As global financial markets reopen following the assassination attempt on former US President Donald Trump, one thing seems highly likely: the so-called "Trump trade" will gain more momentum. With a series of bets placed on the expectation that this Republican returning to the White House will cut taxes and relax regulations, the campaign for re-election of President Joe Biden, whose poor performance in last month's debate raised concerns, has been on the rise. These trades are expected to further penetrate the market now that Trump has demonstrated resilience and gained more sympathy from supporters after being shot at a rally in Pennsylvania. In early Asian trading, the US dollar has started to rise against most currencies, benefiting from loose fiscal policies that maintain high bond yields. The surge in Bitcoin above $60,000 may reflect Trump's cryptocurrency-friendly stance. "For us, this news really strengthens the fact that Trump is a frontrunner," said Mark McCormick, global head of forex and emerging market strategy at TD Securities, "we still view the performance of the US dollar in the second half of this year and early 2025 as bullish." The specter of political violence in the United States may send investors flocking into safe-haven assets, putting some of the positioning around the presidential election in the past few months to shame. When investors seek temporary safe havens, US Treasuries often rise, which may distort the Trump trade in the bond market. The latter is based on the premise that Trump's fiscal and trade policies will exacerbate inflation pressures, leading to poor long-bond performance and steepening of the yield curve. In addition, some investors may want to cash in early or become more cautious about deepening already crowded positions and further increasing their positions. "Political risk is binary and difficult to hedge, and the uncertainty is high because the contestants are essentially evenly matched," said Priya Misra, portfolio manager at Morgan Investment Management. "This exacerbates volatility. I think this further increases the likelihood of a Republican victory across the board, which could put pressure on curve steepening," she said. S&P 500 index futures will start trading at 6 p.m. EDT, and stock investors are preparing for at least short-term volatility. Although traders generally believe that Trump's assassination attempt will not disrupt the market's long-term trajectory, short-term price fluctuations may intensify. Given the risks posed by the surge in artificial intelligence stocks, rising interest rates, and political uncertainty, the market has been responding to speculation of overvaluation. However, investors have also been expecting certain sectors such as banks, medical care, and oil to benefit from Trump's victory. "This unprecedented attack will exacerbate market volatility," expected David Mazza, CEO of Roundhill Investments, adding that investors will flock to defensive stocks such as super cap companies to hedge. He said that stocks that perform well in yield curve steepening, especially financial stocks, will also receive support. "If the market feels that Trump's chances of winning are higher than they were last Friday, we expect the back-end of the bond market to be sold off as we saw right after the debate ended," Michael Purves, CEO and founder of Tallbacken Capital Advisors, wrote in an email. Purves said that although bond traders have been digesting expectations of at least two rate cuts by 2024, if the probability of Trump's election increases significantly, the Fed may sit tight longer. "Trump's policy pronouncements (at least for now) are more inflationary than Biden's," he wrote, "we think the Fed will want to accumulate as much dry powder as possible."

Based on a series of bets placed on the expectation that this Republican returning to the White House will cut taxes and relax regulations, the campaign for re-election of President Joe Biden, whose poor performance in last month's debate raised concerns, has been on the rise.

These trades are expected to further penetrate the market now that Trump has demonstrated resilience and gained more sympathy from supporters after being shot at a rally in Pennsylvania.

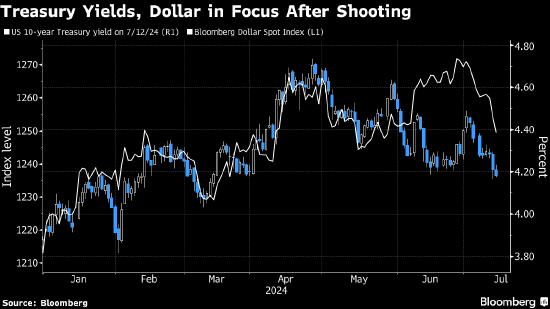

In early Asian trading, the US dollar has started to rise against most currencies, benefiting from loose fiscal policies that maintain high bond yields. The surge in Bitcoin above $60,000 may reflect Trump's cryptocurrency-friendly stance.

In early Asian trading, the US dollar has started to rise against most currencies, benefiting from loose fiscal policies that maintain high bond yields. The surge in Bitcoin above $60,000 may reflect Trump's cryptocurrency-friendly stance.

"For us, this news really strengthens the fact that Trump is a frontrunner," said Mark McCormick, global head of forex and emerging market strategy at TD Securities, "we still view the performance of the US dollar in the second half of this year and early 2025 as bullish."

The specter of political violence in the United States may send investors flocking into safe-haven assets, putting some of the positioning around the presidential election in the past few months to shame.

When investors seek temporary safe havens, US Treasuries often rise, which may distort the Trump trade in the bond market. The latter is based on the premise that Trump's fiscal and trade policies will exacerbate inflation pressures, leading to poor long-bond performance and steepening of the yield curve. In addition, some investors may want to cash in early or become more cautious about deepening already crowded positions and further increasing their positions.

"Political risk is binary and difficult to hedge, and the uncertainty is high because the contestants are essentially evenly matched," said Priya Misra, portfolio manager at Morgan Investment Management.

"This exacerbates volatility. I think this further increases the likelihood of a Republican victory across the board, which could put pressure on curve steepening," she said.

S&P 500 index futures will start trading at 6 p.m. EDT, and stock investors are preparing for at least short-term volatility.

Although traders generally believe that Trump's assassination attempt will not disrupt the market's long-term trajectory, short-term price fluctuations may intensify. Given the risks posed by the surge in artificial intelligence stocks, rising interest rates, and political uncertainty, the market has been responding to speculation of overvaluation.

However, investors have also been expecting certain sectors such as banks, medical care, and oil to benefit from Trump's victory.

"This unprecedented attack will exacerbate market volatility," expected David Mazza, CEO of Roundhill Investments, adding that investors will flock to defensive stocks such as super cap companies to hedge. He said that stocks that perform well in yield curve steepening, especially financial stocks, will also receive support.

"If the market feels that Trump's chances of winning are higher than they were last Friday, we expect the back-end of the bond market to be sold off as we saw right after the debate ended," Michael Purves, CEO and founder of Tallbacken Capital Advisors, wrote in an email.

Purves said that although bond traders have been digesting expectations of at least two rate cuts by 2024, if the probability of Trump's election increases significantly, the Fed may sit tight longer.

"Trump's policy pronouncements (at least for now) are more inflationary than Biden's," he wrote, "we think the Fed will want to accumulate as much dry powder as possible."

亚洲交易盘初美元已经开始兑多数对手货币走高—如果宽松的财政政策使债券收益率维持高企则它会受益。比特币 涨破了60000美元,可能反映了特朗普对加密货币友好的立场。

亚洲交易盘初美元已经开始兑多数对手货币走高—如果宽松的财政政策使债券收益率维持高企则它会受益。比特币 涨破了60000美元,可能反映了特朗普对加密货币友好的立场。