Builders FirstSource's Options: A Look at What the Big Money Is Thinking

Builders FirstSource's Options: A Look at What the Big Money Is Thinking

Financial giants have made a conspicuous bullish move on Builders FirstSource. Our analysis of options history for Builders FirstSource (NYSE:BLDR) revealed 9 unusual trades.

金融巨頭對builders firstsource進行了明顯的看好操作。我們對builders firstsource(紐交所:BLDR)期權歷史數據的分析顯示了9個飛凡交易。

Delving into the details, we found 55% of traders were bullish, while 22% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $137,200, and 7 were calls, valued at $479,961.

深入研究後,我們發現55%的交易者看多,22%的交易者看淡。我們發現所有交易中有2個看空期權,價值$137,200,7個看多期權,總價值爲$479,961。

Projected Price Targets

預計價格目標

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $145.0 to $195.0 for Builders FirstSource over the recent three months.

根據交易活動,顯然重要的投資者們在最近三個月裏都瞄準了builders firstsource從$145.0到$195.0的股價領域。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

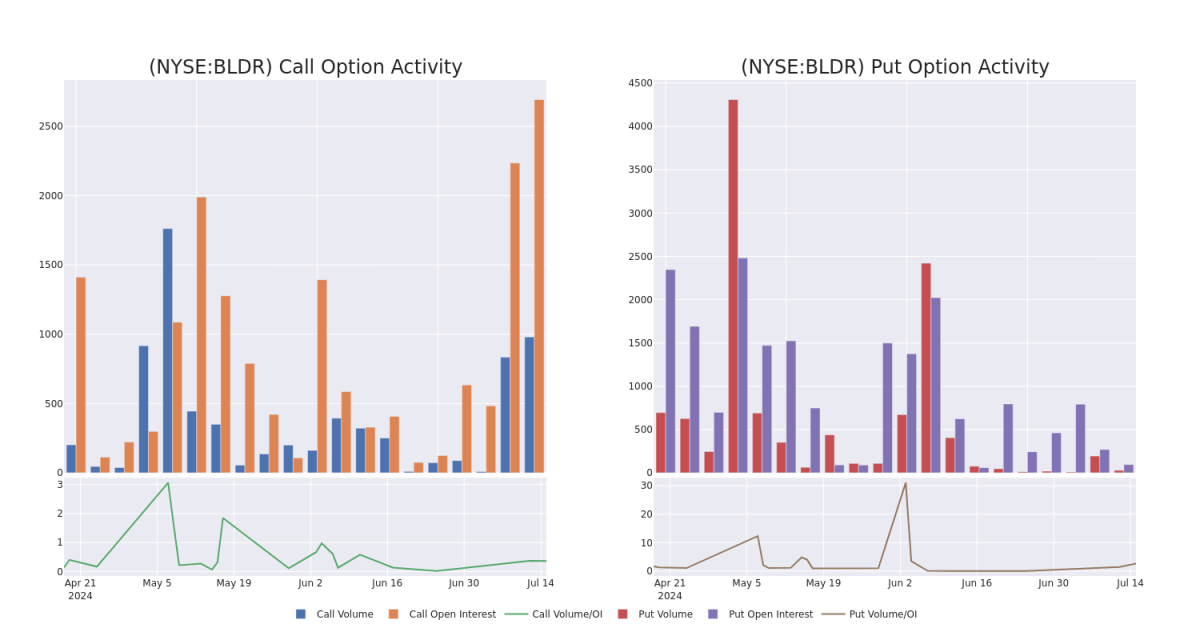

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Builders FirstSource's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Builders FirstSource's substantial trades, within a strike price spectrum from $145.0 to $195.0 over the preceding 30 days.

在期權交易中,評估成交量和持倉量是一個戰略性的步驟。這些量度指標揭示了投資者在指定行權價格下對builders firstsource的期權的流動性和興趣。即將公佈的數據顯示了在$145.0到$195.0行權價格範圍內與 builders firstsource 的大宗交易相關的看多期權和看空期權的成交量和持倉量的波動情況,時間跨度爲30日。

Builders FirstSource 30-Day Option Volume & Interest Snapshot

builders firstsource 30天期權成交量和持倉量快照

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BLDR | CALL | SWEEP | BULLISH | 08/16/24 | $5.4 | $5.3 | $5.3 | $165.00 | $243.4K | 593 | 151 |

| BLDR | PUT | TRADE | BULLISH | 07/19/24 | $5.8 | $5.3 | $5.3 | $160.00 | $106.0K | 11 | 29 |

| BLDR | CALL | SWEEP | NEUTRAL | 08/16/24 | $5.4 | $5.3 | $5.38 | $165.00 | $68.5K | 593 | 609 |

| BLDR | CALL | SWEEP | BULLISH | 07/19/24 | $9.7 | $9.6 | $9.7 | $145.00 | $45.5K | 673 | 9 |

| BLDR | CALL | TRADE | BEARISH | 07/19/24 | $12.7 | $12.2 | $12.4 | $145.00 | $34.7K | 673 | 133 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BLDR | 看漲 | SWEEP | 看好 | 08/16/24 | $5.4 | $5.3 | $5.3 | 165.00美元 | $243.4K | 593 | 151 |

| BLDR | 看跌 | 交易 | 看好 | 07/19/24 | $5.8 | $5.3 | $5.3 | $160.00 | $106.0K | 11 | 29 |

| BLDR | 看漲 | SWEEP | 中立 | 08/16/24 | $5.4 | $5.3 | $5.38 | 165.00美元 | $68.5K | 593 | 609 |

| BLDR | 看漲 | SWEEP | 看好 | 07/19/24 | 9.7 | 9.6 | 9.7 | $145.00 | $45.5K | 673 | 9 |

| BLDR | 看漲 | 交易 | 看淡 | 07/19/24 | $12.7 | $12.2 | $12.4 | $145.00 | $34.7K | 673 | 133 |

About Builders FirstSource

關於Builders FirstSource

Builders FirstSource Inc is a manufacturer and supplier of building materials. The company offers structural and related building products such as factory-built roof and floor trusses, wall panels and stairs, vinyl windows, custom millwork and trim, and engineered wood. The products can be designed for each home individually and are installed by Builders FirstSource. The company's construction-related services include professional installation, turn-key framing, and shell construction. Builders FirstSource's customers range from large production builders to small custom homebuilders.

Builders FirstSource Inc是建築材料製造商和供應商。該公司提供結構和相關建築產品,例如工廠製造的屋頂和樓層桁架、牆板和樓梯、乙烯基窗戶、定製的木製品和修飾產品以及工程木材。這些產品可以根據每個家庭的需求進行設計,並由Builders FirstSource安裝。該公司的建築相關服務包括專業安裝、交鑰匙框架和殼體建設。Builders FirstSource的客戶群從大型生產商到小型定製住宅建築商不等。

After a thorough review of the options trading surrounding Builders FirstSource, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在對builders firstsource的期權交易進行全面審查後,我們將對該公司進行更詳細的評估,包括對其當前的市場狀況和績效的評估。

Where Is Builders FirstSource Standing Right Now?

builders firstsource現在的處境如何?

- Currently trading with a volume of 1,373,584, the BLDR's price is up by 1.89%, now at $155.61.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 22 days.

- BLDR的成交量目前爲1,373,584,漲幅爲1.89%,現價爲$155.61。

- RSI讀數表明該股目前可能接近超買水平。

- 預計將在22天內發佈業績。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Builders FirstSource's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Builders FirstSource's substantial trades, within a strike price spectrum from $145.0 to $195.0 over the preceding 30 days.

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Builders FirstSource's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Builders FirstSource's substantial trades, within a strike price spectrum from $145.0 to $195.0 over the preceding 30 days.