Under the impetus of the largest technology stocks in the world, the S&P 500 index has performed well in the first half of the year. The question for the remainder of this year is whether the strong momentum can continue.

Wall Street is historically biased towards technology stocks. If the upward trend driven by artificial intelligence wavers, the risk will increase. Overvaluation and slowing profit growth add to the uncertainty.

This has added uncertainty to investors betting on large-cap tech stocks continuing their upward momentum, according to Lisa Shalett, chief investment officer of Morgan Stanley's wealth management division.

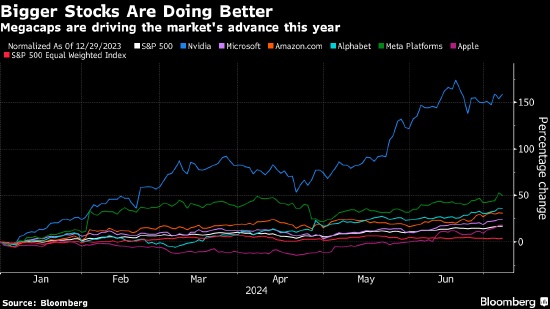

The S&P 500 index has risen 17% this year, with two-thirds of the increase coming from six stocks: Nvidia, Microsoft, Alphabet Inc., Amazon, Meta Platforms Inc., and Apple. Nvidia, which focuses on artificial intelligence chip manufacturing, has soared by 159% this year, accounting for nearly 30% of the S&P 500 index's gain in 2024, contributing to the index's returns to the highest level in at least a decade.

The S&P 500 equal weight index has only risen 3.9% this year, while large-cap stocks are leading small-cap stocks with historic advantages.

The dominance of tech stocks -- especially the rise of a few crucial companies seen as at the forefront of the AI revolution -- suggests some similarities to the dot-com era, when the internet thrived before the bubble burst and took years to recover. But today's large-cap stocks are generally considered stronger, with substantial cash flows, strong competitive positions, and robust long-term demand trends.

Matt Stucky, chief investment portfolio manager for stocks at Northwest Mutual Wealth Management Company, said that because of the uncertainty of the economic outlook, many investors previously favored mega-cap stocks with high profit margins and growth prospects.

"However," he added, "these stocks are now more expensive, and this is one of the most momentum-focused markets I have seen in the past 25 years. If sentiment around AI turns, we will appear fragile."

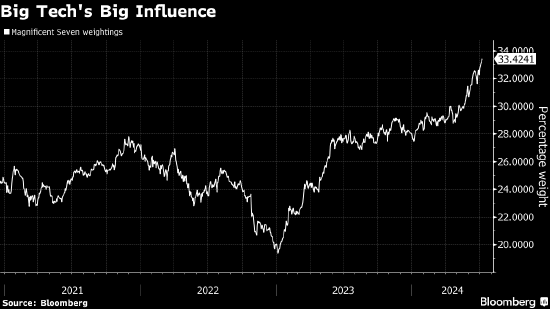

The stock market's increase this year reflects both the strong momentum of mega-cap stocks and their influence on major stock indices. According to data, the "Big Seven" -- which also includes Tesla, whose stock has risen 1.8% this year -- accounts for 33.4% of the market cap of the S&P 500 index, a record high.

There are signs that Wall Street is becoming increasingly cautious. According to Bank of America, strategists did not increase their stock allocations in June, "indicating uncertainty about how long the rally can persist," while Goldman Sachs analysis shows that hedge funds have been "actively" selling tech stocks. Truist Advisory Services recently downgraded the industry to neutral based on valuation concerns.

Citibank strategists expect to see more volatility in the future, and advise investors to take profits on some high-flying AI concept stocks, especially chip manufacturers.