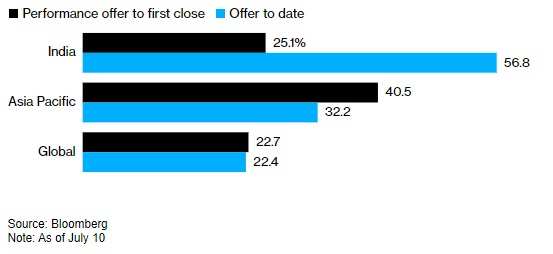

According to what Finance and economics APP has learned, with the new stocks rising far more than the SSE mega-cap index and overseas markets, it is expected that retail investors will continue to flock to India's initial public offering (IPO) market this year. Bloomberg's data shows that the average increase in value of new stocks listed on the Indian stock market this year is about 57%. By contrast, the average increase in value of new stocks in the Asia-Pacific region is 32%, while India's increase is more than twice the global average.

In the next few months, at least 15 companies are actively preparing for IPOs, which are expected to raise up to US$11 billion. The participation of retail investors is crucial to the success of these issues, and India has become one of the hottest IPO markets in the world in 2024, as soaring valuations and positive economic prospects attract the attention of many issuers.

Vineet Arora, a fund manager at Singapore's NAV Capital Emerging Star Fund, said, "At the moment, the momentum seems unstoppable." He mentioned that he had communicated with many young investors and found that they are more inclined to invest in stocks than in traditional property investments.

According to data from Prime Database Group, the value of stocks bid by retail investors in the 36 IPOs listed on Indian exchanges this year amounts to as much as US$10.6 billion, more than 12 times the shares they can get, and all the quotas for new stocks have been snapped up.

Despite regulatory authorities tightening their control over retail investors in the first quarter to eliminate so-called "improper behavior," their enthusiasm for purchasing shares has not diminished. Officials have regulated the participation of retail investors by limiting the provision of stock purchase loans to them.

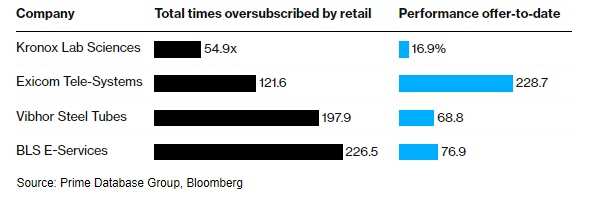

In recent months, seven new IPOs have attracted great attention from individual investors, with the subscription volume exceeding the existing subscription volume by more than 50 times. For example, Exicom Tele-Systems, an electric vehicle charging company, has become a hot stock, with retail investors bidding for stocks 120 times more than the existing subscription volume, and the stock price has risen nearly 230% since it went public.

Pranav Haldea, managing director of Prime Database Group, pointed out that although the degree of participation of individual investors is not expected to weaken, many of them do not have a long-term plan to invest in specific stocks. He explained: "Most retail investors are mainly for speculation and do not conduct in-depth research on these companies, industries, and financial status. Given the current returns on the market, if you can get an allocation, you can quickly make a profit."

India's IPO market has performed strongly this year, becoming one of the hottest IPO markets in the world. This phenomenon is due to the steady growth of the Indian economy, government support for innovation and entrepreneurship, high liquidity in the stock market, and young investors' preference for the stock market. Despite the increased regulatory measures, the market sentiment remains optimistic, attracting a large number of retail investors to participate. The prosperity of India's IPO market not only reflects investors' confidence in emerging enterprises and innovative industries, but also signifies the continuous development and maturity of the market, bringing new opportunities for investors and enterprises, while also reminding investors to conduct sufficient research and invest rationally.