Behind the Scenes of Meta Platforms's Latest Options Trends

Behind the Scenes of Meta Platforms's Latest Options Trends

Investors with a lot of money to spend have taken a bullish stance on Meta Platforms (NASDAQ:META).

拥有大量资金的投资者对meta平台(纳斯达克:META)持看好态度。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我们在这里追踪的公开期权历史记录上看到交易时发现了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with META, it often means somebody knows something is about to happen.

无论这些人是机构还是富人,我们都不知道。但是当meta发生这样的大事时,往往意味着有人知道即将发生的事情。

So how do we know what these investors just did?

那么我们如何知道这些投资者刚刚做了什么呢?

Today, Benzinga's options scanner spotted 11 uncommon options trades for Meta Platforms.

今天,Benzinga的期权扫描器发现,Meta Platforms有11次不同寻常的期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 54% bullish and 36%, bearish.

这些大额资金交易者的总体情绪分为54%看涨和36%看淡。

Out of all of the special options we uncovered, 3 are puts, for a total amount of $189,511, and 8 are calls, for a total amount of $431,912.

在我们发现的所有特殊期权中,有3个看跌,总金额为189,511美元,有8个看涨,总金额为431,912美元。

What's The Price Target?

价格目标是什么?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $500.0 to $590.0 for Meta Platforms over the last 3 months.

考虑到合约的成交量和未平仓合约数,过去3个月,大鲸鱼们在Meta Platforms上瞄准了价格区间在500.0到590.0之间。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

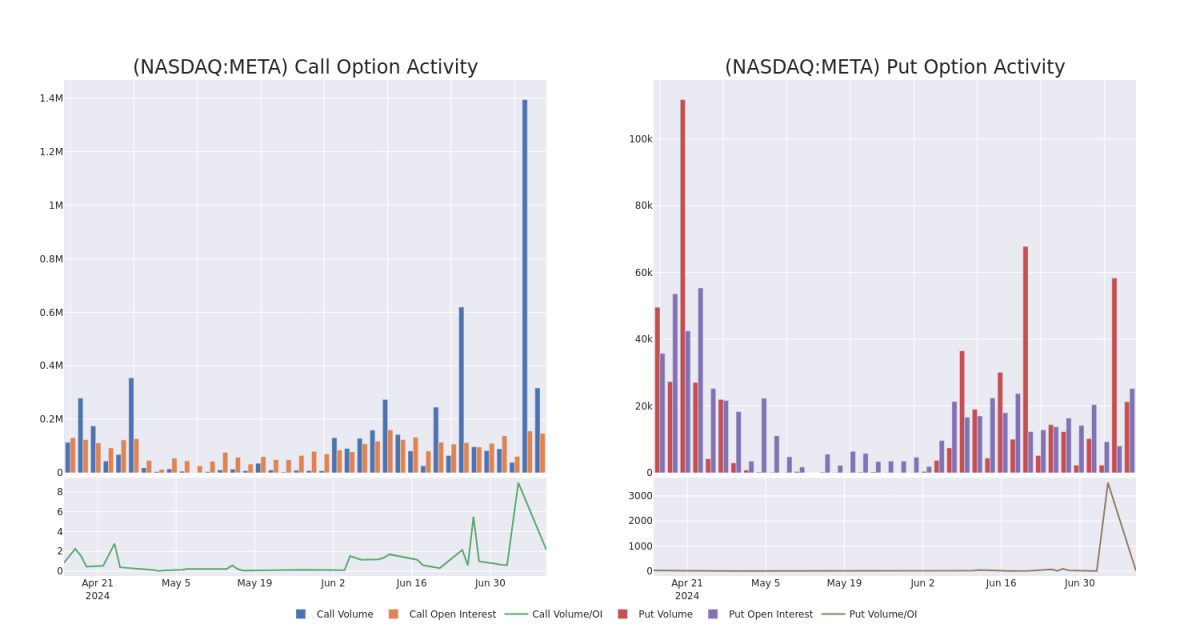

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Meta Platforms's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Meta Platforms's substantial trades, within a strike price spectrum from $500.0 to $590.0 over the preceding 30 days.

评估成交量和未平仓合约是期权交易的战略步骤。这些指标揭示了在特定行使价格时,Meta Platforms的期权的流动性和投资者兴趣。下面的数据可视化显示了Meta Platforms在500.0到590.0行使价格范围内,与看涨和看跌期权相关的成交量和未平仓合约的波动情况,涵盖了过去30天的大宗交易。

Meta Platforms Call and Put Volume: 30-Day Overview

Meta Platforms:看涨期权和看跌期权成交量:30天概述

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| META | PUT | SWEEP | BEARISH | 08/02/24 | $19.95 | $19.55 | $19.95 | $520.00 | $99.5K | 836 | 0 |

| META | CALL | TRADE | BULLISH | 07/26/24 | $14.8 | $14.75 | $14.8 | $530.00 | $74.0K | 2.5K | 4 |

| META | CALL | SWEEP | BEARISH | 07/19/24 | $7.35 | $7.15 | $7.15 | $540.00 | $71.5K | 8.5K | 254 |

| META | CALL | TRADE | BULLISH | 07/19/24 | $4.4 | $4.35 | $4.4 | $550.00 | $66.0K | 8.2K | 550 |

| META | CALL | TRADE | NEUTRAL | 08/16/24 | $30.2 | $29.55 | $29.9 | $535.00 | $59.8K | 676 | 0 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| meta platforms | 看跌 | SWEEP | 看淡 | 08/02/24 | $19.95 | $19.55 | $19.95 | $520.00 | 99.5K美元 | 836 | 0 |

| meta platforms | 看涨 | 交易 | 看好 | 07/26/24 | $14.8 | $14.75 | $14.8 | $530.00 | $74.0K | 2.5千 | 4 |

| meta platforms | 看涨 | SWEEP | 看淡 | 07/19/24 | $7.35 | $7.15 | $7.15 | $540.00 | $71.5千美元 | 8.5千 | 254 |

| meta platforms | 看涨 | 交易 | 看好 | 07/19/24 | $4.4 | $4.35 | $4.4 | $550.00 | $66.0K | 8.2K | 550 |

| meta platforms | 看涨 | 交易 | 中立 | 08/16/24 | $30.2 | $29.55 | $29.9 | $535.00 | $59.8K | 676 | 0 |

About Meta Platforms

关于meta平台

Meta is the world's largest online social network, with nearly 4 billion family of apps monthly active users. Users engage with each other in different ways, exchanging messages and sharing news events, photos, and videos. The firm's ecosystem consists mainly of the Facebook app, Instagram, Messenger, WhatsApp, and many features surrounding these products. Users can access Facebook on mobile devices and desktops. Advertising revenue represents more than 90% of the firm's total revenue, with more than 45% coming from the US and Canada and over 20% from Europe.

Meta是世界上最大的在线社交网络,拥有近40亿月活跃用户。用户以不同的方式进行互动,交换消息并分享新闻事件、照片和视频。该公司的生态系统主要由脸书应用程序、Instagram、Messenger、WhatsApp以及围绕这些产品的许多功能组成。用户可以在移动设备和台式机上使用Facebook。广告收入占公司总收入的90%以上,其中超过45%来自美国和加拿大,超过20%来自欧洲。

After a thorough review of the options trading surrounding Meta Platforms, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在充分审查Meta Platforms周围的期权交易后,我们进一步审查了该公司的情况。这包括对其当前的市场状态和业绩进行评估。

Present Market Standing of Meta Platforms

Meta Platforms的现有市场地位

- With a volume of 519,181, the price of META is down -0.21% at $533.57.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 20 days.

- META的成交量为519,181,价格为533.57美元,下跌了-0.21%。

- RSI指标暗示该股票可能要超买了。

- 下一轮盈利预计将在20天内发布。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Meta Platforms options trades with real-time alerts from Benzinga Pro.

期权交易具有较高的风险和潜在回报。精明的交易者通过不断学习、调整策略、监控多种因子以及密切关注市场动向来管理这些风险。通过Benzinga Pro的实时提醒,了解最新的Meta Platforms期权交易动态。