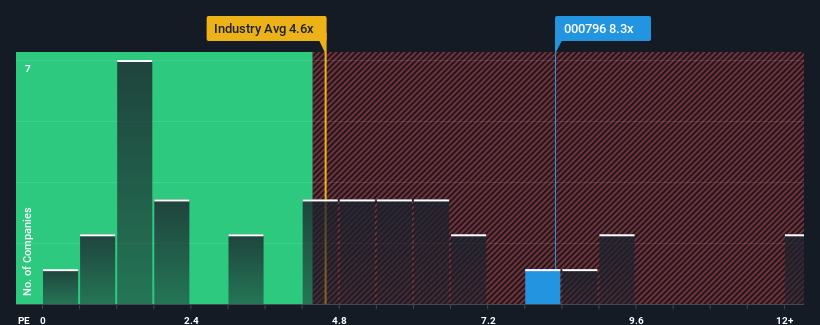

You may think that with a price-to-sales (or "P/S") ratio of 8.3x Caissa Tosun Development Co.,Ltd. (SZSE:000796) is a stock to avoid completely, seeing as almost half of all the Hospitality companies in China have P/S ratios under 4.6x and even P/S lower than 1.7x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

How Has Caissa Tosun DevelopmentLtd Performed Recently?

Recent times have been advantageous for Caissa Tosun DevelopmentLtd as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Caissa Tosun DevelopmentLtd will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Caissa Tosun DevelopmentLtd?

In order to justify its P/S ratio, Caissa Tosun DevelopmentLtd would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 142% last year. Still, revenue has fallen 40% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 265% during the coming year according to the one analyst following the company. That's shaping up to be materially higher than the 29% growth forecast for the broader industry.

In light of this, it's understandable that Caissa Tosun DevelopmentLtd's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Caissa Tosun DevelopmentLtd's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Caissa Tosun DevelopmentLtd shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Caissa Tosun DevelopmentLtd that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com