Spotlight on Texas Instruments: Analyzing the Surge in Options Activity

Spotlight on Texas Instruments: Analyzing the Surge in Options Activity

Financial giants have made a conspicuous bullish move on Texas Instruments. Our analysis of options history for Texas Instruments (NASDAQ:TXN) revealed 9 unusual trades.

金融巨頭對德州儀器採取了明顯的看好動作。我們對德州儀器(納斯達克:TXN)期權歷史數據的分析顯示,出現了9起異常交易。

Delving into the details, we found 33% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $78,620, and 7 were calls, valued at $744,634.

具體分析發現,33%的交易者看漲,33%的交易者看淡。我們發現了所有交易中的2項看跌期權,價值78620美元,以及7項看漲期權,價值744634美元。

Expected Price Movements

預期價格波動

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $175.0 to $280.0 for Texas Instruments over the last 3 months.

考慮到這些合約的成交量和未平倉合約量,似乎鯨魚們在過去的3個月裏一直以的價格區間爲175.0至280.0美元針對德州儀器。

Volume & Open Interest Trends

成交量和未平倉量趨勢

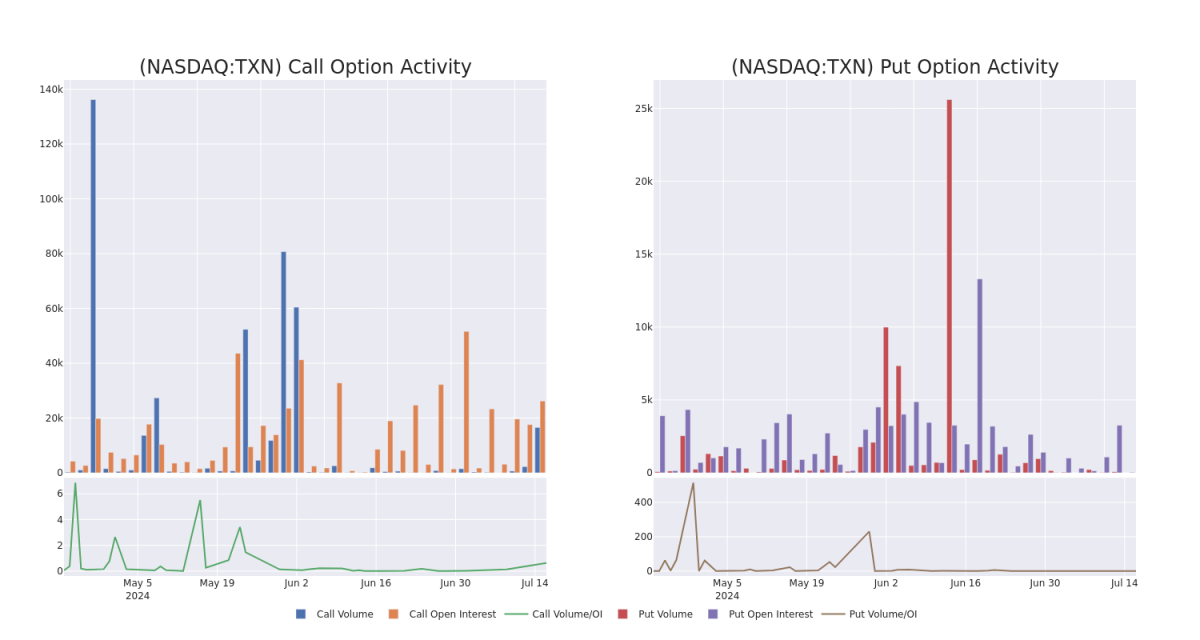

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

這些數據可以幫助您跟蹤Coinbase Glb期權的流動性和利益,以給定的行權價格爲基礎。

This data can help you track the liquidity and interest for Texas Instruments's options for a given strike price.

此數據可幫助您跟蹤德州儀器在給定行權價的期權流動性和興趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Texas Instruments's whale activity within a strike price range from $175.0 to $280.0 in the last 30 days.

以下是我們在過去30天內觀察到的所有德州儀器的鯨魚活動中,針對175.0至280.0美元行權價格區間的看跌和看漲期權的成交量和未平倉合約量的演變。

Texas Instruments Call and Put Volume: 30-Day Overview

德州儀器看跌期權和看漲期權成交量:30天概覽

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TXN | CALL | TRADE | BEARISH | 07/26/24 | $2.1 | $2.03 | $2.04 | $215.00 | $408.0K | 629 | 58 |

| TXN | CALL | SWEEP | BEARISH | 09/20/24 | $7.65 | $7.55 | $7.6 | $210.00 | $88.8K | 23.9K | 8.1K |

| TXN | CALL | TRADE | BULLISH | 06/20/25 | $3.15 | $2.65 | $3.1 | $280.00 | $77.5K | 1 | 0 |

| TXN | CALL | SWEEP | NEUTRAL | 09/20/24 | $7.95 | $7.75 | $7.88 | $210.00 | $58.9K | 23.9K | 10 |

| TXN | PUT | TRADE | NEUTRAL | 07/19/24 | $5.2 | $4.2 | $4.7 | $207.50 | $47.0K | 30 | 0 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TXN | 看漲 | 交易 | 看淡 | 07/26/24 | $2.1 | $2.03 | $2.04 | 215.00美元 | $408.0K | 629 | 58 |

| TXN | 看漲 | SWEEP | 看淡 | 09/20/24 | $7.65 | $7.55 | $7.6 | 目標股價爲$210.00。 | 88.8千美元 | 23.9千 | 8.1千 |

| TXN | 看漲 | 交易 | 看好 | 06/20/25 | $3.15 | $2.65 | $3.1 | $280.00 | $77.5K | 1 | 0 |

| TXN | 看漲 | SWEEP | 中立 | 09/20/24 | $7.95 | $7.75 | 7.88美元 | 目標股價爲$210.00。 | $58.9K | 23.9千 | 10 |

| TXN | 看跌 | 交易 | 中立 | 07/19/24 | $5.2 | $4.2 | $4.7 | $207.50 | $47.0千美元 | 30 | 0 |

About Texas Instruments

關於德州儀器

Dallas-based Texas Instruments generates over 95% of its revenue from semiconductors and the remainder from its well-known calculators. Texas Instruments is the world's largest maker of analog chips, which are used to process real-world signals such as sound and power. Texas Instruments also has a leading market share position in processors and microcontrollers used in a wide variety of electronics applications.

總部位於達拉斯的德州儀器有超過95%的營業收入來自半導體,剩下的來自其著名的計算器。德州儀器是世界上最大的模擬芯片製造商,用於處理實時信號(如聲音和電源)。德州儀器還在處理器和微控制器方面擁有領先的市場份額,用於各種電子應用。

Texas Instruments's Current Market Status

德州儀器當前的市場狀態

- Currently trading with a volume of 1,919,448, the TXN's price is up by 2.08%, now at $205.97.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 7 days.

- 目前交易量爲1919448,股價上漲2.08%,報205.97美元。

- RSI讀數表明該股目前可能接近超買水平。

- 預計7天內發佈收益報告。

What The Experts Say On Texas Instruments

關於德州儀器,專家有何說法

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $204.0.

在過去30天中,共有4名專業分析師發表了對該股票的看法,設置了平均目標價爲204.0美元。

- Consistent in their evaluation, an analyst from Benchmark keeps a Buy rating on Texas Instruments with a target price of $230.

- An analyst from Morgan Stanley has decided to maintain their Underweight rating on Texas Instruments, which currently sits at a price target of $156.

- Maintaining their stance, an analyst from Citigroup continues to hold a Neutral rating for Texas Instruments, targeting a price of $200.

- Maintaining their stance, an analyst from Benchmark continues to hold a Buy rating for Texas Instruments, targeting a price of $230.

- 經常相同的評估,Benchmark分析師給德州儀器保持“買入”評級,目標價爲230美元。

- 大摩資源lof的一位分析師決定保持他們的“輕倉”評級關於德州儀器,該股票目標價格目前爲156美元。

- 花旗集團的一位分析師維持對德州儀器的中立評級,目標價爲200美元。

- 維持看好態度,Benchmark 的一位分析師繼續對德州儀器持有買入評級,目標價爲230美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。