As a series of economic data once again boosted expectations of a Fed rate cut, the US stock market hit new highs.

Overnight, all three major US stock indexes rose by more than 1%. The S&P 500 broke through 5,600 for the first time in history, while the S&P 100 and Nasdaq 100 hit new highs for six consecutive days and the Nasdaq hit a new closing high for seven consecutive days.

Technology giants continue to drive the upward trend. Since Apple's WWDC24, its stock price has risen by a total of 18%, reaching a historic high overnight. Tesla has risen for 11 consecutive days, with an increase of more than 44%, and Taiwan Semiconductor's stock price has also repeatedly hit historic highs.

Concerns about the bubble are arising in the face of strong leading technology stocks.

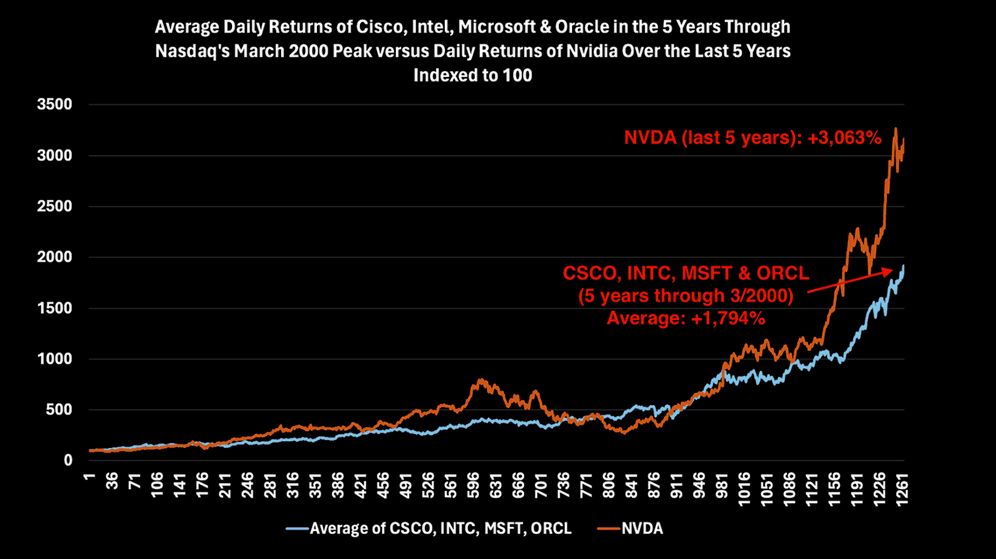

Some institutions have compared today's US stock market with the Internet bubble period through fundamental analysis. First, the performance of Cisco, Intel, Microsoft, and Oracle in the run-up to the Internet bubble in 2000 was compared with Nvidia in the past five years:

The chart shows that Nvidia's daily average increase in the past five years is far greater than the average increase of the other four companies.

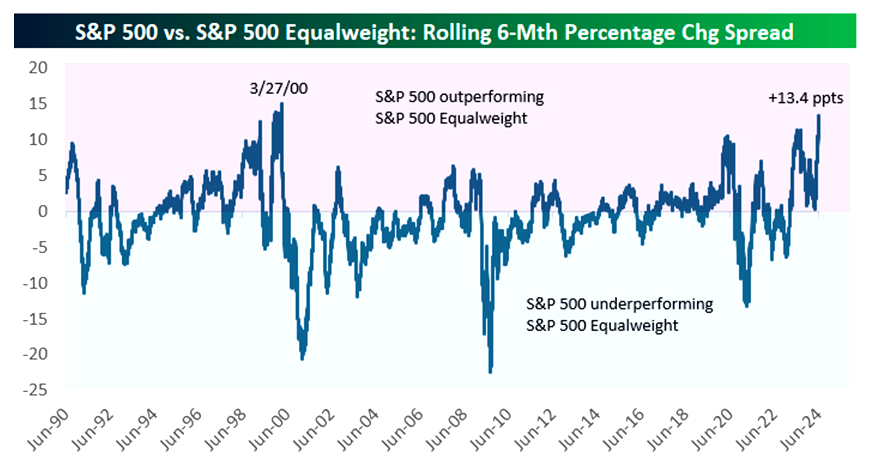

Another indicator indicating a bubble is that in the past six months, the S&P 500 weighted by market capitalization has significantly outperformed the equally weighted S&P 500, indicating that the increase is highly concentrated in weight-bearing stocks. This phenomenon last occurred in late March 2000.

Based on the historical performance of these two indicators, a correction is about to occur.

In addition, the Buffett indicator (total stock market capitalization / GDP) has risen to a historical high of 195%, surpassing the levels of the 2000 Internet bubble, the 2008 financial crisis, and the 2022 bear market, indicating that the US stock market is significantly overheated.

In addition to fundamental indicators showing an overheated stock market, liquidity supporting risk assets is also weakening.

Related data shows that as of mid-June of this year, after the use of corporate tax payments (transferred to the general deposit account TGA) and quarter-end RRP (Fed overnight reverse repurchase agreement) rebounded, reserve levels have also declined.

Citibank also pointed out earlier that the correlation between central bank liquidity and risk assets worldwide is still in the negative zone.

From the perspective of stock market sentiment, although it has not yet reached the "extremely overheated" level, it is dangerous enough.

Goldman Sachs analysis pointed out that the AI boom may be able to boost the stock market and still bullish on technology giants that have experienced an uptrend:

"Currently, the overall positioning, profit expectations, and valuations of the market are very high, while the breadth is very low, and the speed of economic data deteriorating is more like milk than wine. However, the growth of artificial intelligence and the strong financial power of the baby boomer generation can serve as a support for growth."