eprint Group Limited (HKG:1884) shareholders that were waiting for something to happen have been dealt a blow with a 84% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 70% share price decline.

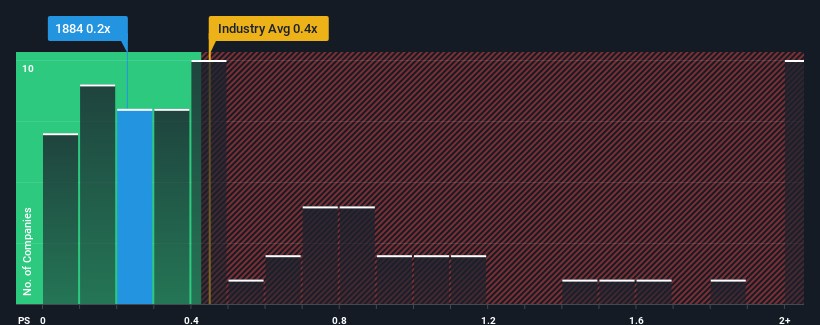

In spite of the heavy fall in price, it's still not a stretch to say that eprint Group's price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Commercial Services industry in Hong Kong, where the median P/S ratio is around 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

How eprint Group Has Been Performing

It looks like revenue growth has deserted eprint Group recently, which is not something to boast about. It might be that many expect the uninspiring revenue performance to only match most other companies at best over the coming period, which has kept the P/S from rising. If not, then existing shareholders may be feeling hopeful about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on eprint Group will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For eprint Group?

There's an inherent assumption that a company should be matching the industry for P/S ratios like eprint Group's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Regardless, revenue has managed to lift by a handy 18% in aggregate from three years ago, thanks to the earlier period of growth. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 7.3% shows it's about the same on an annualised basis.

In light of this, it's understandable that eprint Group's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Final Word

eprint Group's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we've seen, eprint Group's three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Having said that, be aware eprint Group is showing 3 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on eprint Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com