The top three net buying companies on the Dragon and Tiger list are North Copper, Chengtun Mining Group, and Guangdong Fenghua Advanced Technology.

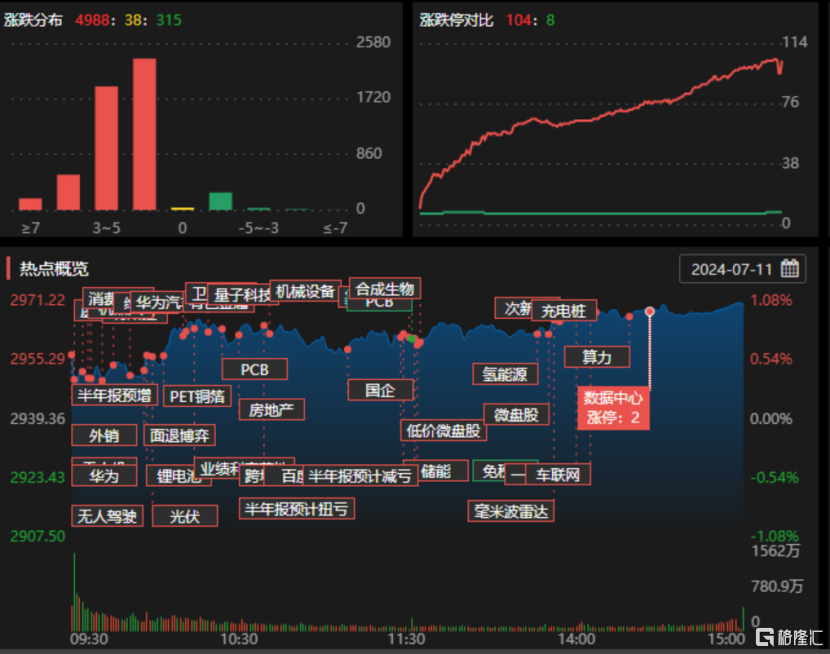

On July 11th, the three major stock indexes opened higher and rose, with nearly 5,000 individual stocks rising and over 100 stocks rising more than 9%. In terms of sector themes, nonferrous metals, PET copper foil, medical and pharmaceuticals, and apple concept stocks were among the top gainers.

In terms of individual stocks, in the consumer electronics sector, Risuntek Inc had four consecutive daily limit board, Beijing Tricolor Technology had 2 limit boards in 3 days, and Guangdong Guanghua Sci-tech had 4 daily limit boards in 7 days. Online car-hailing remained popular, with Zhengzhou Tiamaes Technology having 3 consecutive daily limit boards of 20 cm, Shanghai Jin Jiang Online Network Service having 3 consecutive daily limit boards, and Dazhong Transportation(Group) Co.,Ltd. having 2 consecutive daily limit boards.

Now let's take a look at today's Longhu Bang.

The top three net purchases on the Longhu list were North copper, Chengtun Mining Group, and Guangdong Fenghua Advanced Technology, with a respective amount of 116 million yuan, 91.5503 million yuan, and 87.4215 million yuan.

The top three net sales on the Longhu list were Shenzhen Kaizhong Precision Technology, Guangdong Jiaying Pharmaceutical, and Zhengzhou Tiamaes Technology, with a respective amount of 85.7 million yuan, 64.1714 million yuan, and 41.0606 million yuan.

Among the individual stocks involving institutional special seats in the Longhu list, the top three net purchases of the day were North copper, Yongxing Special Materials Technology, and Suzhou Hengmingda Electronic Technology, with a respective amount of 91.1694 million yuan, 46.6125 million yuan, and 15.4409 million yuan.

Among the individual stocks involving institutional special seats in the Longhu list, the top three net sales of the day were Kwong Wai (Holdings) Limited, Zhejiang Crystal-Optech Co., Ltd., and Shenzhen Genvict Technologies Co Ltd, with a respective amount of 40.7704 million yuan, 22.7398 million yuan, and 13.2438 million yuan.

Some of the top stock themes on the lists are:

North copper (gold+copper mine+restructuring expectation)

The first board rose by the limit, with a turnover of 1.343 billion yuan, a turnover rate of 18.11%, and blocked funds of 76.5416 million yuan. The net purchase of Shenzhen Stock Connect was 76.8945 million yuan, and 3 institutions had a net purchase of 91.1694 million yuan.

1. Brokerages said that the downstream inventory level is low, and some orders are postponed, which creates a strong demand for industrial metals to supplement inventory, making it difficult for prices to fall sharply and may continue the volatile trend, waiting for the next round of demand pulse to regain the upward trend.

2. The company's main business includes mining, ore-dressing, smelting, and sales of copper and gold and other metals.

3. The company owns a resource-rich copper mine, with 0.225 billion tons of copper resources and a mining area of 5.0864 square kilometers. The ore also contains a small amount of gold.

Chengtun Mining Group (first-half report pre-increase+metal+gold)

The second consecutive limit board rose, with a turnover of 1.383 billion yuan and a frozen capital of 0.146 billion yuan. Shanghai-Hong Kong Stock Connect's special seat net purchase was 35.9088 million yuan.

1. The company expects a significant increase in performance from January to June 2024, with a net profit attributable to shareholders of the listed company ranging from 1.06 billion yuan to 1.26 billion yuan, a year-on-year increase of 491.93% to 603.61%.

2. The company's main business is energy metal business, basic metal business, metal trading business, and main products are cobalt products, copper products, nickel products, zinc products, trade, services, and others. On June 6, the company stated that it currently has a copper capacity of 0.16 million metal tons, cobalt capacity of 0.014 million metal tons, nickel capacity of 0.06 million metal tons, and zinc capacity of 0.32 million metal tons. The current raw materials are mainly from self-owned mines, associated minerals, and external purchases.

3. The company holds a 69.6875% stake in Guizhou Huajin. Guizhou Huajin holds mining rights for Yata, Banqi, and Banwan gold mines and prospecting rights for Yata and Banwan gold mines. The total area of the mining rights is over 70 square kilometers.

Zhengzhou Tiamaes Technology (performance pre-increase+automotive electronics+domestic substitution+electronic components)

The first board rose, with a turnover of 0.571 billion yuan, a turnover rate of 3.49%, and a locked-fund of 69.0992 million yuan. The net purchase of Shenzhen Stock Connect was 3.324 million yuan, and that of the first institution was 11.0754 million yuan.

1. The company expects a net profit of 0.185 billion to 0.235 billion yuan in the first half of 2024, up 117.47%-176.25% from the same period last year. This is mainly due to the continuous improvement of market demand and the company's continuous strengthening of market expansion.

2. The company's core business is the development, production and sales of electronic components and electronic materials, mainly including MLCC, chip resistors, inductors, etc.

3. The company was the first to break through the electrostatic capacity limit of domestic MLCC and successfully applied the self-developed low-temperature copper paste to the manufacturing of high-end MLCC, solving the bottleneck problem of high-end MLCC production.

4. The company holds about 27.61% of the shares of Guangdong Fenghua New Energy Co., Ltd., which is mainly engaged in the business of lithium battery cells.

Lifan Technology (Baidu autonomous driving + Geely cooperation + new energy vehicles)

The first board rose, with a turnover of 0.475 billion yuan, and a locked-fund of 54.4153 million yuan. The net purchase of Shanghai Stock Connect was 5.8034 million.

1. Baidu's subsidiary Luobo Kuaipao has opened passenger-carrying test operation services in 11 cities, and is conducting fully automated driving test services for passenger cars in Beijing, Wuhan, Chongqing, Shenzhen, and Shanghai.

2. In 2018, the company's PAND Auto and Baidu jointly released a technology route and landing plan for "shared car autonomous driving" based on large-scale operation, and has begun testing autonomous driving technology. PAND Auto has obtained the road test license for autonomous driving in Chongqing.

3. The company is mainly engaged in the research and development, production and sales of passenger cars, motorcycles, engines and general gasoline engines. The company's motorcycle business mainly includes sales of two-wheeled fuel motorcycles, two-wheeled electric motorcycles, and motorcycle engines.

Some of the top stock themes on the lists are:

Yongxing Special Materials Technology: the first board rose, with a turnover of 0.493 billion yuan, and a turnover rate of 3.60%. Dragon Tiger List data shows that the net purchase of the second institution was 46.6125 million yuan.

Suzhou Hengmingda Electronic Technology: the first board rose, with a turnover of 0.699 billion yuan and a turnover rate of 11.13%. Dragon Tiger List data shows that the net purchase of the first institution was 15.4409 million yuan, and the net sale of the special seat of Shenzhen Stock Connect was 6.8747 million yuan.

Kaizhong Precision Technology: up 10.94%, with a turnover of 0.396 billion yuan, and a turnover rate of 46.00%. Dragon Tiger List data shows that the second institution bought 18.8357 million yuan, and the fifth institution sold 59.6061 million yuan.

Zhejiang Crystal-Optech: the first board rose, with a turnover of 1.559 billion yuan, and a turnover rate of 5.82%. Dragon Tiger List data shows that the second institution bought 73.026 million yuan, and the second institution sold 9576.59 thousand yuan.

Shenzhen Genvict Technologies: down 0.1%, with a turnover of 0.998 billion yuan, and a turnover rate of 21.19%. Dragon Tiger List data shows that the second institution bought 39.7766 million yuan, and the third institution sold 53.0203 million yuan.

In the Dragon Tiger List, there are 4 individual stocks involving Shanghai Stock Connect special seats. Chengtun Mining Group has the largest net purchase amount of Shanghai Stock Connect special seats, with a net purchase amount of 35.9088 million yuan.

In the Dragon Tiger List, there are 8 individual stocks involving Shenzhen Stock Connect special seats. North Copper has the largest net purchase amount of Shenzhen Stock Connect special seats, with a net purchase amount of 76.8941 million yuan.

Yoozoo operation dynamics:

Shangtang Road: Net purchase of Hengmingda 27.01 million yuan, net purchase of Fujian Zitian Media Technology 24.23 million yuan, net sale of Shenzhen Kaizhong Precision Technology 33.52 million yuan.

Northeast Strapping Men: Net purchase of Guangdong Fenghua Advanced Technology 64 million yuan, net purchase of Jinzhong Stock 23.96 million yuan.

Yu Ge: Net purchase of Zhejiang Crystal-Optech 63.48 million yuan.

Qujiang Lake: Net buy Chengtun Mining Group 20.96 million yuan.

Xiaoxian Pai: Net buy North Copper 14.87 million yuan.

Beijing Centergate Technologies: Net sell Fujian Zitian Media Technology 21.13 million yuan.

Foshan Group: Net sell Zhengzhou Tiamaes Technology 52.56 million yuan.