PepsiCo Reports Second-Quarter 2024 Results; Updates 2024 Financial Guidance

PepsiCo Reports Second-Quarter 2024 Results; Updates 2024 Financial Guidance

July 11, 2024 - $PepsiCo (PEP.US)$ today reported results for the second quarter 2024. PepsiCo shares are trading down pre-market by 1.89% on Thursday.

2024年7月11日 - $百事可乐 (PEP.US)$今天发布2024年第二季度的财报。周四百事可乐的股价在盘前交易中下跌了1.89%。

Financial Highlights:

财务业绩亮点:

CEO Statement:

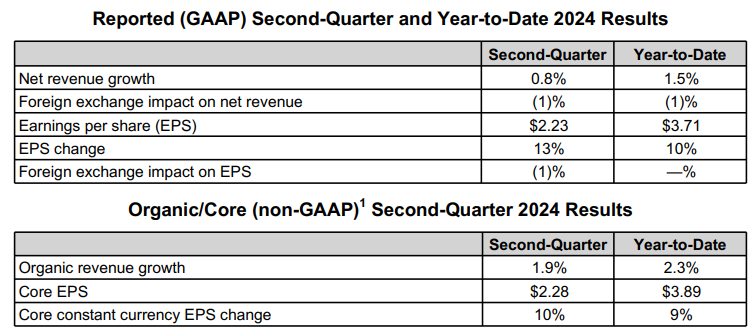

“During the second quarter, our business delivered net revenue growth, strong gross and operating margin expansion and double-digit EPS growth, remaining agile despite facing difficult net revenue growth comparisons versus the prior year, subdued category performance within North America convenient foods and the impacts associated with certain product recalls at Quaker Foods North America,” said Chairman and CEO Ramon Laguarta.

Laguarta continued, “For the balance of the year, we will further elevate and accelerate our productivity initiatives and make disciplined commercial investments in the marketplace to stimulate growth. These investments will focus on surgically providing optimal value propositions within certain portions of our North America convenient foods portfolio, amplifying our advertising and marketing initiatives and leveraging our go-to-market distribution capabilities to enable more precise marketplace execution. As a result, we now expect to deliver approximately 4 percent organic revenue growth (previously at least 4 percent) and have a high degree of confidence in delivering at least 8 percent core constant currency EPS growth for full-year 2024.”

CEO声明:

百事董事长兼首席执行官拉蒙·拉古塔说:“在第二季度,尽管面临与去年相比困难的收入增长对比、北美便利食品类别表现低迷以及Quaker Foods North America出现某些产品召回带来的影响,但我们的业务实现了净营收增长、强劲的毛利率和营业利润率扩张以及双位数字的每股收益增长。”

拉古塔继续说:“今年剩余的时间,我们将进一步提高并加快生产力倡议,并在市场上进行有纪律的商业投资,以刺激增长。这些投资将着重于在我们的北美便利食品产品组合的某些部分提供最优化的价值主张,增强我们的广告和营销倡议,并利用我们的销售渠道分销能力,以实现更精准的市场执行。因此,我们现在预计全年将实现约4%的有机营业收入增长(之前至少是4%),并有很高的信恳智能能够实现至少8%的核心常同货币每股收益增长。”

Source: Q2 2024 PepsiCo Earnings