Jim Cramer, head of CNBC Investing Club, said today that in addition to seven companies such as Microsoft, Apple, and Nvidia, Tesla and Eli Lilly, a pharmaceutical company, may soon join the "trillion-dollar market capitalization" club.

Currently, only seven technology companies such as Apple, Microsoft, Nvidia, Saudi Aramco, Alphabet, Amazon, and Meta have a market value exceeding 1 trillion U.S. dollars, and Taiwan Semiconductor has surged to 1 trillion U.S. dollars this week. Among them, the market values of Apple, Microsoft, and Nvidia have all exceeded 3 trillion U.S. dollars.

On Wednesday local time, Cramer listed eight companies that are expected to break through the $1 trillion market value milestone, Eli Lilly and Tesla may be the first to reach this milestone.

He said: "In my opinion, the next company to reach a market value of $1 trillion will be Eli Lilly. In addition, based on Tesla's popularity alone, the company may return to its peak."

In fact, Tesla, led by Elon Musk, had broken through the trillion-dollar market value threshold as early as 2021, becoming the sixth US company to reach this milestone. Later, with the fluctuations in stock prices, the market value of the company had hovered around $1 trillion several times. Currently, Tesla's market value is over 830 billion US dollars.

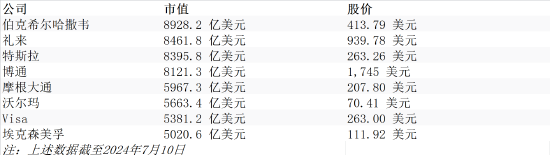

In addition to Eli Lilly and Tesla, the other six companies listed by Cramer are Berkshire Hathaway, Broadcom, JPMorgan, Walmart, Visa, and ExxonMobil.

Cramer emphasized the diversification and wide influence of Berkshire Hathaway's investment portfolio. However, he also pointed out that Berkshire Hathaway may need to reduce interest rates to achieve significant growth.

Cramer made this prediction at a time when Tesla's stock price has begun to rebound recently, thanks to its higher-than-expected second-quarter car delivery volume.

At the same time, Cramer suggested that investors consider buying stocks of the "Seven Giants of the US Stock Market" when interest rates rise, and buy all stocks when interest rates fall, implying a potential shift in market strategy.

In addition to six companies such as Apple, Microsoft, Nvidia, Alphabet, Amazon, and Meta, Taiwan Semiconductor's market value has also recently surpassed the trillion-dollar mark.