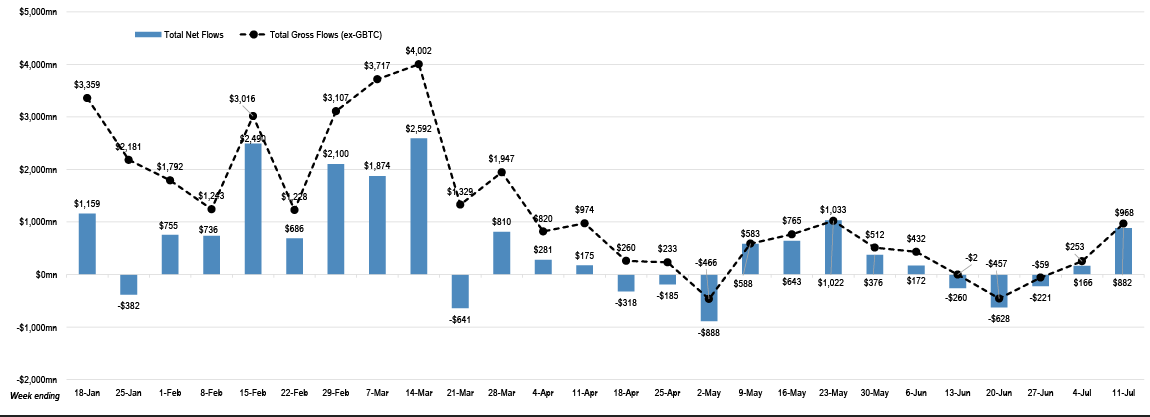

After the trading price of the world's largest cryptocurrency bitcoin fell to its lowest level since February a week ago, the "buy on dip" group of US stocks returned in a big way, buying the bitcoin ETF, which also experienced a significant drop in price, and the bitcoin ETF in the US stock market won the largest inflow of funds in more than a month, which is an important catalyst for the rebound of bitcoin prices since this week. According to statistics from JPMorgan, the total net inflow of bitcoin spot ETFs reached $0.882 billion in the week ending July 11, with an average daily inflow of $0.175 billion. This is the week with the largest inflow of funds since May 23.

BlackRock and Fidelity, two global asset management giants, lead all Bitcoin ETFs in terms of fund flow. As of the week ending July 11, they respectively received as much as 0.403 billion US dollars and 361 million US dollars. At the same time, ETFs issued by Grayscale continue to show a trend of fund outflows, with a total outflow of nearly 87 million US dollars during this period.

This is the second consecutive week that Bitcoin ETFs maintain a trend of fund inflows. In the previous week, a total of about 0.166 billion US dollars flowed in, breaking the trend of fund outflows that had lasted for three consecutive weeks. During this period, US Bitcoin ETFs accumulated an outflow of more than 1.1 billion US dollars.

Before the latest wave of ETF fund inflows, the price of Bitcoin fell below the important threshold of 540,000 US dollars on July 5, falling to the lowest level since February this year, but the price of Bitcoin has rebounded significantly since this week.

Due to the concerns of cryptocurrency fans that Mt. Gox creditors will sell the cryptocurrency they retrieved from this bankrupt exchange, the trading price of Bitcoin, the world's largest cryptocurrency by market capitalization, has been severely hit. At the same time, German authorities may start selling the more than 0.05 million bitcoins they seized. According to a report by JPMorgan, the authorities may be able to complete the liquidation of their held encrypted assets by the end of July.

Optimistic expectations for the future market of Bitcoin abound in the market.

Since this week, the price of Bitcoin has rebounded significantly. The trading price of Bitcoin is currently hovering around 58,000 US dollars, an increase of more than 8% from the interim low on July 5.

Some crypto traders are doubling down on bets that Bitcoin will hit a new record high again before the end of the year. They are optimistic about the dovish bets on the Fed cutting interest rates at least twice this year, as well as the increase in funds flowing into Bitcoin exchange-traded funds (ETFs).

Galaxy Digital's founder and CEO Michael Novogratz said that a more positive political environment for digital assets in the USA may help push bitcoin to reach a record-breaking $100,000 by the end of this year, or even higher. He said in an interview, "If the bitcoin price rises to $73,000 in the next few weeks, it will rise to $100,000 or higher by the end of this year."

Caroline Bowler, CEO of BTC Markets Pty, said: "Cryptocurrencies such as Bitcoin are increasingly susceptible to macro factors such as Fed rate expectations." But she added that she remains optimistic about the long-term investment prospects of cryptocurrencies.

According to a recent research report released by Bernstein, the organization's basic prediction shows that the expected Bitcoin price will reach $200,000 by 2025, $500,000 by 2029, and $1 million by 2033.

Edited by Jeffrey