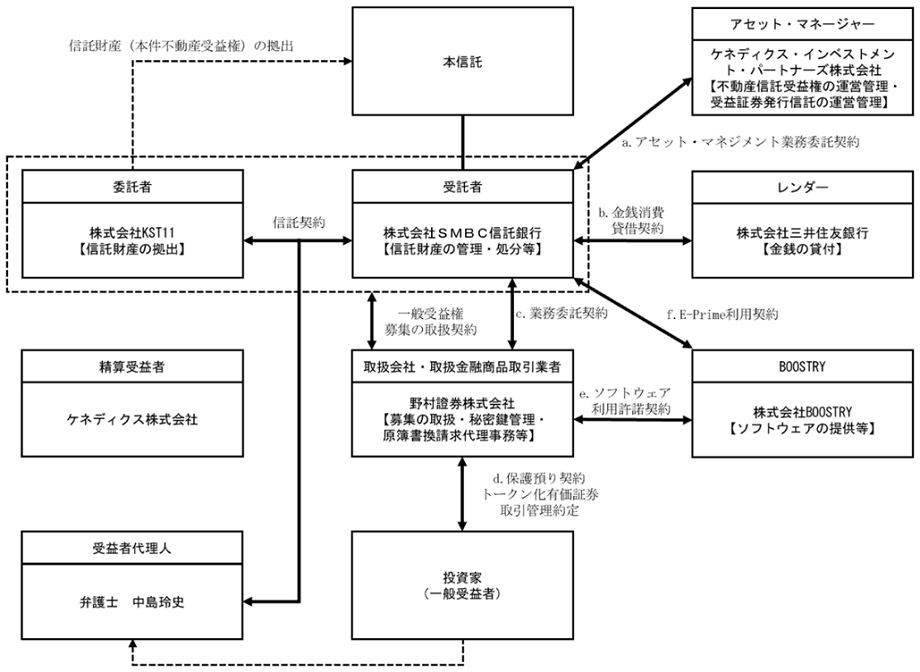

(Reference 1) Scheme image of this ST

(Reference 2) Definition of a security token

| terminology | definitions |

|---|---|

| security token (Security Token, abbreviation: ST, digital securities) | It indicates a financial product (marketable securities) issued and managed using digital technology represented by blockchain, and falls under the “electronic record securities display rights, etc.” stipulated in the Financial Instruments and Exchange Act. |

| Security token offerings (Security Token Offering, abbreviation: STO) | It indicates fund raising by issuing security tokens to investors, and is carried out based on the regulations of the Financial Instruments and Exchange Act. |

| Real estate security tokens (Abbreviation: Real Estate ST) | Among security tokens, it refers to those issued with real estate-related assets as support. An STO using real estate ST is called a real estate STO. |

About the Nomura Group

What is the Nomura Group

- Nomura Group Overview

- List of group companies

- Senior Managing Director (Executive Structure)

- Group CEO Message

- Corporate Philosophy/ Code of Conduct

- The history of the Nomura Group

- media gallery

- List of awards and external evaluations

- Cultural and sports support

- Basic Supplier Transaction Policy

Governance, risk management, and compliance

- corporate governance

- risk management

- compliance

Nomura Services

- Wealth Management Division

- Investment Management Division

- Wholesale Division

- Global research

- NomuraConnects Japanese

sustainability

- The Nomura Group's Approach

- Measures for sustainable growth

- Contribution to society

- environs

- human resources

- stakeholders

- External Assessment

library

- Integrated reports and various materials

- ESG data

- Reference guidelines

SDGs with Nomura

- SDGs with Nomura

Shareholders and Investors (IR)

Message and Executive System Diagram

- Group CEO Message

- Executive system diagram

IR Library

- Management Strategy (presentation)

- Settlements/Financial Information

- Annual Report and Submission Documents

- IR calendar

To all investors

- To Our Shareholders

- To all individual investors

- To all bond investors

- Electronic notice

news

- news release

- Announcements

Recruiting Information

- About the Nomura Group

- services

- Shareholders and Investors (IR)

- news

- sustainability

- Recruiting Information

- Sitemap

- Terms of use

- personal information protection policy

- Conflict of Interest Management Policy

- accessibility policy

COPYRIGHT NOMURA HOLDINGS, INC. ALL RIGHTS RESERVED.