Trump being attacked is also a new variable for the market.

Under the 'hawkish' tone of Powell, precious metals continued to rise on Tuesday.

As of press time, A-share Xiaocheng Technology rose more than 5%, Hunan Gold, Yintai Gold, Shandong Gold and other stocks rose more than 4% respectively. Hong Kong stock Shandong Gold rose more than 5%, Zhaojin Mining rose more than 4%.

Since late June, the A-share metals sector has started an upward trend, with a cumulative increase of more than 16% currently.

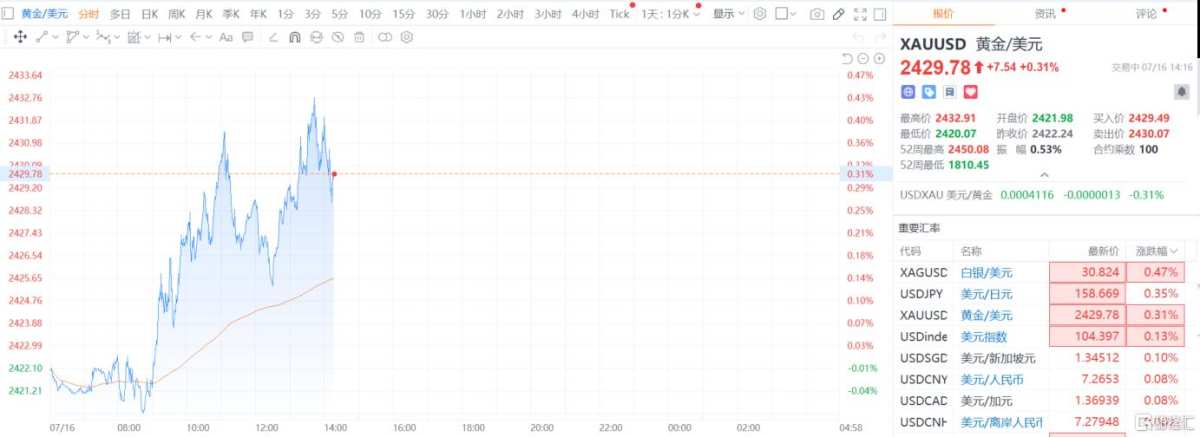

Today, the spot gold rallied briefly above 2430 US dollars/ounce and now rose 0.31% to 2429.86 US dollars/ounce.

'Hawkish' Powell

Last weekend, Trump's attack became the new market variable, and the uncertainty of the US election caused a rise in safe-haven assets. The bullish momentum of gold and precious metals has become even stronger.

Last night, 'hawkish' Powell once again boosted gold bulls.

Powell said that the economy has performed well in recent years and the last three inflation data have indeed increased confidence.

He expects economic growth to slow down this year, and inflation will continue to make progress. The Federal Reserve will not wait for inflation to reach its 2% target before cutting interest rates, because the impact of monetary policy is lagging. If the interest rates are maintained too high for too long, it will excessively suppress economic growth.

Powell's statement may pave the way for future interest rate cuts.

According to the latest data of CME 'FedWatch' tool, traders are betting a high probability of the first interest rate cut in September, with three interest rate cuts expected later this year.

Previously, US CPI in June showed a slower-than-expected growth, and now with 'hawkish' Powell, the market is beginning to increase its bets on interest rate cuts.

Daniel Ghali, senior commodity strategist at TD Securities, pointed out that free traders are returning to the gold market in large numbers.

'Given that this group currently holds the largest position in this cycle, our agent believes that, given that the number of Fed's interest rate cuts in the next year has been reflected in the interest rate market, macro traders' holdings in gold are now slightly higher than expected.'

He said that the current gold price is still far below the highest point of the previous interest rate cut cycle by the Fed, which indicates that if expectations for the upcoming interest rate cut cycle continue to deepen, gold still has room for further upside.

The long positions of free traders have also been increasing in the past few weeks, which is consistent with Trump's trading and has also attracted investors' interest in gold.

'Gold is also the strongest performer in our global macro radar, which highlights the high threshold faced by commodity trading advisors (CTAs) and trend followers in cutting more positions before. Although the recent decline in gold has triggered some cutting of positions, CTA is likely to re-enter the bid now instead of a sharp reversal below 2370 US dollars/ounce.'

Is the gold price aimed at $2,500 by the end of the year?

Central banks around the world are still planning to reserve large amounts of gold, which is also one of the main driving forces for the rise in gold prices.

According to the 2024 Central Bank Gold Reserves (CBGR) survey by the World Gold Council, 29% of central banks surveyed plan to increase their gold reserves in the next 12 months, the highest level observed since this survey began in 2018. Among them, emerging markets are particularly active in increasing their gold holdings.

According to data, China's central bank held 72.8 million ounces of gold in June, which is the same as the previous two months, while the central bank had been increasing its gold holdings for 18 consecutive months before that.

India's central bank increased its gold reserves by more than 9 tons in June, the highest level since July 2022, meaning India's gold reserves have increased by 37 tons to reach 841 tons this year.

ANZ bank's commodity strategy analyst Soni Kumari and Daniel Hynes expect strong gold demand in India this year, which could continue to support gold prices in the second half of the year.

"India's central bank has already become the second largest buyer of gold this year. The first-half purchase volume implies that if the purchase rate continues, the total purchase volume this year may surpass 70 tons."

They expect that gold prices will rise to $2,500 per ounce by the end of this year.

FXStreet analyst Christian Borjon Valencia also said that if gold prices rise above $2,439 per ounce, it will pave the way for testing the year's high of $2,450 per ounce.

He pointed out that once this level is effectively broken, it is expected to rise further, with the next target being $2,500 per ounce.

Bank of America expects gold prices to rebound to $3,000 in the next 12-18 months.