Financial giants have made a conspicuous bullish move on ServiceNow. Our analysis of options history for ServiceNow (NYSE:NOW) revealed 21 unusual trades.

Delving into the details, we found 47% of traders were bullish, while 28% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $320,442, and 13 were calls, valued at $559,904.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $400.0 to $1140.0 for ServiceNow over the last 3 months.

Analyzing Volume & Open Interest

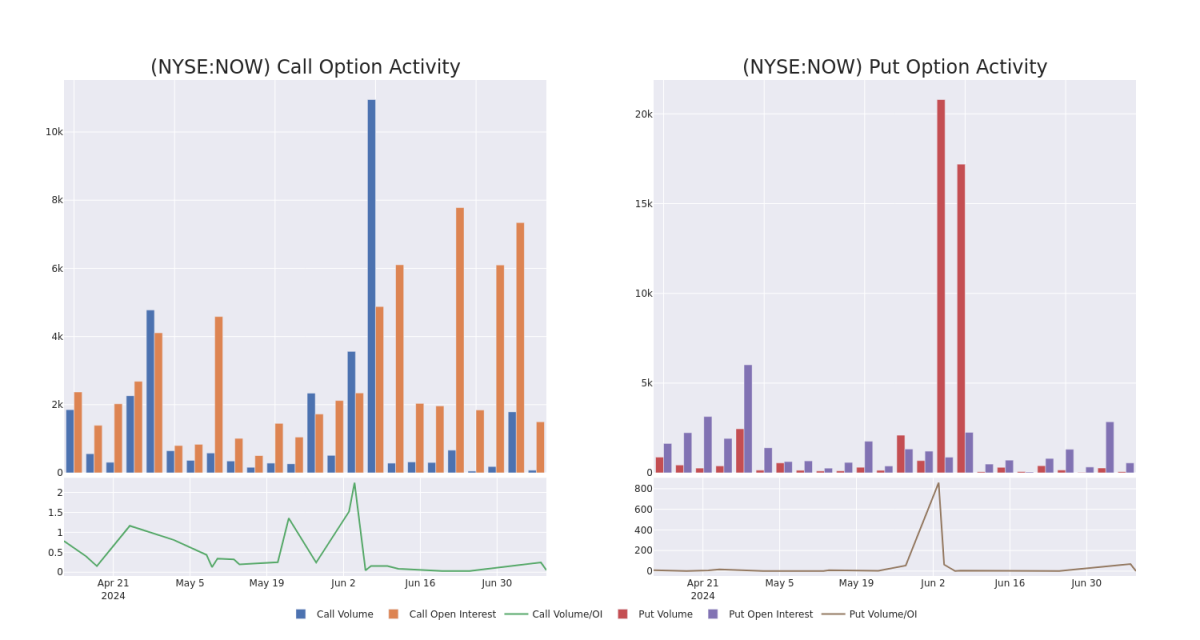

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in ServiceNow's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to ServiceNow's substantial trades, within a strike price spectrum from $400.0 to $1140.0 over the preceding 30 days.

ServiceNow Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NOW | CALL | SWEEP | BULLISH | 08/02/24 | $10.1 | $5.2 | $10.0 | $825.00 | $100.0K | 82 | 0 |

| NOW | CALL | TRADE | BULLISH | 01/16/26 | $168.0 | $158.0 | $168.0 | $730.00 | $67.2K | 31 | 0 |

| NOW | PUT | TRADE | BEARISH | 08/16/24 | $39.0 | $36.4 | $39.0 | $770.00 | $58.5K | 133 | 0 |

| NOW | PUT | SWEEP | BEARISH | 08/16/24 | $40.1 | $39.3 | $40.1 | $760.00 | $52.1K | 81 | 2 |

| NOW | CALL | TRADE | BULLISH | 01/16/26 | $102.0 | $97.8 | $101.1 | $880.00 | $50.5K | 80 | 0 |

About ServiceNow

ServiceNow Inc provides software solutions to structure and automate various business processes via a SaaS delivery model. The company primarily focuses on the IT function for enterprise customers. ServiceNow began with IT service management, expanded within the IT function, and more recently directed its workflow automation logic to functional areas beyond IT, notably customer service, HR service delivery, and security operations. ServiceNow also offers an application development platform as a service.

Where Is ServiceNow Standing Right Now?

- Currently trading with a volume of 711,194, the NOW's price is down by -2.78%, now at $744.88.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 15 days.

Expert Opinions on ServiceNow

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $836.0.

- An analyst from Needham has revised its rating downward to Buy, adjusting the price target to $900.

- An analyst from Guggenheim downgraded its action to Sell with a price target of $640.

- An analyst from Stifel has decided to maintain their Buy rating on ServiceNow, which currently sits at a price target of $820.

- An analyst from Needham has revised its rating downward to Buy, adjusting the price target to $900.

- An analyst from Keybanc persists with their Overweight rating on ServiceNow, maintaining a target price of $920.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.