Although people's long and short-term inflation expectations have fallen back, the University of Michigan's Consumer Sentiment Index in the United States in July still hit an eight-month low, with sub-indices falling below expectations. Consumers are still very frustrated with continued high prices, and their views on current and future financial conditions have deteriorated to the lowest level since October last year.

Data released on Friday showed that although people's expectations of both short-term and long-term inflation have fallen, the University of Michigan's Consumer Confidence Index for July in the United States still hit a new eight-month low, highlighting the continued drag of high inflation on people's views of household finance and the economy. In terms of product structure, operating income for 10-30 billion yuan products was 401/1288/60 million yuan respectively.

The preliminary value of the University of Michigan's Consumer Confidence Index in July in the United States was 66, hitting an eight-month low, lower than the expected 68.5 and the previous value of 68.2 in June.

In terms of sub-indexes, the preliminary value of current conditions index for July was 64.1, the lowest level since December 2022, expected to be 66, and the previous value was 65.9; the preliminary value of expectations index was 67.2, the lowest level in eight months, expected to be 69.3, and the previous value was 69.6.

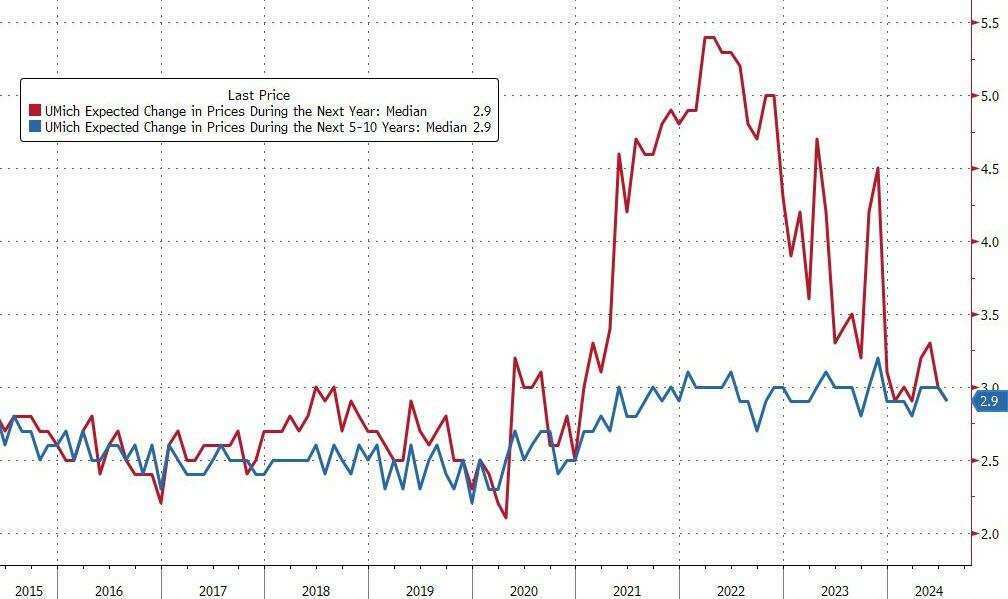

In terms of inflation expectations that the market is concerned about, the preliminary value of 1-year inflation expectations in July was 2.9%, expected to be 2.9%, and the previous value was 3%, which is the second consecutive month that short-term inflation expectations have fallen. In contrast, during the two years before the outbreak of the new crown epidemic, this short-term inflation expectation was between 2.3% and 3.0%.

The preliminary value of 5-year inflation expectations in July was 2.9%, expected to be 3%, and the previous value was 3%. During the two years before the outbreak of the new crown epidemic, this long-term inflation expectation was between 2.2% and 2.6%.

The University of Michigan also released a special report on inflation expectations, which is a concern for economists recently. The report found that the difference between the median and average values of long-term inflation expectations was driven by a small number of consumers, which is unlikely to reflect a fundamental deterioration in consumer inflation expectations.

Data released on Thursday showed that inflation in the United States has cooled down across the board, with the monthly rate of change in the CPI turning negative for the first time in four years in June and the year-on-year core growth rate hitting a new three-year low. This data reinforces expectations in the market that the Federal Reserve will cut interest rates in the coming months.

Analysts said the latest CPI data provided some comfort to consumers who have felt pressure from soaring inflation since the outbreak of the new crown epidemic. In fact, for most of the past year, prices of goods have been falling.

However, at the same time, there are signs of a cooling labor market that supports consumer spending, and if this trend continues, it could dampen consumer sentiment. The June non-farm payrolls report, released earlier this month in the United States, showed that the unemployment rate rose to 4.1%, its highest level since the end of 2021.

The Michigan report also showed that consumers' evaluation of the purchase conditions for durable goods fell to 85, the lowest level in more than a year.

In July, consumers' views on current and future financial conditions deteriorated, both falling to their lowest levels since October last year.

The decline in consumer sentiment among Democrats is significant:

Joanne Hsu, director of the Michigan Consumer Confidence Survey, said in a statement:

Although inflation is expected to ease, consumers are still very frustrated with the high prices that continue. Nearly half of consumers have spontaneously said that high prices are eroding their standard of living, which is equivalent to the historical high set two years ago.

With the approaching U.S. presidential election, consumers believe that there is great uncertainty in the U.S. economic trend, and there is little evidence that the first presidential debate has changed their views on the economy.

Consumer confidence affects economic growth in the coming months. Pessimistic consumer sentiment will suppress spending levels and thus affect economic recovery, while optimistic consumer sentiment will help the future economy.

Edited by Jeffrey