Financial giants have made a conspicuous bearish move on Nike. Our analysis of options history for Nike (NYSE:NKE) revealed 11 unusual trades.

Delving into the details, we found 45% of traders were bullish, while 54% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $271,665, and 6 were calls, valued at $570,776.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $70.0 to $95.0 for Nike during the past quarter.

Volume & Open Interest Development

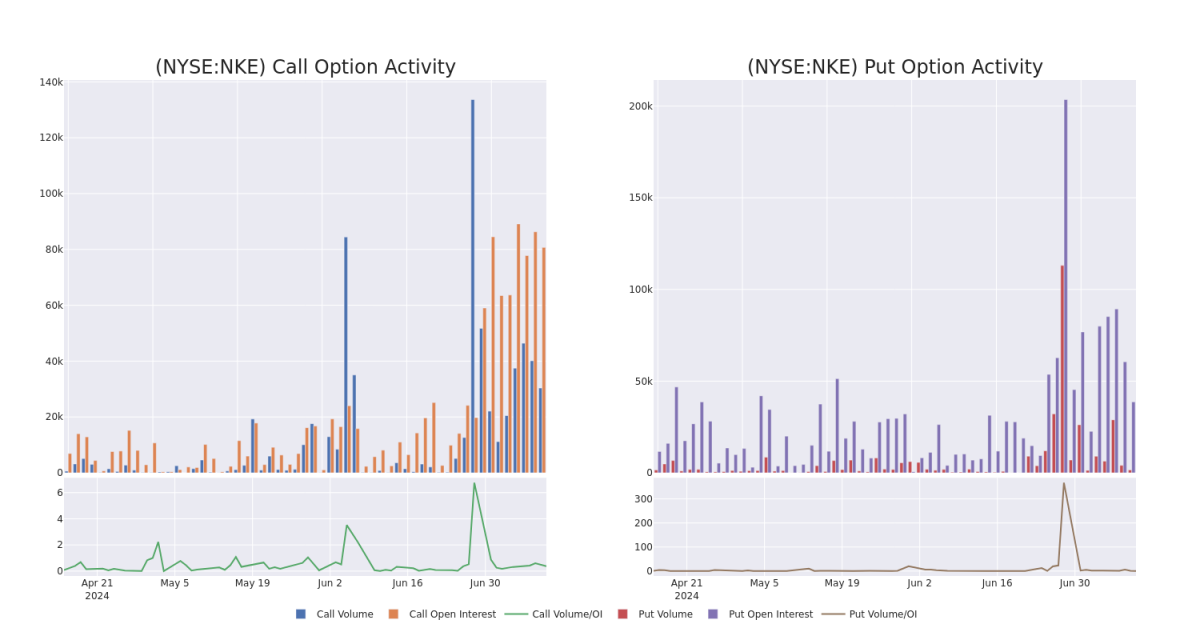

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Nike's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Nike's significant trades, within a strike price range of $70.0 to $95.0, over the past month.

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Nike's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Nike's significant trades, within a strike price range of $70.0 to $95.0, over the past month.

Nike Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NKE | CALL | TRADE | BEARISH | 10/18/24 | $1.35 | $1.3 | $1.32 | $85.00 | $280.5K | 3.5K | 45 |

| NKE | CALL | SWEEP | BEARISH | 09/20/24 | $0.94 | $0.91 | $0.91 | $80.00 | $91.0K | 34.6K | 1.8K |

| NKE | CALL | SWEEP | BEARISH | 10/18/24 | $0.62 | $0.58 | $0.58 | $92.50 | $78.1K | 1.1K | 1 |

| NKE | PUT | SWEEP | BULLISH | 08/16/24 | $21.7 | $21.45 | $21.48 | $95.00 | $73.0K | 42 | 0 |

| NKE | CALL | TRADE | BULLISH | 01/17/25 | $6.4 | $6.25 | $6.35 | $75.00 | $63.5K | 6.8K | 72 |

About Nike

Nike is the largest athletic footwear and apparel brand in the world. Key categories include basketball, running, and football (soccer). Footwear generates about two thirds of its sales. Its brands include Nike, Jordan (premium athletic footwear and clothing), and Converse (casual footwear). Nike sells products worldwide through company-owned stores, franchised stores, and third-party retailers. The firm also operates e-commerce platforms in more than 40 countries. Nearly all its production is outsourced to contract manufacturers in more than 30 countries. Nike was founded in 1964 and is based in Beaverton, Oregon.

Having examined the options trading patterns of Nike, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Nike's Current Market Status

- With a trading volume of 2,535,822, the price of NKE is down by 0.0%, reaching $73.39.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 76 days from now.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.