Deep-pocketed investors have adopted a bullish approach towards Chipotle Mexican Grill (NYSE:CMG), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CMG usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 15 extraordinary options activities for Chipotle Mexican Grill. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 53% leaning bullish and 46% bearish. Among these notable options, 5 are puts, totaling $290,408, and 10 are calls, amounting to $388,894.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $40.0 and $82.0 for Chipotle Mexican Grill, spanning the last three months.

Insights into Volume & Open Interest

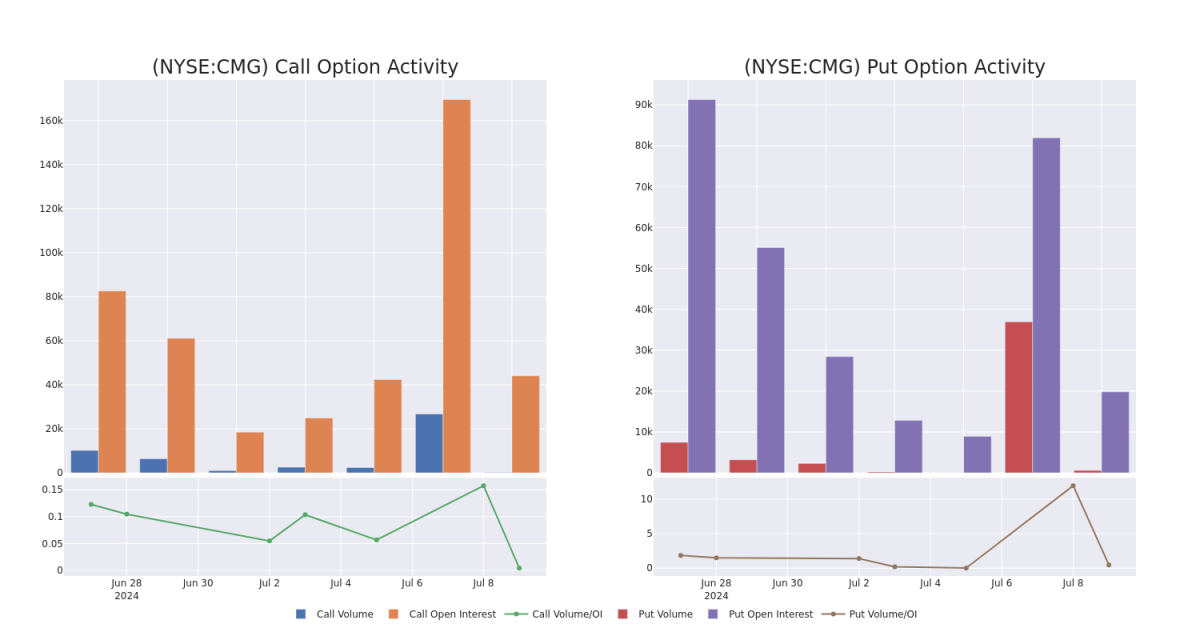

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Chipotle Mexican Grill's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Chipotle Mexican Grill's significant trades, within a strike price range of $40.0 to $82.0, over the past month.

Chipotle Mexican Grill Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CMG | PUT | SWEEP | BEARISH | 06/20/25 | $4.8 | $4.4 | $4.79 | $56.00 | $96.0K | 4.2K | 200 |

| CMG | PUT | SWEEP | BULLISH | 06/20/25 | $4.9 | $4.7 | $4.8 | $56.00 | $96.0K | 4.2K | 0 |

| CMG | CALL | SWEEP | BEARISH | 07/19/24 | $4.6 | $4.3 | $4.3 | $54.80 | $86.0K | 151 | 0 |

| CMG | CALL | TRADE | BULLISH | 07/19/24 | $1.2 | $1.15 | $1.2 | $60.10 | $57.4K | 271 | 5 |

| CMG | CALL | SWEEP | BEARISH | 01/17/25 | $4.9 | $4.6 | $4.7 | $64.00 | $41.9K | 19.3K | 1 |

About Chipotle Mexican Grill

Chipotle Mexican Grill is the largest fast-casual chain restaurant in the United States, with systemwide sales of $9.9 billion in 2023. The Mexican concept is predominately company-owned, although it recently inked a development agreement with Alshaya Group in the Middle East. It had a footprint of nearly 3,440 stores at the end of 2023, heavily indexed to the United States, although it maintains a small presence in Canada, the UK, France, and Germany. Chipotle sells burritos, burrito bowls, tacos, quesadillas, and beverages, with a selling proposition built around competitive prices, high-quality food sourcing, speed of service, and convenience. The company generates its revenue entirely from restaurant sales and delivery fees.

In light of the recent options history for Chipotle Mexican Grill, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Chipotle Mexican Grill's Current Market Status

- Currently trading with a volume of 2,275,160, the CMG's price is down by -0.41%, now at $59.27.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 15 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.