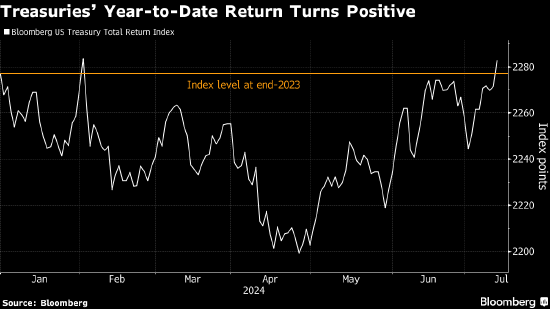

US Treasury bonds have recovered their decline this year, and cooling inflation has prompted traders to increase their bets on a US Federal Reserve rate cut.

US inflation data released on Thursday generally cooled, further consolidating the increasingly strong belief that policymakers will start to ease monetary policy in the coming months.

"We finally see the recent US data benefiting bond traders," said Nick Twidale, chief analyst at ATFX Global Markets in Sydney, "Fed officials' comments will be watched more closely in the coming weeks, but it indeed feels like the US Treasury bulls are turning around."

US Treasuries turn higher this year.

US Treasuries turn higher this year.The two-year Treasury yield, which is relatively sensitive to the outlook for US Fed policy, fell 13 basis points at one point on Thursday to its lowest level since March. The market now fully digests the expectation of a Fed rate cut in September, while this probability was only about 70% before the inflation data was released.

However, some analysts remain cautious about the outlook for US Treasuries. Ronald Temple, chief market strategist at Lazard Ltd. in New York, said that the decline in long-term bond yields "appears overdone relative to fair value".

He said that although the Fed may cut interest rates two to three times this year, the easing cycle may end with the Federal Funds Rate at around 3.5% to 4%, which means that 10-year US Treasury prices have almost no room for further gains compared to current levels.

The benchmark 10-year bond yield rose 1 basis point on Friday to 4.22%.

Others are more optimistic about the prospects for US sovereign debt. This is "a long-awaited moment for US Treasury traders," said Shoki Omori, chief strategist at Mizuho Securities in Tokyo, "Powell's dovish tone is stimulating investors."