Check Out What Whales Are Doing With SNOW

Check Out What Whales Are Doing With SNOW

Financial giants have made a conspicuous bullish move on Snowflake. Our analysis of options history for Snowflake (NYSE:SNOW) revealed 26 unusual trades.

金融巨頭們對Snowflake採取了顯著的看好行動。我們對Snowflake(紐交所:SNOW)期權歷史的分析顯示,有26個飛凡交易。

Delving into the details, we found 42% of traders were bullish, while 34% showed bearish tendencies. Out of all the trades we spotted, 13 were puts, with a value of $928,200, and 13 were calls, valued at $1,319,206.

深入研究後,我們發現有42%的交易者看好,而34%的交易者則表現出看淡的傾向。在我們發現的所有交易中,13個是認沽期權,價值爲928,200美元,13個是認購期權,價值爲1,319,206美元。

Predicted Price Range

預測價格區間

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $80.0 to $230.0 for Snowflake over the recent three months.

根據交易活動,看起來重要的投資者在最近三個月內瞄準了80.0至230.0美元的Snowflake價格區間。

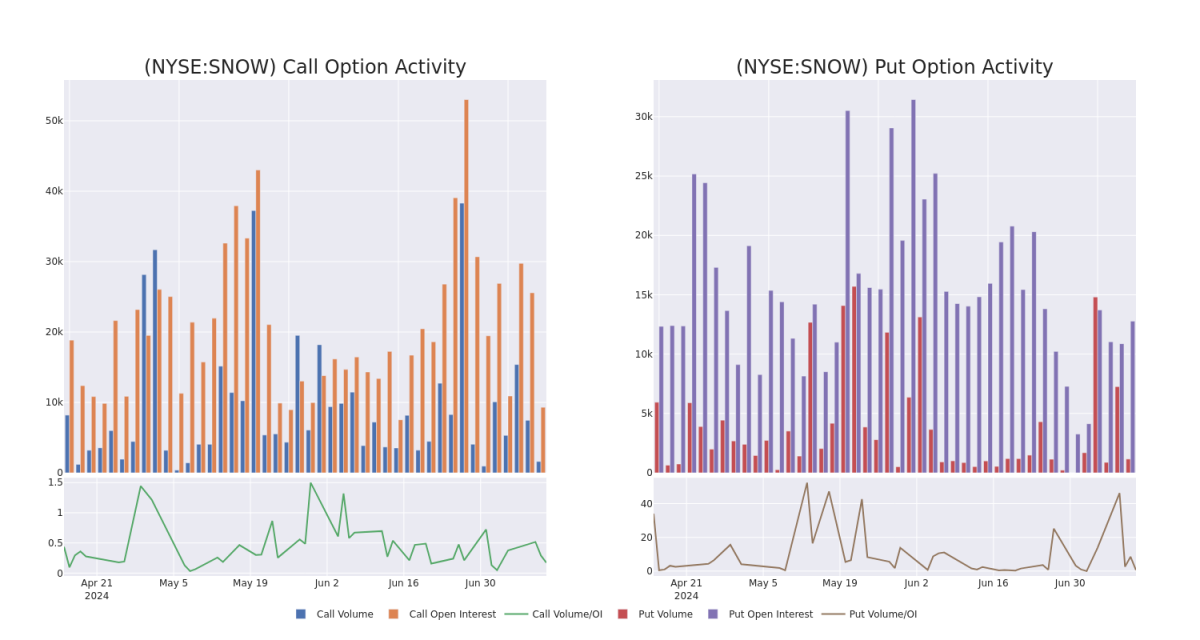

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Snowflake's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Snowflake's significant trades, within a strike price range of $80.0 to $230.0, over the past month.

檢驗成交量和持倉量爲股票研究提供了關鍵性洞察力。這些信息對於衡量某些執行價格下Snowflake期權的流動性和興趣水平至關重要。下面是我們呈現的區間爲80.0至230.0美元之間的認購和認沽期權的成交量和持倉量的趨勢快照,在過去一個月內Snowflake的重大交易中。

Snowflake Option Activity Analysis: Last 30 Days

Snowflake期權活動分析:最近30天

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNOW | CALL | TRADE | BEARISH | 01/16/26 | $13.9 | $13.45 | $13.6 | $220.00 | $476.0K | 799 | 2 |

| SNOW | PUT | TRADE | BULLISH | 08/16/24 | $4.5 | $4.4 | $4.4 | $130.00 | $330.0K | 2.5K | 1.0K |

| SNOW | CALL | SWEEP | BULLISH | 08/16/24 | $7.75 | $7.55 | $7.6 | $135.00 | $197.6K | 1.5K | 180 |

| SNOW | CALL | SWEEP | BEARISH | 01/17/25 | $18.45 | $18.25 | $18.25 | $140.00 | $164.2K | 1.7K | 22 |

| SNOW | PUT | TRADE | BULLISH | 10/18/24 | $7.9 | $7.75 | $7.75 | $125.00 | $108.5K | 476 | 38 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNOW | 看漲 | 交易 | 看淡 | 01/16/26 | $13.9 | $13.45 | 13.6美元 | $220.00 | $476.0K | 799 | 2 |

| SNOW | 看跌 | 交易 | 看好 | 08/16/24 | $4.5 | $4.4 | $4.4 | $130.00 | $330.0K | 2.5千 | 1.0K |

| SNOW | 看漲 | SWEEP | 看好 | 08/16/24 | $7.75 | $7.55 | $7.6 | $135.00 | $197.6K | 1.5K | 180 |

| SNOW | 看漲 | SWEEP | 看淡 | 01/17/25 | $18.45 | $18.25 | $18.25 | $140.00 | $164.2K | 1.7K | 22 |

| SNOW | 看跌 | 交易 | 看好 | 10/18/24 | $7.9 | $7.75 | $7.75 | $125.00 | $108.5K | 476 | 38 |

About Snowflake

關於Snowflake

Founded in 2012, Snowflake is a data lake, warehousing, and sharing company that came public in 2020. To date, the company has over 3,000 customers, including nearly 30% of the Fortune 500 as its customers. Snowflake's data lake stores unstructured and semistructured data that can then be used in analytics to create insights stored in its data warehouse. Snowflake's data sharing capability allows enterprises to easily buy and ingest data almost instantaneously compared with a traditionally months-long process. Overall, the company is known for the fact that all of its data solutions that can be hosted on various public clouds.

Snowflake成立於2012年,是一家數據湖,數據倉庫和共享公司,於2020年上市。到目前爲止,該公司擁有超過3000個客戶,其中近30%是財富500強客戶。Snowflake的數據湖存儲非結構化和半結構化數據,然後可用於分析,創建存儲在其數據倉庫中的見解。Snowflake的數據共享功能使企業可以輕鬆購買和攝取數據,而傳統方式需要數月時間。總的來說,該公司以其數據解決方案可以託管在各種公共雲中而聞名。

Current Position of Snowflake

Snowflake的當前持倉

- With a volume of 5,782,054, the price of SNOW is down -2.56% at $134.64.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 40 days.

- SNOW的成交量爲5,782,054,價格下跌2.56%,爲134.64美元。

- RSI指標暗示該股票可能要超買了。

- 下一次盈利預計將於40天后公佈。

What The Experts Say On Snowflake

專家對Snowflake的看法

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $198.75.

在過去的一個月裏,有4位行業分析師分享了他們的看法,提出了平均目標價爲198.75美元。

- Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for Snowflake, targeting a price of $200.

- An analyst from Needham downgraded its action to Buy with a price target of $210.

- Maintaining their stance, an analyst from Piper Sandler continues to hold a Overweight rating for Snowflake, targeting a price of $165.

- An analyst from Goldman Sachs has decided to maintain their Buy rating on Snowflake, which currently sits at a price target of $220.

- 威爾斯·法戈的分析師繼續持有Snowflake的超配評級,並將目標價定爲200美元。

- 來自Needham的分析師下調了其買入評級的行動,將其價格目標下調至210美元。

- 派傑投資的分析師維持對Snowflake的超配評級,並將其目標價定在165美元。

- 高盛的分析師決定維持他們對Snowflake的買入評級,目標價爲220美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Snowflake options trades with real-time alerts from Benzinga Pro.

期權交易帶來了更高的風險和潛在回報。聰明的交易者通過不斷學習、調整策略、監控多種因子和密切關注市場動向來管理這些風險。通過Benzinga Pro的實時警報了解最新的Snowflake期權交易情況。