To the annoyance of some shareholders, Dinglong Culture Co.,Ltd. (SZSE:002502) shares are down a considerable 26% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 70% share price decline.

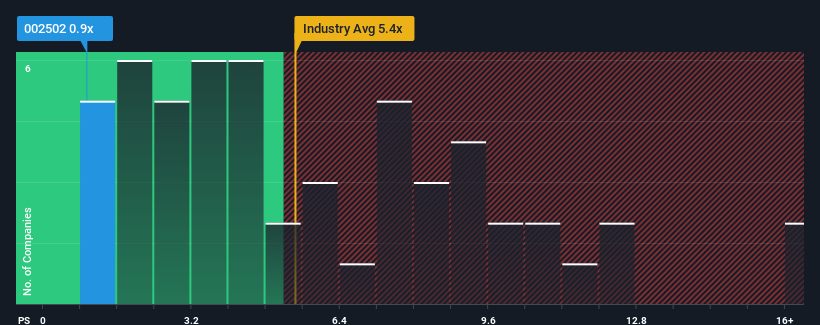

Following the heavy fall in price, Dinglong CultureLtd may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.9x, considering almost half of all companies in the Entertainment industry in China have P/S ratios greater than 5.4x and even P/S higher than 9x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

What Does Dinglong CultureLtd's P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, Dinglong CultureLtd has been doing very well. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Dinglong CultureLtd's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Dinglong CultureLtd?

Dinglong CultureLtd's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Dinglong CultureLtd's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 76% last year. The latest three year period has also seen an excellent 84% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 25% shows it's about the same on an annualised basis.

With this information, we find it odd that Dinglong CultureLtd is trading at a P/S lower than the industry. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Final Word

Shares in Dinglong CultureLtd have plummeted and its P/S has followed suit. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that Dinglong CultureLtd currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

Having said that, be aware Dinglong CultureLtd is showing 3 warning signs in our investment analysis, and 1 of those is potentially serious.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com