Investors Aren't Entirely Convinced By GalaxyCore Inc.'s (SHSE:688728) Revenues

Investors Aren't Entirely Convinced By GalaxyCore Inc.'s (SHSE:688728) Revenues

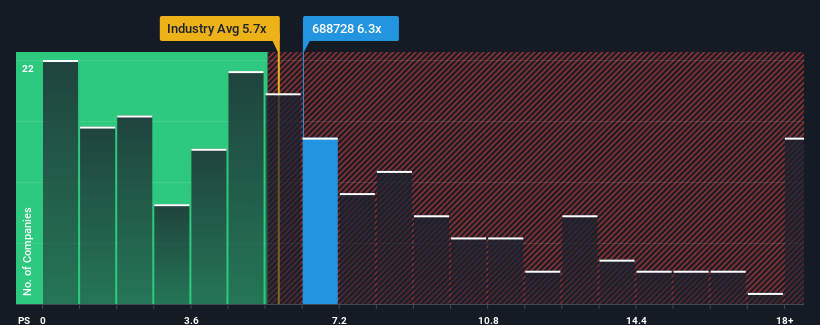

It's not a stretch to say that GalaxyCore Inc.'s (SHSE:688728) price-to-sales (or "P/S") ratio of 6.3x right now seems quite "middle-of-the-road" for companies in the Semiconductor industry in China, where the median P/S ratio is around 5.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How GalaxyCore Has Been Performing

GalaxyCore could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on GalaxyCore will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For GalaxyCore?

There's an inherent assumption that a company should be matching the industry for P/S ratios like GalaxyCore's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. This isn't what shareholders were looking for as it means they've been left with a 28% decline in revenue over the last three years in total. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 42% as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 35%, which is noticeably less attractive.

With this in consideration, we find it intriguing that GalaxyCore's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does GalaxyCore's P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite enticing revenue growth figures that outpace the industry, GalaxyCore's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You should always think about risks. Case in point, we've spotted 3 warning signs for GalaxyCore you should be aware of, and 1 of them makes us a bit uncomfortable.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com