According to Rabobank, the Australian dollar can continue to strengthen. Rabobank's analysis shows that the Reserve Bank of Australia will be the key factor driving the Australian dollar's strength, leading to an earlier realization of the Australian dollar's target forecast.

Rabobank believes that the Reserve Bank of Australia will raise interest rates twice this year in August and November to address stubborn domestic inflation.

Jane Foley, the Senior FX Strategist at Rabobank, said: "Recent Australian economic data has reinforced our expectations for further rate hikes in this cycle."

She pointed out that retail sales grew by 0.6% MoM in May, indicating strong consumer demand. Economists say that strong consumer demand is a key driver of inflation.

Affected by the base effect, the YoY CPI growth rate fell from 4.1% in the first quarter to 3.6%, which was higher than the expected 3.5%. In March alone, CPI rose 3.5% YoY, higher than February's 3.4%.

A closely watched core inflation measure, the trimmed mean, rose 1% in the first quarter, again exceeding expectations of 0.8%. The annual growth rate fell from 4.2% to 4%.

The government has decided to reduce taxes for all 13.6 million Australian taxpayers from July 1, which does not help to fight inflation as it will increase the potential for economic demand. The Reserve Bank of Australia said that the impact of the tax increase is a source of uncertainty.

The prospect of the Reserve Bank of Australia raising interest rates contrasts sharply with the expectation of other major central banks lowering interest rates. This creates support for the Aussie dollar's interest differential.

"It's clear that expectations for interest rate differentials are a huge driver of the entire forex market this year," said Foley.

Rabobank maintained its forecast of the Aussie dollar rising to 0.70 against the US dollar, but now predicts it will reach this level within 6 months instead of the previously forecast 9 months.

"We believe there is greater volatility in the euro to Aussie dollar pair, and we forecast a 6-month target of 1.51. Looking ahead 6 months, we expect the British pound to Aussie dollar exchange rate to fall from 1.90 to 1.80," Foley said.

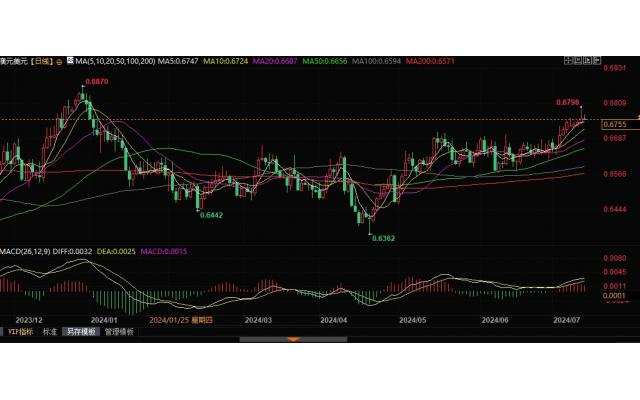

Australian dollar against US dollar daily chart.

At 10:20am Beijing time on July 12th, the AUD/USD was quoted at 0.6755/56.