Unpacking the Latest Options Trading Trends in Amgen

Unpacking the Latest Options Trading Trends in Amgen

Financial giants have made a conspicuous bearish move on Amgen. Our analysis of options history for Amgen (NASDAQ:AMGN) revealed 18 unusual trades.

金融巨头对安进采取了明显的看跌举动。我们对安进(纳斯达克股票代码:AMGN)期权历史的分析显示了18笔不寻常的交易。

Delving into the details, we found 22% of traders were bullish, while 38% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $131,787, and 15 were calls, valued at $561,349.

深入研究细节,我们发现22%的交易者看涨,而38%的交易者表现出看跌趋势。在我们发现的所有交易中,有3笔是看跌期权,价值为131,787美元,15笔是看涨期权,价值561,349美元。

Expected Price Movements

预期的价格走势

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $210.0 to $370.0 for Amgen during the past quarter.

分析这些合约的交易量和未平仓合约,大型企业似乎一直在关注安进在过去一个季度的价格范围从210.0美元到370.0美元不等。

Volume & Open Interest Trends

交易量和未平仓合约趋势

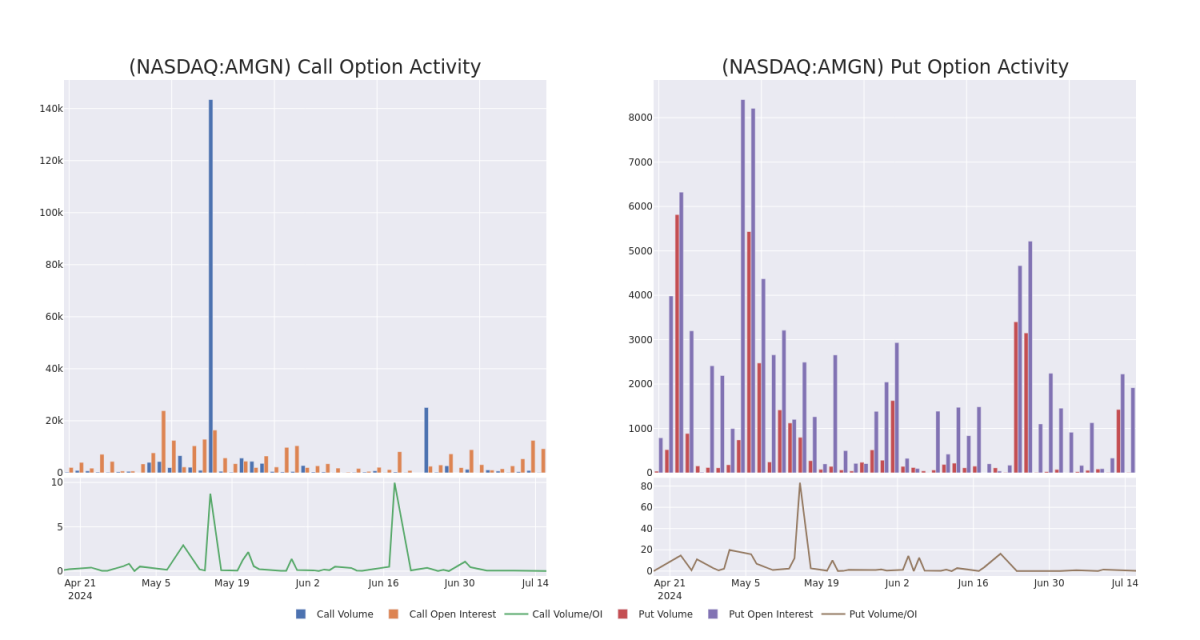

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Amgen's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Amgen's whale trades within a strike price range from $210.0 to $370.0 in the last 30 days.

交易期权时,查看交易量和未平仓合约是一个强有力的举动。这些数据可以帮助您跟踪给定行使价下安进期权的流动性和利息。下面,我们可以观察到过去30天内安进所有鲸鱼交易的看涨期权和看跌期权交易量和未平仓合约的变化,其行使价在210.0美元至370.0美元之间。

Amgen Option Volume And Open Interest Over Last 30 Days

过去 30 天的安进期权交易量和未平仓合约

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMGN | CALL | TRADE | NEUTRAL | 07/19/24 | $20.7 | $18.6 | $19.57 | $315.00 | $97.8K | 1.4K | 13 |

| AMGN | PUT | TRADE | BEARISH | 07/26/24 | $5.35 | $5.0 | $5.23 | $335.00 | $52.3K | 9 | 2 |

| AMGN | PUT | SWEEP | NEUTRAL | 01/16/26 | $7.15 | $0.1 | $3.95 | $210.00 | $47.3K | 114 | 0 |

| AMGN | CALL | TRADE | BEARISH | 01/17/25 | $20.3 | $19.35 | $19.35 | $355.00 | $38.7K | 40 | 20 |

| AMGN | CALL | TRADE | BEARISH | 01/17/25 | $20.3 | $19.3 | $19.3 | $355.00 | $38.6K | 40 | 40 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMGN | 打电话 | 贸易 | 中立 | 07/19/24 | 20.7 美元 | 18.6 美元 | 19.57 美元 | 315.00 美元 | 97.8 万美元 | 1.4K | 13 |

| AMGN | 放 | 贸易 | 粗鲁的 | 07/26/24 | 5.35 美元 | 5.0 美元 | 5.23 美元 | 335.00 美元 | 52.3 万美元 | 9 | 2 |

| AMGN | 放 | 扫 | 中立 | 01/16/26 | 7.15 美元 | 0.1 美元 | 3.95 美元 | 210.00 美元 | 47.3 万美元 | 114 | 0 |

| AMGN | 打电话 | 贸易 | 粗鲁的 | 01/17/25 | 20.3 美元 | 19.35 美元 | 19.35 美元 | 355.00 美元 | 38.7 万美元 | 40 | 20 |

| AMGN | 打电话 | 贸易 | 粗鲁的 | 01/17/25 | 20.3 美元 | 19.3 美元 | 19.3 美元 | 355.00 美元 | 38.6 万美元 | 40 | 40 |

About Amgen

关于安进

Amgen is a leader in biotechnology-based human therapeutics. Flagship drugs include red blood cell boosters Epogen and Aranesp, immune system boosters Neupogen and Neulasta, and Enbrel and Otezla for inflammatory diseases. Amgen introduced its first cancer therapeutic, Vectibix, in 2006 and markets bone-strengthening drug Prolia/Xgeva (approved 2010) and Evenity (2019). The acquisition of Onyx bolstered the firm's therapeutic oncology portfolio with Kyprolis. Recent launches include Repatha (cholesterol-lowering), Aimovig (migraine), Lumakras (lung cancer), and Tezspire (asthma). The 2023 Horizon acquisition brings several rare-disease drugs, including thyroid eye disease drug Tepezza. Amgen also has a growing biosimilar portfolio.

安进是基于生物技术的人体疗法的领导者。旗舰药物包括红细胞增强剂Epogen和Aranesp、免疫系统增强剂Neupogen和Neulasta以及治疗炎症性疾病的Enbrel和Otezla。安进于2006年推出了其首款癌症疗法Vectibix,并销售强化骨骼的药物Prolia/Xgeva(2010年获得批准)和Evenity(2019年)。对Onyx的收购加强了该公司与Kyprolis合作的治疗肿瘤学产品组合。最近推出的产品包括Repatha(降胆固醇)、Aimovig(偏头痛)、Lumakras(肺癌)和Tezspire(哮喘)。2023年Horizon的收购带来了几种罕见疾病药物,包括甲状腺眼病药物Tepezza。安进的生物仿制药产品组合也在不断增长。

Having examined the options trading patterns of Amgen, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了安进的期权交易模式之后,我们的注意力现在直接转向了该公司。这种转变使我们能够深入研究其目前的市场地位和表现

Amgen's Current Market Status

安进目前的市场地位

- With a trading volume of 279,645, the price of AMGN is up by 1.19%, reaching $334.07.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 16 days from now.

- AMGN的交易量为279,645美元,上涨了1.19%,达到334.07美元。

- 当前的RSI值表明该股可能已被超买。

- 下一份收益报告定于16天后发布。

What Analysts Are Saying About Amgen

分析师对安进的看法

In the last month, 2 experts released ratings on this stock with an average target price of $321.5.

上个月,两位专家发布了该股的评级,平均目标价为321.5美元。

- An analyst from Morgan Stanley persists with their Equal-Weight rating on Amgen, maintaining a target price of $303.

- Maintaining their stance, an analyst from Argus Research continues to hold a Buy rating for Amgen, targeting a price of $340.

- 摩根士丹利的一位分析师坚持对安进的同等权重评级,将目标价维持在303美元。

- 阿格斯研究的一位分析师保持立场,继续维持安进的买入评级,目标价格为340美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。