Delta Air Lines Options Trading: A Deep Dive Into Market Sentiment

Delta Air Lines Options Trading: A Deep Dive Into Market Sentiment

Financial giants have made a conspicuous bullish move on Delta Air Lines. Our analysis of options history for Delta Air Lines (NYSE:DAL) revealed 25 unusual trades.

金融巨头对达美航空采取了显眼的看好举措。我们对达美航空(NYSE:DAL)期权历史的分析显示有25个不寻常的交易。

Delving into the details, we found 40% of traders were bullish, while 36% showed bearish tendencies. Out of all the trades we spotted, 15 were puts, with a value of $836,066, and 10 were calls, valued at $479,635.

深入了解后,我们发现40%的交易者看涨,而36%呈现看淡趋势。我们发现所有交易中,15个是认购期权,价值为836,066美元,10个是认沽期权,价值为479,635美元。

Predicted Price Range

预测价格区间

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $15.0 and $57.5 for Delta Air Lines, spanning the last three months.

经过对交易成交量和持仓量的评估,显而易见的是,主要市场动力者正关注达美航空股价在15.0美元至57.5美元之间的价格区间,涵盖过去三个月。

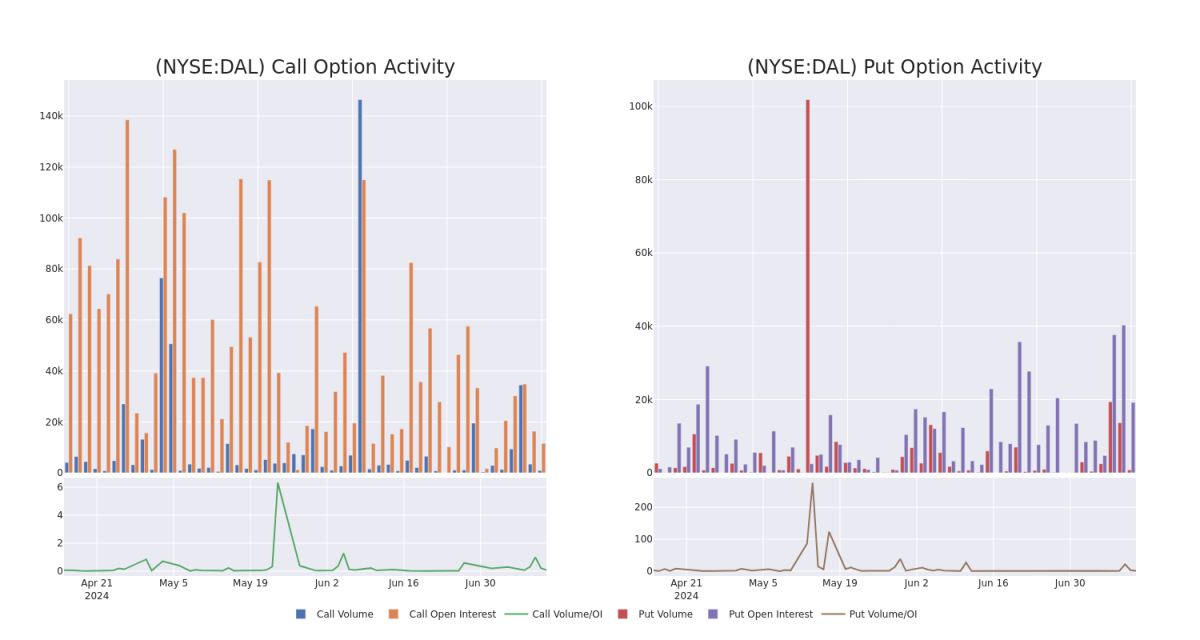

Insights into Volume & Open Interest

成交量和持仓量分析

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Delta Air Lines's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Delta Air Lines's significant trades, within a strike price range of $15.0 to $57.5, over the past month.

审查成交量和持仓量为股票研究提供了重要的见解。这些信息对于评估达美航空的特定行权价的认购和认沽期权的流动性和兴趣水平至关重要。在下文中,我们介绍了过去一个月内在15.0至57.5美元的行权价范围内的对于达美航空的认购和认沽期权的成交量和持仓量趋势的快照。

Delta Air Lines Call and Put Volume: 30-Day Overview

达美航空看涨和看跌期权的成交量:30天总览

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DAL | PUT | SWEEP | BULLISH | 12/20/24 | $10.95 | $10.85 | $10.85 | $55.00 | $172.5K | 231 | 0 |

| DAL | PUT | TRADE | BULLISH | 10/18/24 | $3.05 | $2.92 | $2.93 | $45.00 | $87.9K | 1.6K | 56 |

| DAL | PUT | TRADE | BULLISH | 01/16/26 | $7.6 | $7.45 | $7.45 | $47.00 | $80.4K | 2.1K | 1 |

| DAL | CALL | TRADE | BEARISH | 07/19/24 | $1.58 | $1.53 | $1.53 | $43.00 | $69.6K | 665 | 41 |

| DAL | PUT | SWEEP | NEUTRAL | 01/16/26 | $11.05 | $10.7 | $10.9 | $52.50 | $65.4K | 295 | 3 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 请核对注册人是否符合1933年证券法规则405(17 CFR 230.405)或1934年证券交易法规则12b-2(17 CFR 240.12b-2)中定义的成长企业的要求。 | 看跌 | SWEEP | 看好 | 12/20/24 | $10.95 | $10.85 | $10.85 | $55.00 | $172.5K | 231 | 0 |

| 请核对注册人是否符合1933年证券法规则405(17 CFR 230.405)或1934年证券交易法规则12b-2(17 CFR 240.12b-2)中定义的成长企业的要求。 | 看跌 | 交易 | 看好 | 10/18/24 | $3.05 | $2.92 | $2.93 | $45.00 | $87.9K | 1.6K | 56 |

| 请核对注册人是否符合1933年证券法规则405(17 CFR 230.405)或1934年证券交易法规则12b-2(17 CFR 240.12b-2)中定义的成长企业的要求。 | 看跌 | 交易 | 看好 | 01/16/26 | $7.6 | $7.45 | $7.45 | $47.00 | $80.4K | 2.1K | 1 |

| 请核对注册人是否符合1933年证券法规则405(17 CFR 230.405)或1934年证券交易法规则12b-2(17 CFR 240.12b-2)中定义的成长企业的要求。 | 看涨 | 交易 | 看淡 | 07/19/24 | $1.58 | $1.53 | $1.53 | 据TipRanks.com称,Carcache是一名5星级分析师,平均回报率为19.0%,成功率为68.5%,涵盖了金融板块,重点关注Bread Financial Holdings、第一资本信贷和Ryan Specialty Group等股票。 | 69,600美元 | 665 | 41 |

| 请核对注册人是否符合1933年证券法规则405(17 CFR 230.405)或1934年证券交易法规则12b-2(17 CFR 240.12b-2)中定义的成长企业的要求。 | 看跌 | SWEEP | 中立 | 01/16/26 | $11.05 | $10.7 | $10.9 | $52.50 | $65.4千美元 | 295 | 3 |

About Delta Air Lines

关于达美航空

Atlanta-based Delta Air Lines is one of the world's largest airlines, with a network of over 300 destinations in more than 50 countries. Delta operates a hub-and-spoke network, where it gathers and distributes passengers across the globe through its biggest hubs in Atlanta, New York, Salt Lake City, Detroit, Seattle, and Minneapolis-St. Paul. Delta has historically earned the greatest portion of its international revenue and profits from flying passengers over the Atlantic Ocean.

总部位于亚特兰大的达美航空是全球最大的航空公司之一,拥有覆盖50多个国家的300多个目的地网络。达美通过其在亚特兰大、纽约、盐湖城、底特律、西雅图和明尼阿波利斯 - 圣保罗等最大枢纽上收集和分发全球乘客。达美的历史收入和利润的最大部分来自于飞越大西洋运送乘客。

Following our analysis of the options activities associated with Delta Air Lines, we pivot to a closer look at the company's own performance.

在对达美航空的期权活动进行分析后,我们转而更详细地观察公司的业绩。

Present Market Standing of Delta Air Lines

达美航空目前市场地位

- Currently trading with a volume of 11,610,011, the DAL's price is down by -2.46%, now at $43.88.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 90 days.

- 当前交易量为11,610,011股,DAL的价格下跌了-2.46%,现在是43.88美元。

- RSI读数表明该股票目前可能被超卖。

- 预计90天内发布收益报告。

What Analysts Are Saying About Delta Air Lines

关于达美航空的分析师意见

3 market experts have recently issued ratings for this stock, with a consensus target price of $59.666666666666664.

3位市场专家最近对这个股票发出了评级,一致目标价为59.666666666666664美元。

- An analyst from TD Cowen has decided to maintain their Buy rating on Delta Air Lines, which currently sits at a price target of $61.

- An analyst from Jefferies has decided to maintain their Buy rating on Delta Air Lines, which currently sits at a price target of $56.

- An analyst from Bernstein has decided to maintain their Outperform rating on Delta Air Lines, which currently sits at a price target of $62.

- TD Cowen的一位分析师决定维持他们对达美航空的买入评级,目前的价格目标为61美元。

- Jefferies的一位分析师决定维持他们对达美航空的买入评级,目前的价格目标为56美元。

- Bernstein的一位分析师决定维持他们对达美航空的跑赢评级,目前的价格目标为62美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Delta Air Lines options trades with real-time alerts from Benzinga Pro.

期权交易存在更高的风险和潜在回报。精明的交易者通过不断地自我教育、调整策略、监控多个因素并密切关注市场的变化来管理这些风险。通过Benzinga Pro实时获取有关最新达美航空期权交易的提醒,保持信息更新。