To the annoyance of some shareholders, Guangdong Rongtai Industry Co.,Ltd (SHSE:600589) shares are down a considerable 28% in the last month, which continues a horrid run for the company. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

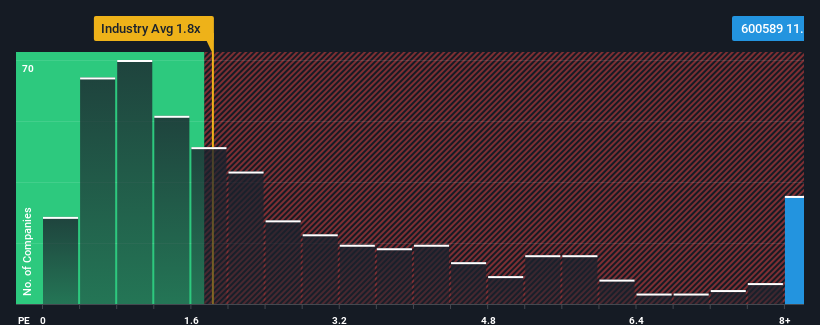

Even after such a large drop in price, given around half the companies in China's Chemicals industry have price-to-sales ratios (or "P/S") below 1.8x, you may still consider Guangdong Rongtai IndustryLtd as a stock to avoid entirely with its 11.6x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

How Has Guangdong Rongtai IndustryLtd Performed Recently?

The revenue growth achieved at Guangdong Rongtai IndustryLtd over the last year would be more than acceptable for most companies. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Guangdong Rongtai IndustryLtd's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Guangdong Rongtai IndustryLtd's to be considered reasonable.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Guangdong Rongtai IndustryLtd's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 20% last year. However, this wasn't enough as the latest three year period has seen the company endure a nasty 67% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 24% shows it's an unpleasant look.

With this information, we find it concerning that Guangdong Rongtai IndustryLtd is trading at a P/S higher than the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Even after such a strong price drop, Guangdong Rongtai IndustryLtd's P/S still exceeds the industry median significantly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Guangdong Rongtai IndustryLtd revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

Plus, you should also learn about this 1 warning sign we've spotted with Guangdong Rongtai IndustryLtd.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com