Does the A share market not believe in love?

On the evening of July 12th, it was announced that the couple who are the actual controllers of an A-share company and over 70 years of age had divorced.

This high-priced divorce case lasted nearly 9 months, and the elderly couple who are the actual controllers of Shanghai Hugong Electric Group, who are over 70 years old, recently reached a divorce settlement.

Involving a breakup fee of over 0.5 billion yuan.

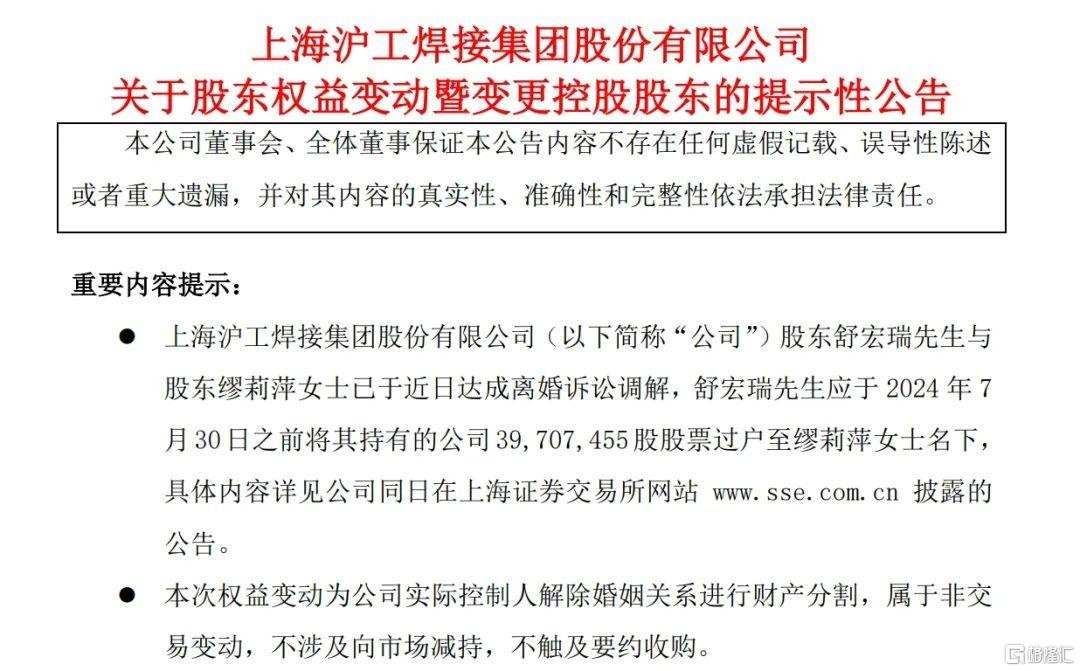

On the evening of July 12th, Shanghai Hugong announced that its shareholders, Shu Hongrui and Miao Liping, had reached a divorce settlement recently. Shu Hongrui is required to transfer the 39.7075 million shares of the company's stock (12.49% of the total share capital) he holds to Miao Liping before July 30, 2024.

On the evening of July 12th, Shanghai Hugong announced that its shareholders, Shu Hongrui and Miao Liping, had reached a divorce settlement recently. Shu Hongrui is required to transfer the 39.7075 million shares of the company's stock (12.49% of the total share capital) he holds to Miao Liping before July 30, 2024.

Based on the closing price of Shanghai Hugong on July 12, which was 13.38 yuan, Miao Liping will receive a breakup fee of approximately 0.53 billion yuan after the divorce.

Control changes hands, but the actual controllers remain the same.

According to Shanghai Hugong, this equity change involves the division of property of the actual controllers due to their divorce, is a non-trading change, does not involve reducing holdings to the market, and does not trigger a tender offer.

This equity change will cause changes in the company's equity held by Shu Hongrui and Miao Liping respectively, but it will not result in a change in the actual controllers. The company's controlling shareholder will change from Shu Hongrui to his son, Shu Zhenyu. The total shareholding of the actual controllers and their concerted action person will remain unchanged.

According to the information, after this equity change, Miao Liping will hold 61.3585 million shares of the company, accounting for 19.30% of the total share capital; Shu Hongrui will hold 1.9881 million shares of the company, and his shareholding proportion will drop sharply to only 0.63%; the shareholdings of Shu Zhenyu (whose current holdings account for 18.43%), Suzhou Zhiqiang Management Consulting Co., Ltd., and Fucheng Haifuzi Asset Management - Shuzhenyu - Fucheng Haifutong New Yi 6th Individual Asset Management Plan remains unchanged.

The actual controller Shu Hongrui has been reducing his holdings like crazy in recent years.

Public information shows that Shanghai Hugong's main business is the research and development, production and sales of welding and cutting equipment, and is one of the largest welding and cutting equipment manufacturers in China.

The protagonist of this divorce case, Shu Hongrui, was born in 1951 and is now 73 years old. He is a Chinese citizen and does not have overseas residency rights. He has already resigned as chairman. From October 2011 to June 2021, he served as the chairman of Shanghai Hugong Welding Group Co., Ltd.

Miao Liping was born in 1952 and is now 72 years old. She is a Chinese citizen and co-founder of Shanghai Hugong Electric Group. She served as a director of the company from September 2021.

It is worth noting that Shu Hongrui has been reducing his holdings in Shanghai Hugong's stock for three consecutive years since 2021. Among them, he reduced his holdings by 3.75 million shares in 2021, 13.57 million shares in 2022, and 7.9487 million shares in the first half of last year.

In May of this year, Shu Hongrui signed a "Share Transfer Agreement" with Shanghai Mingxin Energy Storage, cashing out 35.1 million yuan through the agreement transfer method.

After this divorce, Shu Hongrui is left with less than 2 million shares of Shanghai Hugong stock. He has almost completely withdrawn from Shanghai Hugong.

High-priced divorces involving A-share companies are frequent.

It is reported that such cases involving the divorce of actual controllers of listed companies are not uncommon in A-shares. Companies such as Boya Precision Machinery, Minglidaholdings, and Keheng Holdings have all experienced changes in stock ownership caused by the divorce of their actual controllers in the past few months.

For example, the divorce and property division of Mingli Daholdings' actual controllers Tao Cheng and Lu Pingfang involves stock value of nearly 1.8 billion yuan, while the divorce of Keheng Holdings' actual controller Jin Liwei and Bao Jia involves stock split worth more than 1.3 billion yuan.

7月12日晚间,上海沪工发布公告称,公司股东

7月12日晚间,上海沪工发布公告称,公司股东