Meta Platforms Unusual Options Activity For July 15

Meta Platforms Unusual Options Activity For July 15

Financial giants have made a conspicuous bearish move on Meta Platforms. Our analysis of options history for Meta Platforms (NASDAQ:META) revealed 47 unusual trades.

金融巨頭在Meta Platforms上採取了明顯的看跌舉動。我們對Meta Platforms(納斯達克股票代碼:META)期權歷史的分析顯示,有47筆不尋常的交易。

Delving into the details, we found 42% of traders were bullish, while 46% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $471,439, and 42 were calls, valued at $4,426,028.

深入研究細節,我們發現42%的交易者看漲,而46%的交易者表現出看跌傾向。在我們發現的所有交易中,有5筆是看跌期權,價值爲471,439美元,42筆是看漲期權,價值4,426,028美元。

Expected Price Movements

預期的價格走勢

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $170.0 to $580.0 for Meta Platforms over the last 3 months.

考慮到這些合約的交易量和未平倉合約,在過去的3個月中,鯨魚似乎一直將Meta Platforms的價格定在170.0美元至580.0美元之間。

Insights into Volume & Open Interest

對交易量和未平倉合約的見解

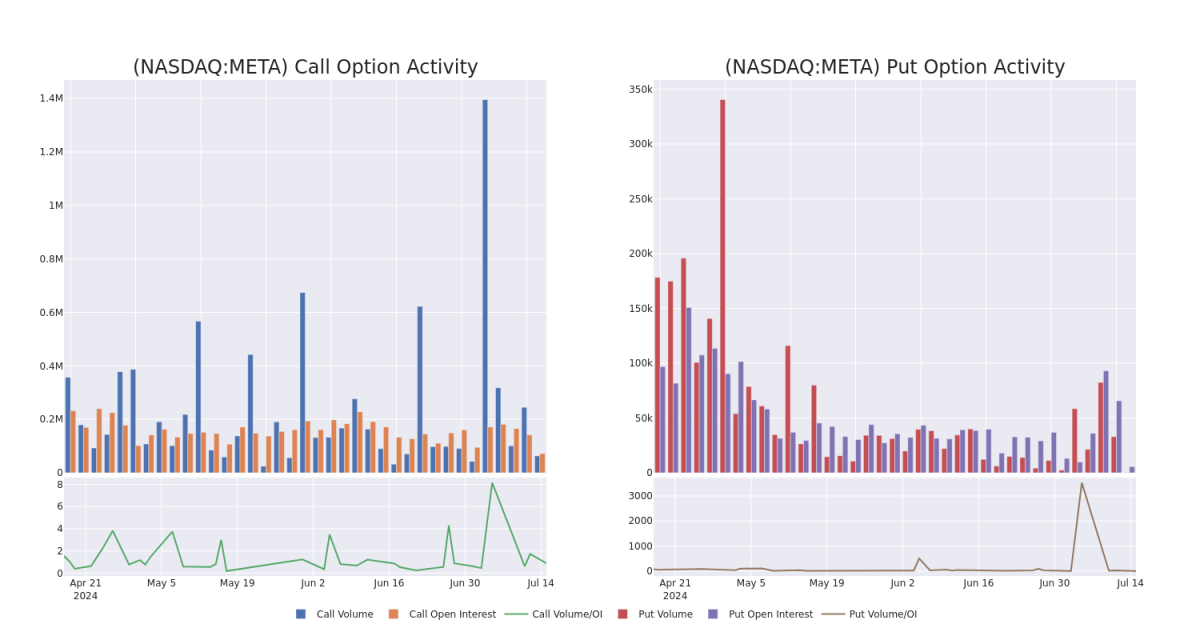

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Meta Platforms's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Meta Platforms's significant trades, within a strike price range of $170.0 to $580.0, over the past month.

檢查交易量和未平倉合約爲股票研究提供了至關重要的見解。這些信息是衡量元平台期權在特定行使價下的流動性和利息水平的關鍵。下面,我們將簡要介紹過去一個月Meta Platforms重大交易的看漲期權和未平倉合約的交易量和未平倉合約的趨勢,行使價區間爲170.0美元至580.0美元。

Meta Platforms Option Volume And Open Interest Over Last 30 Days

過去 30 天的 Meta Platforms 期權交易量和未平倉合約

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| META | CALL | SWEEP | BULLISH | 09/20/24 | $36.35 | $36.05 | $36.35 | $500.00 | $727.0K | 5.0K | 1.4K |

| META | CALL | SWEEP | BULLISH | 09/20/24 | $36.2 | $36.15 | $36.15 | $500.00 | $618.1K | 5.0K | 1.6K |

| META | CALL | SWEEP | BEARISH | 09/20/24 | $44.15 | $44.0 | $44.0 | $490.00 | $572.0K | 1.8K | 491 |

| META | CALL | SWEEP | BEARISH | 09/20/24 | $36.85 | $36.8 | $36.8 | $500.00 | $257.6K | 5.0K | 2.0K |

| META | CALL | SWEEP | BEARISH | 09/20/24 | $37.75 | $37.7 | $37.7 | $500.00 | $211.1K | 5.0K | 2.3K |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 元 | 打電話 | 掃 | 看漲 | 09/20/24 | 36.35 美元 | 36.05 美元 | 36.35 美元 | 500.00 美元 | 727.0 萬美元 | 5.0K | 1.4K |

| 元 | 打電話 | 掃 | 看漲 | 09/20/24 | 36.2 美元 | 36.15 美元 | 36.15 美元 | 500.00 美元 | 618.1 萬美元 | 5.0K | 1.6K |

| 元 | 打電話 | 掃 | 粗魯的 | 09/20/24 | 44.15 美元 | 44.0 美元 | 44.0 美元 | 490.00 美元 | 572.0 萬美元 | 1.8K | 491 |

| 元 | 打電話 | 掃 | 粗魯的 | 09/20/24 | 36.85 美元 | 36.8 美元 | 36.8 美元 | 500.00 美元 | 257.6 萬美元 | 5.0K | 2.0K |

| 元 | 打電話 | 掃 | 粗魯的 | 09/20/24 | 37.75 美元 | 37.7 美元 | 37.7 美元 | 500.00 美元 | 211.1 萬美元 | 5.0K | 2.3K |

About Meta Platforms

關於 Meta Platforms

Meta is the world's largest online social network, with nearly 4 billion family of apps monthly active users. Users engage with each other in different ways, exchanging messages and sharing news events, photos, and videos. The firm's ecosystem consists mainly of the Facebook app, Instagram, Messenger, WhatsApp, and many features surrounding these products. Users can access Facebook on mobile devices and desktops. Advertising revenue represents more than 90% of the firm's total revenue, with more than 45% coming from the US and Canada and over 20% from Europe.

Meta 是世界上最大的在線社交網絡,每月有近 40 億應用程序系列的活躍用戶。用戶以不同的方式互動,交換消息,分享新聞事件、照片和視頻。該公司的生態系統主要包括Facebook應用程序、Instagram、Messenger、WhatsApp以及與這些產品相關的許多功能。用戶可以在移動設備和臺式機上訪問Facebook。廣告收入佔公司總收入的90%以上,其中45%以上來自美國和加拿大,超過20%來自歐洲。

Following our analysis of the options activities associated with Meta Platforms, we pivot to a closer look at the company's own performance.

在分析了與Meta Platforms相關的期權活動之後,我們將轉向仔細研究公司自身的表現。

Present Market Standing of Meta Platforms

Meta Platforms 目前的市場地位

- With a trading volume of 3,476,693, the price of META is up by 0.88%, reaching $503.27.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 16 days from now.

- META的交易量爲3,476,693美元,價格上漲了0.88%,達到503.27美元。

- 當前的RSI值表明該股可能已接近超買。

- 下一份收益報告定於16天后發佈。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Meta Platforms with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高利潤的潛力。精明的交易者通過持續的教育、戰略貿易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用Benzinga Pro獲取實時提醒,了解Meta Platforms的最新期權交易。