Summary

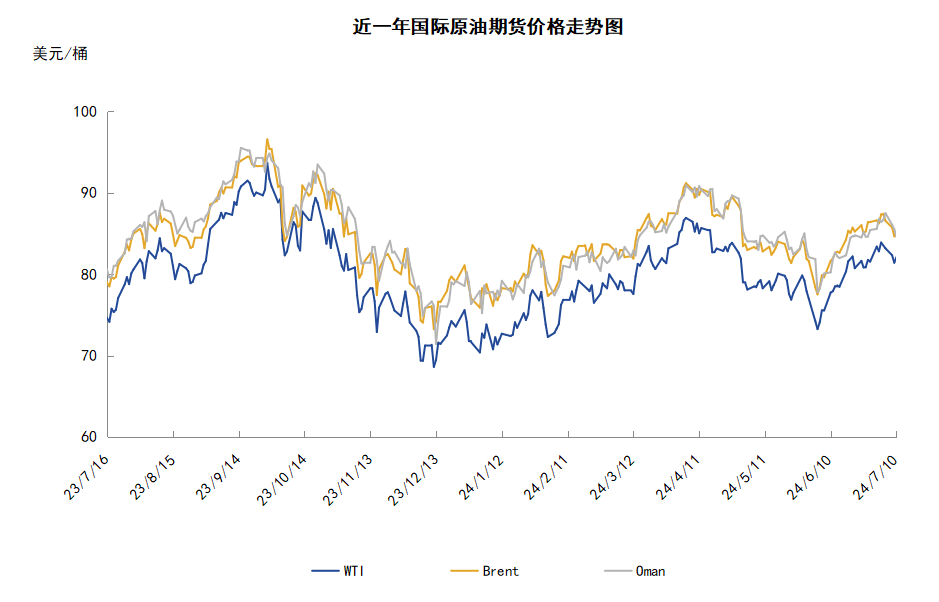

This week (7.4-7.10), crude oil showed a trend of top reversal. The average price of WTI this week was 82.25 US dollars per barrel, a decrease of 0.42 US dollars per barrel or -0.51% compared to the previous week. During the week, the main factors that caused pressure on oil prices were: extreme weather did not affect the supply of US crude oil and some OPEC oil producing countries exceeded their production plans. The factors that mainly support oil prices include: EIA data shows that US crude oil and gasoline inventories decreased more than expected.

Chapter 1 Review of the Trends in the International Crude Oil Market

Review of This Week's Crude Oil Futures Market

This week (7.4-7.10), crude oil showed a trend of top reversal, with a weekly average price decline.

During the week, the market news was mixed. On the one hand, investors' concerns about the impact of extreme weather on crude oil supply eased. After Hurricane Beryl weakened to a tropical storm, major oil refineries along the US Gulf Coast were less affected. The market's concerns about refinery shutdowns along the Gulf Coast were alleviated, which led to pressure on oil prices. In addition, investors' wait-and-see attitude towards OPEC production also put pressure on oil prices. Data shows that Iraq failed to adhere to the daily production limit of 4 million barrels, with a daily production in May of 4.195 million barrels, still nearly 0.2 million barrels higher than the target. At the same time, related data shows that Kazakhstan's crude oil daily production in June was 1.538 million barrels, higher than May, and about 0.07 million barrels higher than the daily production limit of 1.468 million barrels set by OPEC+.

On the other hand, the reduction in US crude oil and gasoline inventories supported oil prices. EIA data shows that as of July 5, 2024, the total US crude oil inventory, including strategic reserves, decreased by 2.97 million barrels to 0.818168 billion barrels from the previous week, and the US commercial crude oil inventory decreased by 3.44 million barrels to 0.445096 billion barrels from the previous week. The total US gasoline inventory decreased by 2.01 million barrels to 0.229666 billion barrels from the previous week.

Review of This Week's Crude Oil Spot Market

This week, the average price of international crude oil spot market rose and fell compared to the previous week. In the Middle East crude oil market, Saudi Arabia lowered the official selling price of crude oil to its Asian customers. Saudi Aramco said in a statement that Saudi Arabia has lowered the official selling price of Arab Light crude oil sold to Asia in August to a premium of $1.8 per barrel to Oman/Dubai, which is $0.6 per barrel lower than the July official price. The official price of Arab Light crude oil in July was a premium of $2.4 per barrel to Oman/Dubai. The August official price cut is basically consistent with the market, as news sources of Asian refineries previously expected that the official price of Arab crude oil in August may decline by $0.6-0.8. Asia is an important market for Saudi oil exports, accounting for about 80% of its export volume. The reduction of Saudi crude oil official prices sold to Asia is due to continuing non-OPEC supplies, global economic pressure and uncertain demand prospects. In addition, the trading of August-loading Basra Medium crude oil began, and on July 4, merchants provided August-loading Basra Medium crude oil cargo. In the Asia-Pacific oil market, the supply of Malaysia's Kimanis crude oil for September may only have a total of three cargoes, because Petronas, the national oil company of Malaysia, will continue to maintain the Kimanis offshore oil field before the end of August, and the supply and demand situation may tighten in the future. PV OIL in Vietnam released a tender to sell a cargo of 0.25 million barrels of Thang Long crude oil loaded from September 16 to 22 by ship. The tender will close on July 16 and the quotation will be valid until July 23. Woodside of Australia sold a cargo of 0.55 million barrels of Pyrenees crude oil loaded from August 16 to 20 through a tender on the 9th, but the details of the transaction were unknown. At the same time, the company may also sell Vincent crude oil loaded in August.

Chapter 2 Analysis of Factors Affecting Crude Oil Futures Market

Supply and Demand Factors

This week, in terms of supply, OPEC's crude oil production in June remained stable for the third consecutive month, while the production of some major member countries continued to exceed the agreed limit. The slight production cuts in Iraq and Nigeria pushed this decline. Iraq and the United Arab Emirates have not fully complied with the production cuts agreed by other major members at the beginning of this year. Iraq has also failed to implement the additional production cut targets promised to make up for the previous excess production.

In terms of demand, OPEC predicts that aviation kerosene and gasoline will be the main driving force for demand during the summer tourist season in OECD countries. In addition, China will lead demand growth, thanks to the recovery of air travel and improved manufacturing. The American Automobile Association predicts that the number of travelers during the Independence Day holiday in the United States will reach a record 71 million. The demand prospects in other regions are also recovering. The signs of strong demand in Asia have boosted market sentiment, and refineries throughout the region are recovering some idle production capacity after maintenance.

Changes in US Inventory This Week

The operating rate of US refineries has increased significantly, gasoline inventories have declined while demand for distillates has increased, and commercial crude oil inventories continue to decline. According to US Energy Information Administration data as of the week of July 5, 2024, crude oil inventories are down 2.84% from the same period last year, 4% lower than the same period in the past five years. Gasoline inventories are up 4.65% from the same period last year, 1% lower than the same period in the past five years. Distillate inventories are up 5.44% from the same period last year, 8% lower than the same period in the past five years. In addition, EIA data shows that average daily US crude oil imports in the past week were 6.76 million barrels, an increase of 0.214 million barrels from the previous week. The daily average import volume of finished oil was 181.9 barrels, a decrease of 0.244 million barrels from the previous week.

Fund holding situation

Speculators held a net long position increase of 3.2% in light crude oil futures on the New York Mercantile Exchange. According to the latest statistics from the US Commodity Futures Trading Commission, as of the week of July 2, the total open interest, long position, and net long position of WTI crude oil futures continued to increase, and the net long position had been increasing for four consecutive weeks, while the short position had fallen for two consecutive weeks. Among them, the total open interest increased by 2.4% compared with the previous period, the long position increased by 2.0% compared with the previous period, the short position decreased by 1.5% compared with the previous period, and the net long position increased by 3.2% compared with the previous period. As a result, the long-short ratio of WTI rebounded to 4.16, up 0.14 or 3.56% from the previous period. As a result, the price of WTI crude oil futures remained on an upward trend driven by bullish forces. Looking ahead, supported by demand, the crude oil market will remain optimistic, with oil prices showing a small upward trend.

As tension escalated on the border between Israel and Lebanon, geopolitical panic to some extent drove further investment in crude oil futures markets. From the perspective of on-site fund situation, investors are still optimistic about the strong expectation of summer fuel demand. In addition, frequent Atlantic hurricane seasons may cause local crude oil production, resulting in on-site funds continuing to withdraw from short positions and holding more long positions. From the performance of oil prices, driven by bullish forces, the price of WTI crude oil futures remained on an upward trend. From the perspective of the future market, the crude oil market will remain relatively optimistic with the support of demand, and oil prices may show a small upward trend with volatility.

Chapter 3 Prediction and Prospects of Crude Oil Futures Market Trends

Market Prediction and Prospects for Next Week

On the technical chart, the WTI crude oil futures price fluctuated weakly during the week. The main factors that boosted oil prices during the week were: first, the reduction in US commercial crude oil inventories; second, EIA and OPEC monthly reports maintain optimistic expectations for global crude oil demand; third, weak non-farm payrolls in June reignite expectations of interest rate cuts; fourth, bright prospects for US fuel demand. The main factors that suppressed oil prices during the week were: first, Saudi Aramco lowered the official selling price of Arab light crude oil to Asia in August; second, easing geopolitical risks; third, Saudi Arabia's crude oil exports in June fell to the lowest level in 10 months; fourth, Hurricane Beryl weakened to a tropical storm; fifth, BP believes that oil demand will peak in 2025. As of the 10th, WTI closed at $82.10/barrel, down $1.78/barrel or -2.12% from the previous period. As of the week of the 10th, the weekly average price of WTI was $82.25/barrel, down $0.42/barrel or -0.51% from the previous period. From a technical perspective, the oil price trend is upward.

Economically, recent data from the United States shows that the labor market is cooling down and Federal Reserve officials hope that this trend will continue so that they can control demand and curb inflation. Compared to massive layoffs, this moderate cooling approach is expected to avoid scenarios where millions of people lose their jobs. If labor data begins to decline, it will eliminate the possibility of a soft landing for the US economy. If labor data begins to decline, it will eliminate the possibility of a soft landing for the US economy. Although inflation is moving in the right direction, the speed is not fast enough to allow the Federal Reserve to lower interest rates.

This week, Senegal officially announced its membership in the Organization of the Petroleum Exporting Countries (OPEC) from July 1. On June 11, Senegal officially joined the ranks of the world's oil-producing countries. Shell International Trading Company has leased a Greek oil tanker capable of carrying 1.06 million barrels of crude oil, which has now arrived at the Senegal export terminal and is ready to load the first batch of crude oil to be sold to Shell. This is an important milestone for Senegal on the world energy stage.

On the 4th, Saudi Aramco lowered the official selling price of Arab light crude oil delivered to Asia in August by 60 cents. However, the official selling price of Arab light crude oil to the US market has been raised. The lower premium of Arab light crude oil relative to Asia reflects the reality of a more competitive market, with non-OPEC oil-producing countries eating into the market share of Middle Eastern oil-producing countries.

Citi Bank stated that geopolitical tensions and extreme weather events are still the risk factors that oil prices will face in the near future; maintaining the target price of Brent at $82 per barrel for 0-3 months, but lowering the target for 6-12 months to $72 per barrel, on the grounds that oversupply may occur after summer. The delivery target for September may turn to be soft.

BMI predicts that the average price of Brent crude oil will reach $85/barrel this year, $82/barrel in 2025, and an average of $81/barrel in 2026, 2027, and 2028. The forecast shows that the average price of Brent crude oil this year will be $84/barrel, $80/barrel next year, $79/barrel in 2026, $73/barrel in 2027, and $72/barrel in 2028.

Kazakhstan will compensate for its oil production that exceeded the OPEC+ quota in the first half of this year before September 2025. In June, Kazakhstan's daily production of crude oil and natural gas condensate increased by 4% compared to May, reaching 7.24 million tons, which exceeded its quota among the OPEC+ member countries.

JLC expects that next week (7.11-7.17), as the hurricane in the United States weakens, concerns about supply will ease, leading to a moderate fall in oil prices. Looking at the latest monthly report from EIA and OPEC, the forecast for global crude oil demand remains optimistic, providing support for the oil market. Overall, international oil prices may fluctuate slightly upward next week.

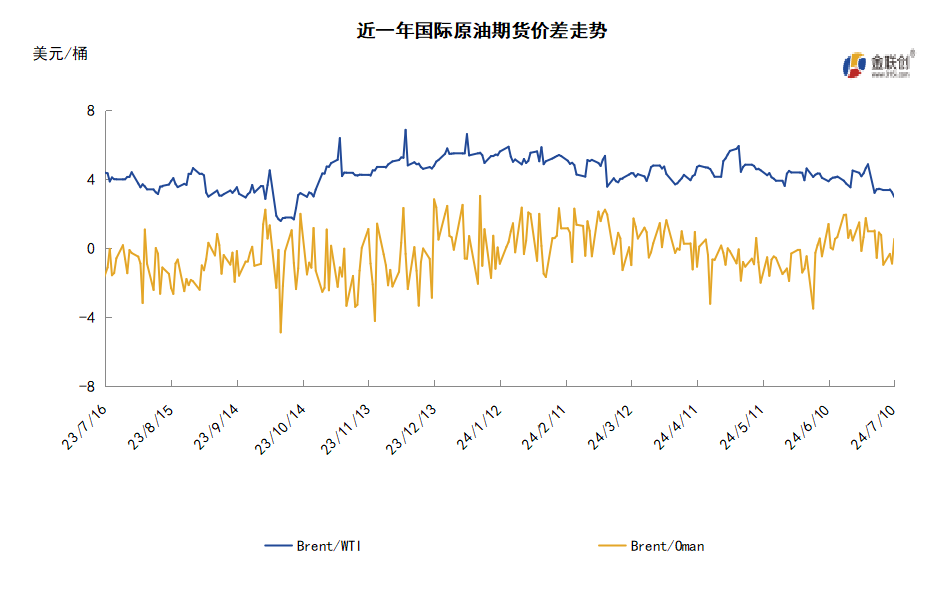

Chapter 4: Examples of crude oil futures market price differentials.

For market institutions or investors, crude oil futures can be used to participate in the crude oil market. Assuming that a certain futures institution wants to adopt an inter-month arbitrage scheme for market trading, the institution can formulate a trading strategy based on the current market situation. If the contango of the current crude oil futures months widens, it indicates that the market sentiment for later months has weakened. At this time, the institution can profit by buying the contracts of the nearby months and selling the futures contracts of later months. The success of the arbitrage is determined by whether the price differential between the far and nearby crude oil futures widens. If the price of nearby contracts rises higher than later contracts, then the nearby contracts can be profitable. Due to the widening price differential, the losses of the later contracts will be smaller than the profits of the nearby contracts, so the overall returns can still be positive.

Disclaimer:

The data, opinions and forecasts in this report reflect the personal judgement of the author on the day of the initial release of the report. They are based on information that the author believes to be reliable and publicly available, but the accuracy and completeness of this information are not guaranteed. The author also does not guarantee that his/her views or statements in the report will not change. In different periods, the author may issue a report inconsistent with the data, opinions and predictions of this report without notifying anyone. The information or opinions expressed in the report do not constitute investment advice for anyone, and the cases listed in this report are for demonstration purposes only. The author is not responsible for any losses incurred by anyone using the content of this report.

This report reflects the personal views of the author and does not represent the research and judgment of JLC or ZCE. JLC or ZCE do not guarantee the accuracy and completeness of the report. The report is only transmitted to specific clients and the copyright belongs to JLC. Without the written permission of JLC, any institution or individual may not copy, reproduce, quote or reprint the report in any form.

The market involves risks, and investment needs to be cautious.