The European Central Bank cut interest rates for the first time in June by 25 basis points. Respondents expect the bank to pause its rate cut at the July 18th (next Thursday) meeting, but expect another rate cut in September. That is, the European Central Bank cuts interest rates once a quarter until the interest rate reaches 2.5% after one year. Product structure, 10-30 billion yuan products operating income of 401/1288/60 million yuan respectively.

The next decision of the European Central Bank will be at 20:15 on July 18, Beijing time.

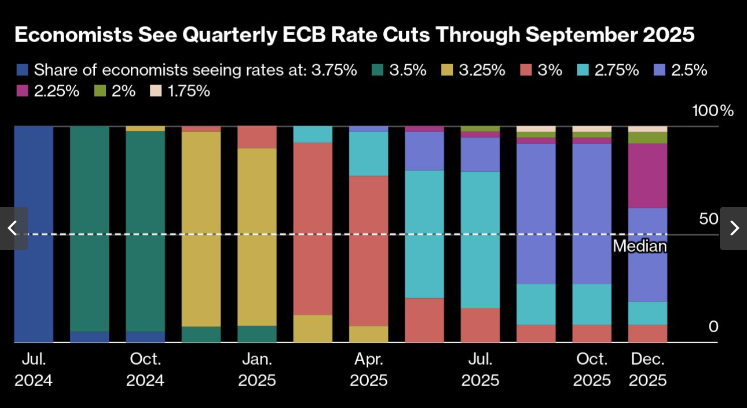

Economists believe that the European Central Bank will cut interest rates once a quarter (currently 4.25%) by 2025. The different colors of the columns in the figure represent different levels of interest rates, and the length of the columns represents the proportion of analysts who believe that the interest rate will fall to that level.

The unprecedented monetary tightening policy is gradually reversing, reflecting the increasing difficulty of evaluating the future economic traps of the eurozone's 20 countries. Inflation pressure is still strong, and the momentum of recovery from months of stagnation may have come to an end. Meanwhile, elections - especially across the Atlantic - are forcing investors to rethink everything from government spending to trade.

Analysts now list the threat of the November US presidential election and Trump's re-election as the biggest danger facing the region's economy, while France's turmoil has awakened memories of the past 10 years of the European sovereign debt crisis.

Carsten Brzeski, director of macroeconomic management at ING Bank, said, "At the current juncture, there is simply no urgency for further rate cuts. As a result, the European Central Bank will eventually stick to its data-based approach and avoid giving any prospective guidance."

In the US, it remains unclear whether Trump will face a challenge from Biden or another Democrat, thus making the US election look more complicated. France's early election has made investors uneasy, although the situation has stabilized since the initial shock.

David Powell, senior economist at the eurozone, said, "Investors will closely monitor the European Central Bank's next meeting to adjust their expectations for the timing of the next rate cut, though rates this month are almost certain to remain unchanged. Lagarde may hint at another move in September, but not too clearly."

The vast majority of analysts say the European Central Bank will not change its course because of events there. Only one of the 29 respondents expects officials to adjust their quantitative easing plan. Only two think they will turn the remaining reinvestment to France.

Dennis Shen, economist at Scope Ratings, said: "This is a choice for the euro system before considering TPI." TPI refers to a safeguard measure established in 2022 to deal with "unfounded and disorderly" market volatility when the ECB begins to raise interest rates.

Only one respondent said the plan would start within the next three months.

In contrast, many people are concerned that economic growth may be weaker than the European Central Bank's June forecast, and that inflation may be stronger. In particular, service costs are still a major issue, partly because of expected robust wage growth.

Andrzej Szczepaniak, senior economist at Nomura Securities in Europe, said:"Service companies report that supply factors, not insufficient demand, are restraining their output growth. Therefore, severe labor shortages and strong service demand may continue to push up inflation pressures in the near and medium term."

He believes that next week's meeting should be "uneventful," with a focus on whether the European Central Bank will cut interest rates again in September.

Daily chart of EUR/USD

At 13:53 on July 12th, Beijing time, the euro against the US dollar reported 1.0869/70.