Investors with a lot of money to spend have taken a bearish stance on Verizon Communications (NYSE:VZ).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with VZ, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 9 uncommon options trades for Verizon Communications.

This isn't normal.

The overall sentiment of these big-money traders is split between 33% bullish and 44%, bearish.

Out of all of the special options we uncovered, 2 are puts, for a total amount of $141,568, and 7 are calls, for a total amount of $514,354.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $35.0 and $45.0 for Verizon Communications, spanning the last three months.

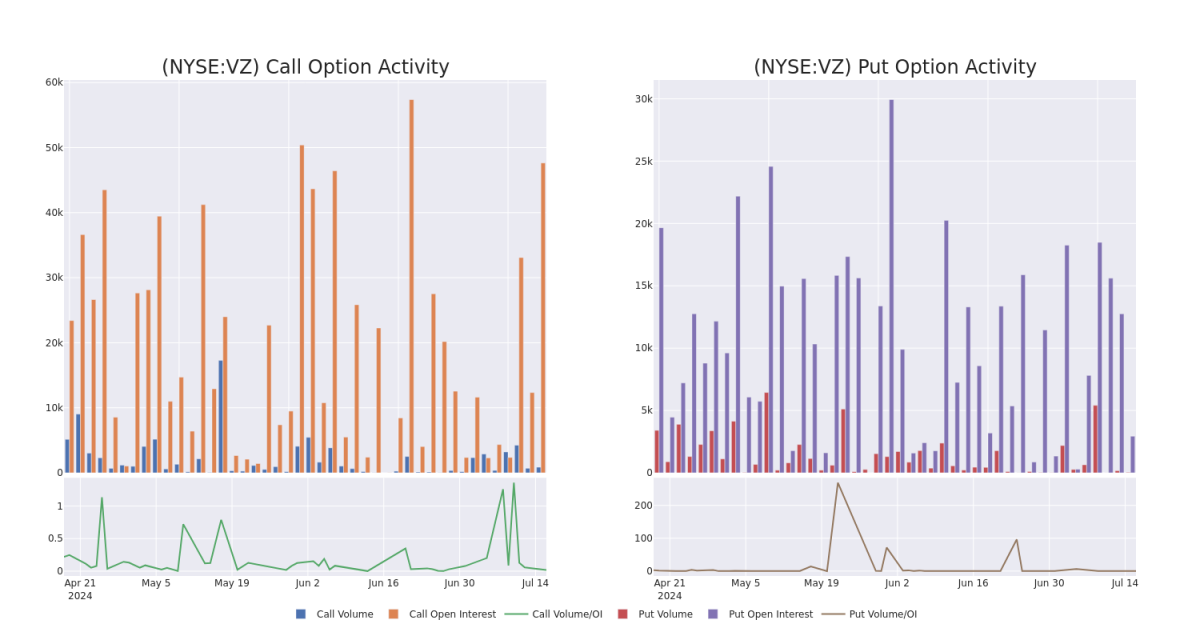

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Verizon Communications's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Verizon Communications's significant trades, within a strike price range of $35.0 to $45.0, over the past month.

Verizon Communications Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VZ | CALL | SWEEP | BEARISH | 07/26/24 | $1.46 | $1.44 | $1.45 | $40.00 | $131.1K | 4.9K | 302 |

| VZ | CALL | SWEEP | BULLISH | 07/26/24 | $0.65 | $0.62 | $0.65 | $41.50 | $102.7K | 1.6K | 71 |

| VZ | PUT | SWEEP | BEARISH | 06/20/25 | $3.75 | $3.65 | $3.75 | $42.00 | $100.5K | 729 | 0 |

| VZ | CALL | SWEEP | BULLISH | 08/02/24 | $0.8 | $0.74 | $0.74 | $41.50 | $72.1K | 5 | 0 |

| VZ | CALL | SWEEP | BEARISH | 01/17/25 | $7.2 | $7.15 | $7.15 | $35.00 | $71.5K | 12.4K | 0 |

About Verizon Communications

Wireless services account for about 70% of Verizon Communications' total service revenue and nearly all of its operating income. The firm serves about 93 million postpaid and 21 million prepaid phone customers (following the acquisition of Tracfone) via its nationwide network, making it the largest US wireless carrier. Fixed-line telecom operations include local networks in the Northeast, which reach about 29 million homes and businesses and serve about 8 million broadband customers. Verizon also provides telecom services nationwide to enterprise customers, often using a mixture of its own and other carriers' networks.

Following our analysis of the options activities associated with Verizon Communications, we pivot to a closer look at the company's own performance.

Where Is Verizon Communications Standing Right Now?

- With a volume of 15,559,676, the price of VZ is up 1.52% at $41.41.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 6 days.

Expert Opinions on Verizon Communications

In the last month, 1 experts released ratings on this stock with an average target price of $46.5.

- An analyst from Scotiabank persists with their Sector Perform rating on Verizon Communications, maintaining a target price of $46.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Verizon Communications options trades with real-time alerts from Benzinga Pro.