Financial giants have made a conspicuous bearish move on Bristol-Myers Squibb. Our analysis of options history for Bristol-Myers Squibb (NYSE:BMY) revealed 10 unusual trades.

Delving into the details, we found 30% of traders were bullish, while 70% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $136,531, and 7 were calls, valued at $647,002.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $25.0 to $50.0 for Bristol-Myers Squibb during the past quarter.

Analyzing Volume & Open Interest

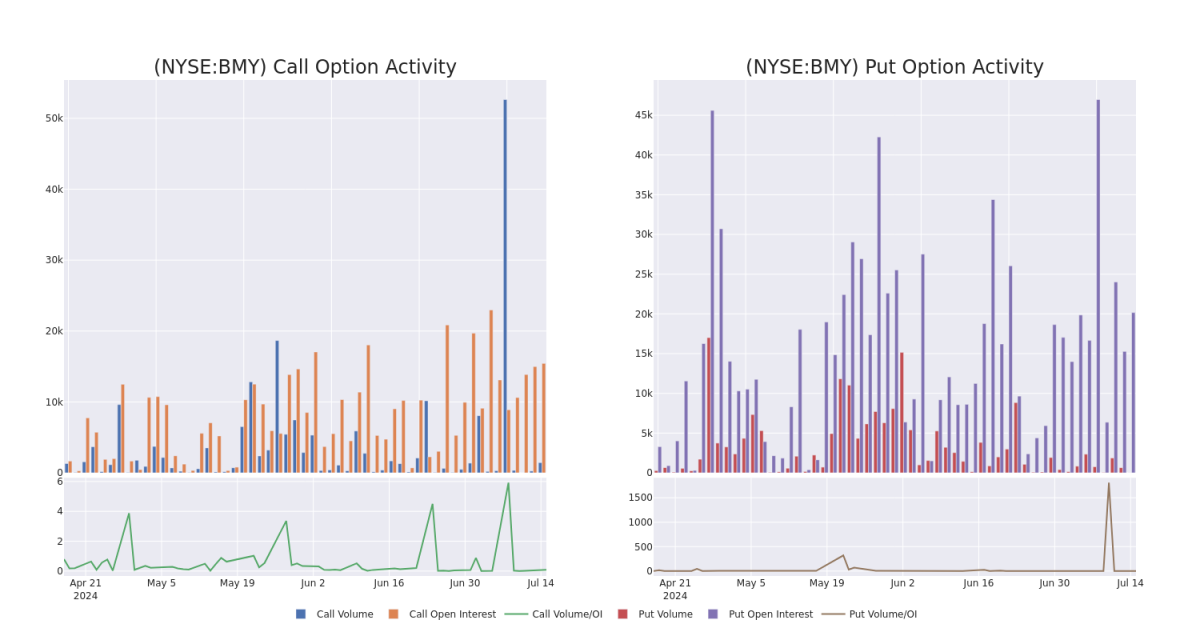

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Bristol-Myers Squibb's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Bristol-Myers Squibb's substantial trades, within a strike price spectrum from $25.0 to $50.0 over the preceding 30 days.

Bristol-Myers Squibb Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BMY | CALL | SWEEP | BULLISH | 01/16/26 | $15.75 | $15.6 | $15.7 | $25.00 | $196.2K | 2.9K | 219 |

| BMY | CALL | TRADE | BEARISH | 01/16/26 | $15.9 | $15.75 | $15.75 | $25.00 | $155.9K | 2.9K | 113 |

| BMY | CALL | SWEEP | BULLISH | 01/16/26 | $16.0 | $15.6 | $16.0 | $25.00 | $87.7K | 2.9K | 30 |

| BMY | CALL | SWEEP | BEARISH | 08/15/25 | $1.64 | $1.54 | $1.64 | $50.00 | $86.6K | 1.6K | 0 |

| BMY | PUT | SWEEP | BEARISH | 12/20/24 | $8.35 | $8.25 | $8.35 | $48.00 | $49.2K | 613 | 0 |

About Bristol-Myers Squibb

Bristol-Myers Squibb discovers, develops, and markets drugs for various therapeutic areas, such as cardiovascular, cancer, and immune disorders. A key focus for Bristol is immuno-oncology, where the firm is a leader in drug development. Bristol derives close to 70% of total sales from the U.S., showing a higher dependence on the U.S. market than most of its peer group.

Following our analysis of the options activities associated with Bristol-Myers Squibb, we pivot to a closer look at the company's own performance.

Present Market Standing of Bristol-Myers Squibb

- With a trading volume of 9,670,839, the price of BMY is down by -1.12%, reaching $40.01.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 11 days from now.

What Analysts Are Saying About Bristol-Myers Squibb

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $41.0.

- An analyst from Barclays has decided to maintain their Equal-Weight rating on Bristol-Myers Squibb, which currently sits at a price target of $41.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Bristol-Myers Squibb with Benzinga Pro for real-time alerts.