Investors with a lot of money to spend have taken a bullish stance on Enphase Energy (NASDAQ:ENPH).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ENPH, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 22 uncommon options trades for Enphase Energy.

This isn't normal.

The overall sentiment of these big-money traders is split between 59% bullish and 31%, bearish.

Out of all of the special options we uncovered, 6 are puts, for a total amount of $280,459, and 16 are calls, for a total amount of $972,082.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $55.0 and $185.0 for Enphase Energy, spanning the last three months.

Volume & Open Interest Trends

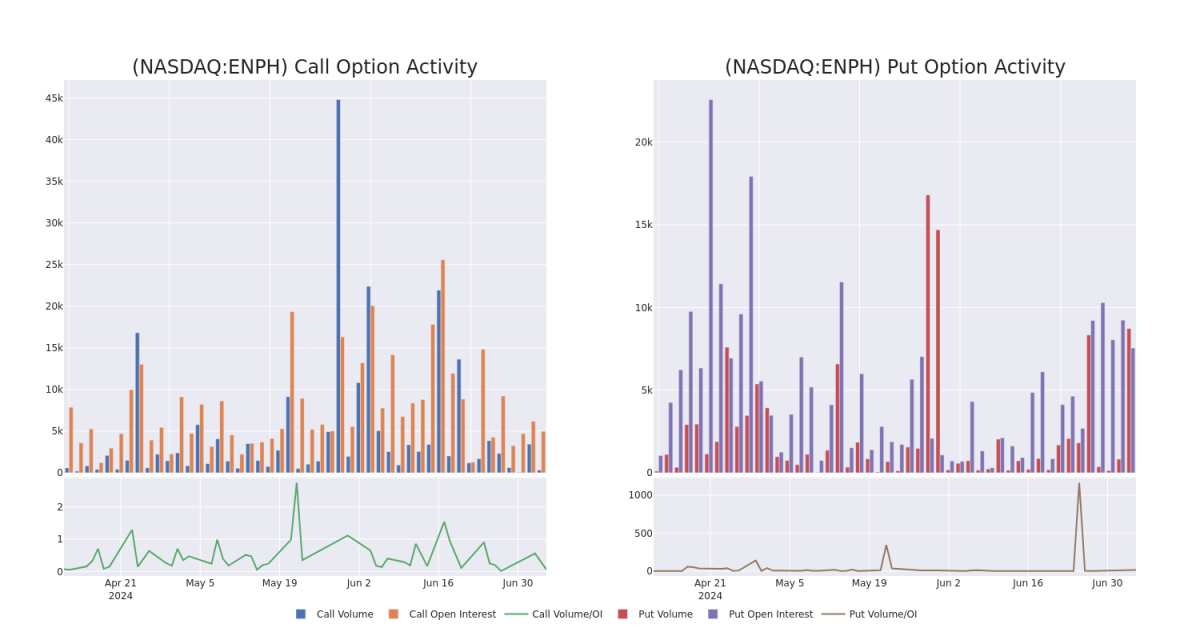

In today's trading context, the average open interest for options of Enphase Energy stands at 754.53, with a total volume reaching 1,846.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Enphase Energy, situated within the strike price corridor from $55.0 to $185.0, throughout the last 30 days.

Enphase Energy Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ENPH | CALL | TRADE | NEUTRAL | 06/20/25 | $35.05 | $16.5 | $26.2 | $105.00 | $157.2K | 52 | 0 |

| ENPH | CALL | TRADE | BULLISH | 01/16/26 | $13.4 | $11.2 | $13.4 | $185.00 | $134.0K | 409 | 0 |

| ENPH | PUT | SWEEP | BULLISH | 06/20/25 | $22.1 | $21.65 | $21.65 | $100.00 | $86.6K | 1.2K | 18 |

| ENPH | CALL | TRADE | BULLISH | 06/20/25 | $27.7 | $26.3 | $27.55 | $100.00 | $82.6K | 193 | 0 |

| ENPH | CALL | TRADE | BULLISH | 06/20/25 | $27.7 | $26.9 | $27.46 | $100.00 | $82.3K | 193 | 30 |

About Enphase Energy

Enphase Energy is a global energy technology company. The company delivers smart, easy-to-use solutions that manage solar generation, storage, and communication on one platform. The company's microinverter technology primarily serves the rooftop solar market and produces a fully integrated solar-plus-storage solution. Geographically, it derives a majority of revenue from the United States.

After a thorough review of the options trading surrounding Enphase Energy, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Enphase Energy

- Trading volume stands at 1,601,794, with ENPH's price up by 1.64%, positioned at $104.5.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 14 days.

What The Experts Say On Enphase Energy

In the last month, 3 experts released ratings on this stock with an average target price of $111.94.

- In a positive move, an analyst from HSBC has upgraded their rating to Buy and adjusted the price target to $166.

- Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on Enphase Energy with a target price of $124.

- An analyst from GLJ Research downgraded its action to Sell with a price target of $45.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Enphase Energy options trades with real-time alerts from Benzinga Pro.