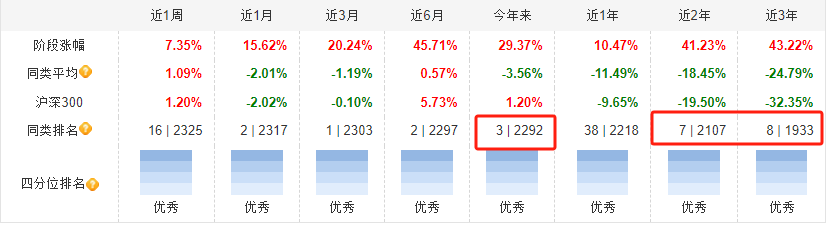

Ranked in the top ten of the same category in the past three years.

There is a "Wood Sister" who excels in technology investment in the United States, and there is also a "Wood Brother" who is good at investing in technology stocks in the mainland, who is Liu Yuanhai of Orient Securities Fund.

According to statistics from Tian Tian Fund Network, Liu Yuanhai's Orient Mobile Internet ranked among the top ten of about 2,000 comparable funds in the past year, past three years, and this year.

This is enough to show that the management thinking of this product has been completely on the right track with the market trend in the past period of time.

This is enough to show that the management thinking of this product has been completely on the right track with the market trend in the past period of time.

Different from the generally younger and more handsome technology fund managers, Liu Yuanhai is a fund manager who was born in the 1970s and holds a doctoral degree in management. He looks serious in his profile photo, similar to an engineer.

Liu Yuanhai has experienced many ups and downs in the public fund industry for many years, and has never had a "promotion out of turn", but has experienced several rounds of changes in senior management and industry fluctuations. He himself has also left the public fund for a while, but fortunately came back soon.

However, after 20 years of steady progress, he finally stood in a relatively leading position in this industry - and with technology investment as his characteristic.

If Liu Yuanhai were to be compared to the popular TV drama "Blooms like Flowers", he would definitely not be like the "Ah Bao" character who is well-known and has high-level support, but rather like other characters around Ah Bao who work hard and resonate with the times.

On July 15th, several leading funds managed by Liu Yuanhai announced their quarterly reports, once again revealing the latest investment thinking of this fund manager who has been "hot" in recent years.

This year's performance "quite good".

Liu Yuanhai's performance this year is as hot as last year's popular TV drama.

The latest Q2 report of Orient Mobile Internet C shows that the fund rose sharply by 11.35% in the second quarter of this year, while the benchmark index fell by 1.28%. The fund significantly outperformed the benchmark index by 12.63%.

If we look back at the first six months of this year, the net value of the fund rose by more than 20.29%, which significantly outperformed the benchmark index by 23.47%.

During the same period, another industry-specific fund managed by him, Orient New Energy Automobile A, significantly outperformed the benchmark index by 16.81% in the first six months of this year.

Both industry funds have obviously surpassed the benchmark index and ranked high among similar products, which shows the strength of his performance this year.

But in Liu Yuanhai's own "summary", you may not be able to fully understand his "method" of making money.

According to Liu Yuanhai's report in the Q2 report of Orient Mobile Internet, the A-share market has shown a reverse V-shaped trend in the second quarter of this year. From the perspective of industry performance, the red asset represented by banks, utilities, and coal, as well as AI computing power and AI hardware represented by optical modules, have relatively strong performance.

At the end of the first quarter, this fund mainly focused on AI computing power and application, electronic semiconductors, and smart cars. Among them, the proportion of AI computing power was relatively high.

This has become the reason why his performance has been strong against the trend.

Is the electronic semiconductor in the "triple bottom"?

However, the reason for making such a decision is rather arbitrary, as explained by Liu Yuanhai in the quarterly report.

He said: In the second half of last year, the global electronic semiconductor industry recovered from the bottom and continued to trend upward in the first quarter of this year. From the historical experience, it may be a good time to focus on electronic semiconductors during the upward business cycle.

In addition, in the second quarter, he observed that overseas technology giants indicated at their developer conference that large AI models are expected to be deployed on end devices such as mobile phones, PCs, and AIOT (Internet of Things devices). He determined that the AI hardware era is expected to begin, which may drive the recovery of the global electronic semiconductor industry beyond market expectations. Therefore, the fund increased its investment in AI-related electronic semiconductors in the second quarter.

In addition, Liu Yuanhai also stated that the A-share electronic semiconductor companies' stock prices had fallen sharply in the first quarter report, and the stock prices were at a relatively historical low. He judged that the A-share electronic semiconductor may be at a triple bottom: profit bottom, valuation bottom, and position bottom, and that long-term investment opportunities in the electronic semiconductor industry may be approaching. Therefore, the fund increased its investment in AI-related electronic semiconductors in the second quarter.

Four new "heavyweight stocks" were added at the end of the second quarter.

Opening the Dongwu Mobile Internet Heavy Stock Combination, he had 4 new heavy-weight shares in the second quarter: Gigadevice Semiconductor Inc., Goertek Inc., Avary Holding, and Foxconn Industrial Internet.

Among them, Gigadevice Semiconductor Inc. is a storage chip company, Goertek Inc. is a mobile phone electronic component company, Avary Holding is a PCB circuit board for mobile phones and workstations, and Foxconn Industrial Internet is a mobile phone OEM enterprise.

In addition, Huizhou Desay SV Automotive, and Ningbo Tuopu Group, as well as Kingsoft Office Software, Inc. and Suzhou TFC Optical Communication withdrew from the new energy vehicle field.

After adjusting the portfolio, Liu Yuanhai's heavy positions were all inclined towards the smartphone, AI, and electronic semiconductor industry chain, and the overall layout was quite concentrated.

Bullish on "tech stocks" altogether?

Liu Yuanhai's "love" for technology stocks, especially new technology stocks such as AI concepts, is quite evident and far exceeds that of his peers.

This inevitably brings to mind a group of investors with a deep passion for investment, such as "阿宝" and "爷叔" among the blossoms.

Even if we do not consider the positioning of the Dongwu Mobile Internet Fund itself, Liu Yuanhai's persistent heavy position in the relevant sector is the main reason for his differentiation from other peers in terms of performance.

Compared with this, his judgment on the market stage and macro-economy is not particularly critical and outstanding in this combination.

This reminds people of the famous overseas technology fund manager "木头姐", whose bullish view on individual technology industries with the feature of "disruptive innovation" is also in stark contrast to her peers and has made her famous in the market.

Veteran indulging in technology?

One of the differences between Liu Yuanhai and most fund managers is his age.

Among the current peers, Liu Yuanhai, born in the 1970s, is almost one of the older "active fund managers," about the same age as the deputy general manager in charge of investment of other large fund companies.

Liu Yuanhai has a doctorate in management from Tongji University. In 2004, he joined Dongwu Fund as one of the earliest researchers in the Chinese fund industry.

At that time, Dongwu Fund was still exploring in the early days of its creation. In a small building on Yuanshen Road in Shanghai, Dongwu Fund experienced the initial entrepreneurship period and several changes of investment research managers within the first few years.

In the early years of the public fund industry, there were all "talented people", but Liu Yuanhai, who entered the game with his education, never had the opportunity to gain practical experience. It wasn't until after 2011 when a cyclical style fund manager from East Wu System experienced large fluctuations in performance that Liu Yuanhai finally had the opportunity to get hands-on training. This period of fund practice ended in May-June 2015, when Liu Yuanhai resigned from his public fund position. In February 2016, Liu Yuanhai rejoined East Sunshine Fund and resumed his role as fund managers such as East Sunshine Mobile Internet Fund. After several changes in the company's senior management, Liu Yuanhai finally emerged from the pack with his performance and was appointed director of equity investment and general manager of equity investment headquarters and fund manager. Compared with other fund managers who have become senior executives by investing well, Liu Yuanhai has not yet entered the senior management team.

It wasn't until after 2011 when a cyclical style fund manager from East Wu System experienced large fluctuations in performance that Liu Yuanhai finally had the opportunity to get hands-on training.

This period of fund practice ended in May-June 2015, when Liu Yuanhai resigned from his public fund position.

In February 2016, Liu Yuanhai rejoined East Sunshine Fund and resumed his role as fund managers such as East Sunshine Mobile Internet Fund.

After several changes in the company's senior management, Liu Yuanhai finally emerged from the pack with his performance and was appointed director of equity investment and general manager of equity investment headquarters and fund manager.

Compared with other fund managers who have become senior executives by investing well, Liu Yuanhai has not yet entered the senior management team.

AI computing power may still have opportunities

In the latest quarterly report, Liu Yuanhai believes that as this round of global technological innovation is driven by AI artificial intelligence, he believes that the core investment strategy for future technology stocks will be embracing AI. Whoever has higher AI content may have better investment opportunities.

Looking at the current time, he is more concerned about the investment opportunities of AI application, including: (1) AI large-scale models driving the opening of the AI hardware era on the end side, investment opportunities: electronic semiconductors, etc.; (2) AI technology in the field of intelligent driving, investment opportunities: automotive intelligent driving industry chain, etc.; (3) AI humanoid robots; (4) software companies embracing AI. In the short to medium term, he is more concerned about the investment opportunities that the first two AI applications may bring.

Whether Liu Yuanhai's predictions will be validated in the future remains to be seen.

这足以说明,这个产品的管理思路在过去一段时间和市场走向“完全对路”。

这足以说明,这个产品的管理思路在过去一段时间和市场走向“完全对路”。